“When you talk about fractional CFO in its purest sense, it’s forward‑looking strategic guidance. It’s not bookkeeping or just monthly reporting. It’s: Your brand is here. You want it there in five years. What must we prioritize next week, next month, next quarter to make that happen?” — Alexej Pikovsky

A true Fractional CFO is the founder’s strategic co‑pilot who:

- Builds a long‑range financial model—2–3 years of monthly P&L, balance‑sheet, and cash‑flow projections—to map the path to scale and exit.

- Builds 13‑week cash‑flow forecasts tied to marketing calendars and inventory orders, so you never run dry or overstock.

- Models SKU‑ and channel‑level contribution margins to inform pricing and promo strategy.

- Stress‑tests expansion plans against inventory financing and tax implications.

- Aligns business metrics with the founder’s personal targets, whether it’s take‑home pay, exit valuation, lifestyle, etc.

Hiring the right Fractional CFO with your in-house team can take two to three months. Here’s a high-level guide to hire a Fractional CFO in-house:

- Decide What You Need: Create a recruitment scorecard (more on this later) to understand what responsibilities you need a Fractional CFO to fulfil.

- Core Objectives: raise gross margin by 5 pp, cut CAC payback to <90 days

- KPIs: rolling 13‑week cash runway, inventory turn <65 days, EBITDA target.

- Cultural must‑haves: async‑first, CPG obsession, challenger mindset.

- Fundraising/ Exit Readiness: This is specific to your situation, but if you are looking to fundraise for your brand or prepare for an exit event, the Fractional CFO will need to help you prepare the data room and also the investor materials / information required by the potential buyers

- Create Job Board Posts: Advertise the position on relevant job boards, including Upwork, Catalant, and LinkedIn using keywords like eCommerce fractional CFO, DTC finance leader. Fractional CFOs for eCommerce have a different skill set and focus on very different metrics to Fractional CFOs in the Construction Industry or in SaaS, so it’s important to be very focused in the search.

- Network for Recommendations: Reach out to your immediate network for potential candidates.

- Evaluate CVs: Shortlist applicants based on their CVs. Look for experience in DTC, Amazon, or retail‑to‑online transitions.

- First Interviews: Conduct initial interviews to gauge qualifications and fit based on values alignment, growth mindset, communication style.

- Take-Away Task or Case Studies: Assign a task or ask to see case studies to evaluate skills. For example, ask for a 3‑statement model of a $10 m DTC brand + SKU sensitivity table.

- Second Interviews: Dive deeper into qualifications and expectations.

- Make a Fractional CFO Hire: Finalise your decision and extend an offer.

Navigating the in-house hiring process for a Fractional CFO can be complex and time-consuming. Book a 30‑minute call with Alexej. He’s already vetted dozens of CFOs who specialise in eCommerce. He can match you within days, not months. → Schedule Your Call

If you want more details on the hiring process, read below.

Decide What You Need in a Fractional CFO

Before conducting the hiring process, you need to pinpoint the specific responsibilities and skills you require from a Fractional CFO. Creating a recruitment scorecard can streamline this phase, serving as a reference point throughout the selection process.

A recruitment scorecard aligns the CFO’s role with your company’s objectives. Here’s how to craft one:

- Identify Core Responsibilities: List the essential tasks the Fractional CFO will handle. These could range from financial reporting and modelling to investor relations and fundraising.

- Set Performance Indicators: Define key performance indicators (KPIs) to measure success in each responsibility area. For example, increasing working capital by 20%, creating fortnightly internal business reports, and generating quarterly marketing budgets.

- Skillset Requirements: Specify the skills and experience needed. Consider qualifications such as experience in mergers and acquisitions, certified accountancy credentials, expertise in supplier negotiations, and a strong understanding of marketing metrics such as LTV (Lifetime Value of a Customer), ROAS (Return on Ad Spend), and Customer Acquisition Costs (CAC).

- Cultural Fit: Consider the company culture and how the Fractional CFO will integrate. This is often overlooked but vital for long-term success.

- Budget Constraints: Factor in your budget. Fractional CFOs can cost between $3k – $6k monthly, so ensure your budget aligns with the level of expertise you seek.

Create Job Board Posts

When you’re clear on what you need in a Fractional CFO, the next step is to get the word out. This involves creating job board posts that attract the right talent.

Choose the Right Job Boards

Different platforms attract different kinds of professionals. Here’s a quick rundown:

- Upwork: Ideal for short-term contracts and specific tasks. You’ll find a range of experience levels here.

- Catalant: Focuses on high-level experts, making it a good fit for experienced Fractional CFOs

- Graphite: Similar to Catalant, more international based CFOs for hire.

- Indeed: A general job board but with a wide reach. You can post for free or sponsor your job for more visibility.

- LinkedIn: Excellent for tapping into a network of professionals. You can also use its advanced search features to headhunt.

- Other Fractional CFO agencies: If you’re shopping around, there are quite a few agencies specialised in Fractional CFO work. Many of them are generalist with a few being specialised in sectors. For objective comparisons, read the round‑ups: Top 10 Fractional CFO Firms, Top 7 Fractional CFOs in New York, Boston, Denver, and London.

- Alexej’s Curated Collective: There’s no need to post a job board. Simply reach out and get matched with a Fractional CFO who meets your specific needs. Schedule Your Call to simplify your hiring process.

Crafting the Job Description

You can explore our comprehensive guide on crafting the perfect job description for a Fractional CFO. In the meantime, here are some essential elements to consider:

- Role Summary: Provide an overview of the responsibilities and expectations to give candidates a snapshot of what the role entails.

- Key Responsibilities: Enumerate the primary tasks the Fractional CFO will be responsible for, such as financial reporting, budgeting, and investor relations.

- Qualifications: Specify the essential skills and experience required, perhaps a background in investment banking or a minimum number of years in a similar role.

- Compensation: Offer a ballpark figure for the salary range or hourly rate to manage expectations.

- Application Process: Detail the steps for application, such as submitting a CV and cover letter or completing an online form.

- Deadline: Include the application closing date to instill a sense of urgency.

- Company Overview: Briefly introduce your company, its culture, and values to attract like-minded professionals.

- Benefits and Perks: Highlight any additional incentives like health insurance, retirement plans, or professional development opportunities.

Network for Recommendations

Once your job description is live, utilise your immediate network for quality recommendations. Personal connections can often lead to candidates who are not only qualified but also a good cultural fit for your company.

When reaching out to your network, be clear, concise, and specific about what you’re looking for. Here’s a template message you can use:

Subject: Seeking a Highly-Qualified Fractional CFO for [Your Company’s Name]

Hope you’re well! Wondering if you could help us out (:

We’re on the hunt for a Fractional CFO. We’re looking for someone who:

- Is skilled in financial reporting

- Has experience in fundraising

- Is a good culture fit for our team

Here’s the full description on what we need: [insert link to job description].

Know anyone who’d be a great fit? Would love any intros you can make!

Best

This template specifies what you’re looking for, why you’re reaching out to the recipient, and how they can help, making it more likely to elicit a helpful response.

Evaluate CVs

Once you’ve posted on job boards and tapped into your network, you’ll likely have a stack of CVs to sift through. The evaluation process is critical in shortlisting candidates who not only meet the job description but also align with your company’s values and objectives.

Key Elements to Consider

- Years of Experience: Look for candidates with a minimum of 5 years in roles that closely align with the responsibilities of a Fractional CFO.

- Industry Expertise: Consider whether the candidate has experience in your specific industry, as this can shorten the learning curve.

- Service Line: Examine their expertise in specific service lines like financial reporting, fundraising, or investor relations. This should align with the core responsibilities you’ve outlined.

- Business Model: Check if they have experience with your type of business model, be it Software as a Service (SaaS), eCommerce, or manufacturing, to ensure they can navigate its unique challenges.

- Processes Managed: Scrutinise the CV for evidence of processes they’ve managed or improved, such as budgeting cycles or financial audits.

- Team Structure: Determine whether they’ve managed a team or worked independently. Both have their merits but consider what’s more suitable for your company’s current structure.

- Additional Qualifications: Look for any certifications, courses, or additional training that make them stand out.

- Soft Skills: While harder to gauge from a CV, look for indications of soft skills like leadership, communication, and problem-solving.

First Round of Interviews

The initial interview is your first opportunity to interact with candidates directly. It allows you to assess not just their qualifications but also their fit within your company’s culture.

Key Interview Components

- Clarify the Recruitment Scorecard: Briefly discuss the recruitment scorecard to ensure the candidate understands the role’s responsibilities and expectations.

- Address CV Queries: Ask any questions that arose while reviewing their CV. This could relate to gaps in employment, specific projects, or skills they’ve listed.

- Gauge Compatibility: The first interview is not just about skills but also about personality and cultural fit. Do you like them? Do they communicate effectively?

- Discuss Availability: Confirm their availability to align with your company’s needs, especially if the role requires immediate attention.

- Initial Skill Assessment: While a deep dive comes later, ask a few questions that touch on their technical skills to gauge their expertise level.

- Next Steps: Clearly outline the next stages in the recruitment process so the candidate knows what to expect going forward.

Take-Away Task or Case Studies

After the initial interview, the next step is a more practical evaluation of the candidates. This often involves either assigning a take-away task or reviewing case studies that showcase their skills and experience.

Key Points for Evaluation

- Assign a Take-Away Task: If you opt for a task, make it relevant to the job role. For example, you could ask for a basic financial model or a short presentation on a hypothetical fundraising strategy. Ensure the task can be completed within a reasonable timeframe.

- Review Case Studies: Alternatively, ask candidates to present case studies from their previous roles. Look for projects that align with the responsibilities they would assume in your company. Evaluate the outcomes, strategies employed, and the challenges they overcame.

- Skill Assessment: Whether through a task or case studies, assess the candidate’s technical skills, problem-solving abilities, and attention to detail.

- Time Management: If a take-away task is given, the time taken to complete it can also be an indicator of the candidate’s time management skills.

- Communication: Assess how well the candidate presents their task or case studies. Effective communication is crucial, especially if they’ll be dealing with investors or leading a team.

- Feedback Loop: Provide constructive feedback on the task or case studies and gauge their receptiveness. This can offer insights into their willingness to adapt and improve.

Second Round of Interviews

The second round of interviews is a more in-depth exploration of the candidates’ competencies that were touched upon in the first interview. This stage is crucial for making a final decision.

Key Focus Areas

- Technical Proficiency: Delve into the specifics of their technical skills. For example, you could ask them to explain a complex financial model they’ve created or discuss their approach to equity fundraising.

- Problem-Solving: Pose hypothetical scenarios related to the role, such as managing a budget shortfall or negotiating with investors, to assess their problem-solving and critical thinking skills.

- Cultural Fit: Use this opportunity to assess how well the candidate would fit into your company culture. Ask questions that reveal their values, work ethic, and team collaboration skills.

- Leadership Qualities: If the role involves team management, inquire about their leadership style, past experiences in team management, and how they handle conflict resolution.

- Long-Term Vision: Discuss the candidate’s long-term career goals to see if they align with your company’s objectives and growth plans.

- References: Consider asking for professional references if you haven’t done so already. This can provide third-party validation of the candidate’s skills and character.

Make a Fractional CFO Hire

You’ve navigated through the recruitment process. Now it’s time to make an informed hiring decision. Finalising your Fractional CFO hire involves several key steps to ensure a smooth transition and a successful working relationship.

Steps to Finalise the Hire

- Review All Data: Take a moment to revisit the recruitment scorecard, CVs, interview notes, take-away tasks, and case studies. Ensure the chosen candidate excels in all required areas.

- Salary Negotiation: Discuss and agree upon the compensation package, keeping in mind industry standards and the candidate’s experience level.

- Contract Details: Clearly outline the terms of engagement, including roles, responsibilities, and any performance-based incentives in the contract.

- Reference Checks: If not already done, now is the time to contact the candidate’s references to validate their skills and character.

- Legal Compliance: Ensure all legal requirements are met, including background checks and verification of qualifications.

- Onboarding Plan: Develop a comprehensive onboarding plan to integrate the new hire into your team and systems efficiently.

- Extend the Offer: Once all the above steps are satisfactorily completed, extend a formal job offer to the candidate.

What Services Do eCommerce Fractional CFOs Provide?

Understanding the range of services an eCommerce Fractional CFO offers is essential for maximising the value they bring to your organisation.

Core Services

- Financial Reporting: Generate regular, customised financial reports that offer a clear snapshot of your business’s fiscal health. These reports are invaluable for internal decision-making and for keeping investors informed.

- Financial Modeling, Forecasting & Budgeting: Craft detailed financial models to predict future revenue streams, expenses, and profitability. This aids in strategic planning and ensures you’re prepared for various market conditions.

- Investor Relations: Manage communications with current and potential investors, providing them with the financial data and forecasts they need to make informed decisions.

- Competitor Benchmarking: Analyse competitors’ financial metrics to identify your business’s strengths and weaknesses, helping you make data-driven strategic decisions.

- Fundraising: Assist in raising capital through various channels, including venture capital, private equity, and debt financing. They’ll prepare detailed financial forecasts to attract investors.

- Mergers and Acquisitions: Oversee the financial aspects of buying or selling businesses, including due diligence and valuation.

- Bookkeeping: Ensure accurate tracking of all financial transactions, from expenses to revenue, maintaining a clean financial slate.

- Payments & Payroll: Manage all outgoing payments to suppliers and staff, ensuring compliance with tax and other legal obligations.

- Cash Flow Management: Implement strategies to optimise cash flow, freeing up capital that can be reinvested in the business.

How Much Does a Fractional CFO Cost?

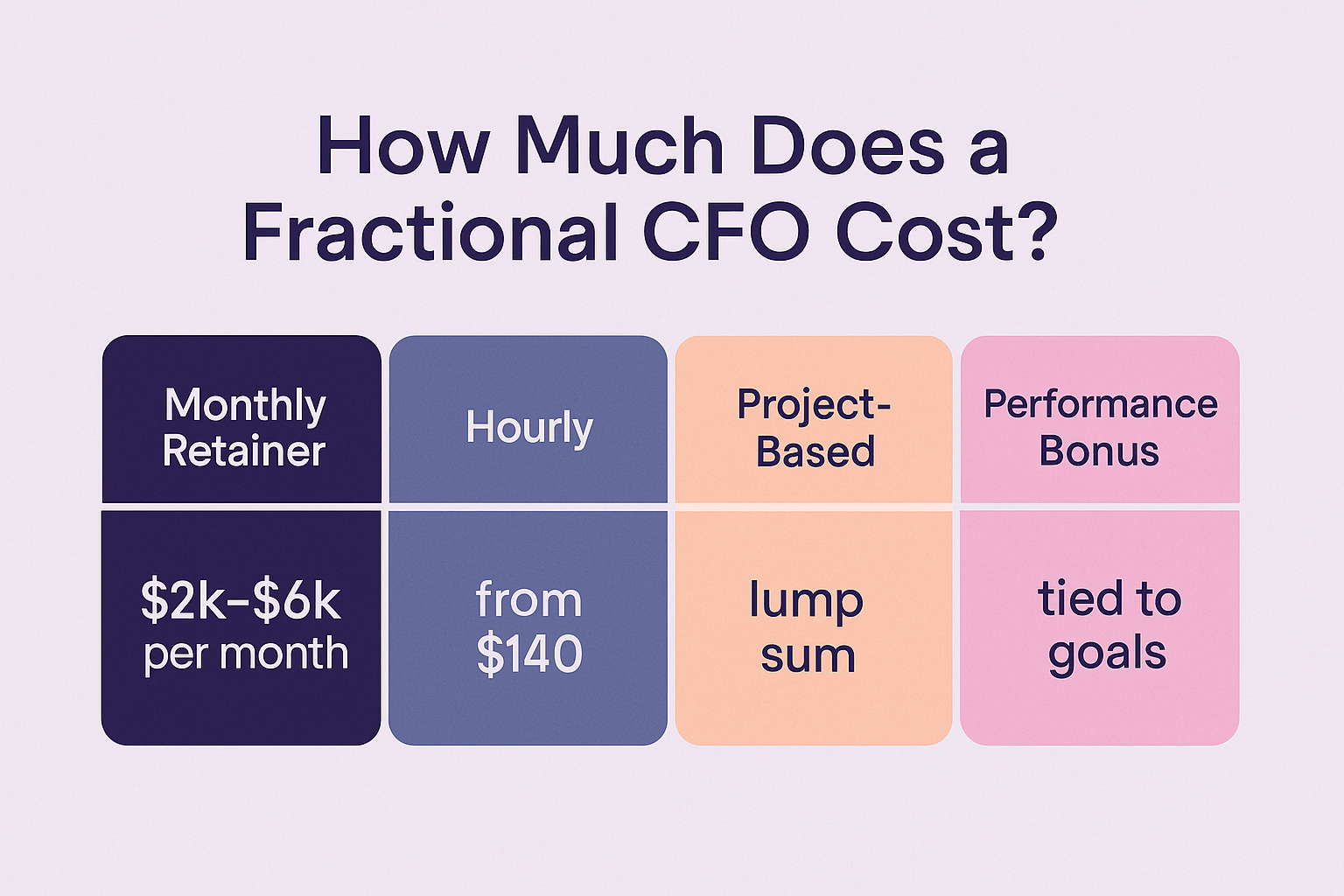

Alt text: Infographic titled ‘How Much Does a Fractional CFO Cost?’ comparing four pricing models—Monthly Retainer $2k‑$6k per month, Hourly from $140, Project‑Based lump sum, and Performance Bonus tied to goals.

Determining the cost of hiring a Fractional CFO is crucial for budget planning and assessing the return on investment (ROI). It can vary widely based on the following factors:

Pricing Models

- Monthly Retainer: A common pricing model is a monthly retainer, which can range from $2,000 to $6,000. This model provides a set number of hours each month and is ideal for ongoing, long-term needs.

- Hourly Rates: If your needs are more project-specific, hourly rates may be more suitable. These can start from $140 per hour, depending on the CFO’s experience and the complexity of the task.

- Project-Based: For one-off projects like fundraising or mergers, a project-based fee might be negotiated. This is often a lump sum based on the estimated workload.

- Performance-Based Incentives: Some Fractional CFOs may offer performance-based pricing, where part of their compensation is tied to achieving specific financial or business milestones.

Factors Influencing Cost

- Experience: CFOs with a rich background in your industry will generally command higher fees.

- Geographical Location: Rates can also vary based on the cost of living in a particular region.

- Scope of Work: The broader the range of services required, the higher the likely cost.

- Specialisation: Niche expertise, such as experience in a highly regulated industry, can also command a premium.

- Geographic Location: Fractional CFOs based outside the U.S. often charge about 30 % less for comparable expertise, thanks to cost‑of‑living differences and favorable exchange rates.

When Is the Right Time to Hire a Fractional CFO?

Identifying the optimal moment to hire a Fractional CFO is pivotal for maximising their impact on your business. Timing can depend on various factors, from your company’s growth stage to specific financial challenges you’re facing.

Key Indicators

- Rapid Growth: If your business is scaling quickly and the financial complexities are increasing, it’s a strong sign you need a Fractional CFO to manage this growth effectively.

- Investor Relations: When you’re at a stage where you need to engage with investors, a Fractional CFO can provide the financial transparency and forecasting that investors require.

- Cash Flow Issues: If you’re facing challenges in managing cash flow or have capital tied up in non-performing assets, a Fractional CFO can help optimize your financial resources.

- Strategic Decisions: Planning to enter new markets, launch new products, or even acquire another business? A Fractional CFO can provide the financial modelling and risk assessment needed for these strategic moves.

- Regulatory Compliance: As your business grows, so do the complexities of legal and financial compliance. A Fractional CFO ensures you navigate these requirements without hiccups.

- Team Limitations: If your current financial team is overwhelmed or lacks the expertise for more strategic tasks, it’s time to consider hiring a Fractional CFO.

- Cost Concerns: If a full-time CFO is beyond your budget, a Fractional CFO offers expertise without the full-time commitment, making it a cost-effective solution.

Why Work with Alexej Pikovsky’s CFO Collective?

Scaling an eCommerce brand means balancing cash‑gobbling growth with ruthless margin discipline—usually on a shoestring finance team. After spending years operating, investing, and advising in the DTC arena, Alexej Pikovsky saw founders struggling to find finance partners who actually understood the nuance of SKU‑level profitability, ad‑spend pacing, and inventory finance.

So Alexej built something different: a vetted fractional CFO network designed exclusively for consumer, retail, and eCommerce brands. Think of it as a “founder filter”—only senior finance operators who can demonstrate real eCom wins (raising capital, lifting margins, steering exits) and pass rigorous soft‑skill screening make the cut.

Here’s why founders choose Alexej’s bench over generic talent platforms:

- Founder‑First Vetting – Alexej hand‑screens CFOs who’ve already scaled 7‑ to 9‑figure DTC brands.

- Vertical Mastery – Every partner has track records in Amazon, Shopify, or retail‑hybrid models.

- Speed to Value – Average match time: 10-14 days. First margin‑impact initiative: 2-6 weeks days.

- Transparent Pricing – Flat retainers; no recruiter mark‑ups.

- Community Access – Founders matched through Alexej also gain entry to his eCommerce profitability circle (see next section).

eCommerce Founder Community

Over the years, Alexej Pikovsky has participated in world‑class founder networks such as Hampton, YPO, OnDeck, EO, and Dynamite Circle, learning first‑hand how peer support accelerates growth. While invaluable, these groups cater to all industries and rarely deep‑dive into the financial mechanics that make or break online retail profitability.

Pure‑play eCommerce forums like eCommerceFuel or FMCG Slack groups fill some gaps, yet conversations often stay high‑level—tactics, tooling, agency referrals—and seldom tackle granular topics such as SKU‑level contribution margins, negotiation tactics with suppliers, deep dives into salaries across the team, cash‑conversion‑cycle optimisation tactics, or preparing financials for an exit to a strategic, a private‑equity fund, or an aggregator.

Recognising the void, Alexej launched a private community laser‑focused on one goal: maximising profit margins for eCommerce founders, specifically those running 6‑ to 9‑figure brands. Members benefit from:

- Profit‑First Webinars & Masterminds – Veteran finance operators and scale‑stage founders share proven margin‑boosting tactics.

- Peer Knowledge Exchange – A private forum to discuss supplier terms, capital‑efficiency hacks, and financial benchmarks in real time.

- Exclusive eCommerce Dinners – Intimate gatherings in Los Angeles, New York, London, Lisbon, and Dubai for deeper relationship‑building and mastermind conversations.

- Resource Vault & Warm Intros – Access to curated templates, SOPs, and an investor network.

Join the Community

Applications are open for eCommerce operators and founders generating $500k–$20 million in annual revenue. → Apply Here

The Bottom Line

Navigating the steps to hire a Fractional CFO is just the beginning. The true value emerges when this financial expert becomes an integrated part of your team. Their expertise can be a game-changer in areas like strategic growth, investor relations, and financial stability.

Whether it’s fine-tuning your financial models or preparing for a funding round, the Fractional CFO you hire should align with your specific needs and objectives. Whether you DIY the search or leverage Alexej Pikovsky’s vetted collective, don’t wait until cash feels tight or investors start asking hard questions. Move first, move smart, and scale profitably.

FAQ

Brands doing $2 m–$50 m in annual revenue that need deeper margin visibility, fundraising prep, or exit planning—but can’t yet justify a full‑time CFO.

The duration can vary depending on your specific needs and the hiring process you follow. However, through Alexej’s network, most founders receive a shortlist within two weeks of the discovery call.

Alexej Pikovsky is first and foremost an operator‑investor in eCommerce. He owns a profitable home‑and‑wellness brand where he still wears the CFO hat, plus a digital‑marketing agency that scales DTC stores. Inside his private eCommerce Profitability Community and small‑group coaching calls, founders tap directly into his playbooks on cash flow, SKU‑level margins and exit prep.

When you need ongoing, hands‑on finance horsepower, Alexej acts as the matchmaker and quality gatekeeper, pairing you with a rigorously vetted fractional CFO who has already scaled 7‑ to 9‑figure eCom brands. In short, you get Alexej’s strategic oversight and a dedicated CFO operator, without paying for his personal billable hours.