As the digital landscape continues to evolve, so does the complexity of B2B SaaS fundraising. The benchmarks and investor expectations are not static; they shift with market dynamics, technological advancements, and economic factors.

Recognising this ever-changing environment, Point Nine, one of Europe’s leading venture capital firms, has once again stepped up to offer invaluable insights with their 2023 SaaS Funding Napkin based on extensive research, market analysis, and real-world data.

In this in-depth guide, I delve into key performance indicators (KPIs) that matter in the fundraising process, from Compound Monthly Growth Rate to Sales Efficiency Metrics, and explore the benchmarks required for startups at various stages, from pre-seed to series B. A well-structured Indication of Interest (IOI) can set the stage for successful deal-making.

But numbers are just part of the story. Discover the importance of human elements that can make or break your fundraising efforts, such as team dynamics, product-market fit, and capital efficiency.

As Artificial Intelligence becomes an inextricable part of modern business strategies, learn how it’s revolutionising conversations around fundraising, offering new avenues for innovation and efficiency.

I’ll also tackle the challenges you’re likely to face, including market volatility and competition for investor attention, and offer actionable tips for crafting a compelling pitch. Finally, to help you avoid common pitfalls, I’ll outline mistakes that could derail your fundraising efforts.

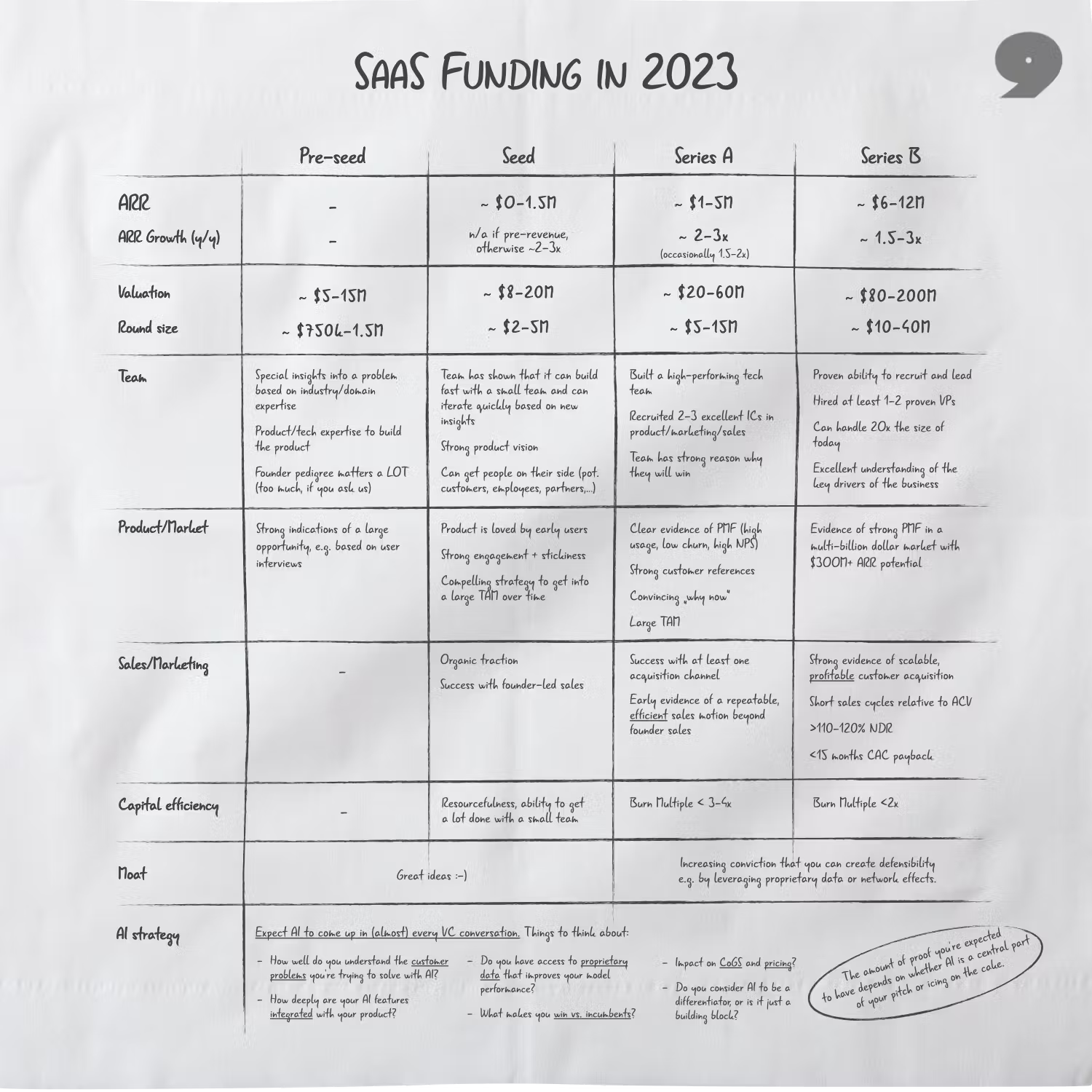

Here’s a snapshot of the 2023 SaaS Funding Napkin:

Saas Metrics That Matter in 2023 and more so in 2024

Before diving into the granular details of each fundraising stage, it’s crucial to first understand the key performance indicators (KPIs) that are most important to investors across various stages of growth.

By cross-referencing them with the benchmarks stipulated in the 2023 SaaS Funding Napkin, startups can better tailor their fundraising strategies to meet investor expectations.

Compound Monthly Growth Rate (CMGR)

CMGR is a metric that has gained prominence. A rate of at least 15% is desirable for startups with an ARR below $1 million. For those above this threshold, a CMGR of at least 10% is considered healthy. This metric is crucial as it shows the speed at which your company is growing, which is a vital factor for investors.

Customer Concentration and Retention Rates

Investors are increasingly scrutinising customer concentration and retention rates. A diversified customer base reduces the risk associated with the loss of a single large client. High retention rates, often measured through Net Revenue Retention (NRR), indicate strong customer satisfaction and are a sign of a sustainable business model.

Sales Efficiency Metrics

Customer Acquisition Cost (CAC) and CAC Payback Period are key metrics that investors consider when evaluating the efficiency of your sales and marketing efforts. A lower CAC and shorter payback period are indicators of a more efficient and scalable customer acquisition strategy.

The Importance of Burn Multiple

The Burn Multiple is a newer metric that evaluates how much a startup is burning to achieve each unit of growth. A lower Burn Multiple is generally more attractive to investors as it indicates capital efficiency.

Pre-seed Stage: The Foundation

The pre-seed stage is often considered the “ideation phase,” where the foundational elements of a startup are laid. It’s a critical juncture where the initial validation of the business idea occurs and the groundwork for future fundraising rounds is established. In 2023, the benchmarks for this stage have been clearly defined, offering startups a roadmap to navigate this initial yet pivotal phase.

2023 Benchmarks

- ARR (Annual Recurring Revenue): At this stage, ARR is typically not applicable as the focus is on product development and market validation rather than revenue generation.

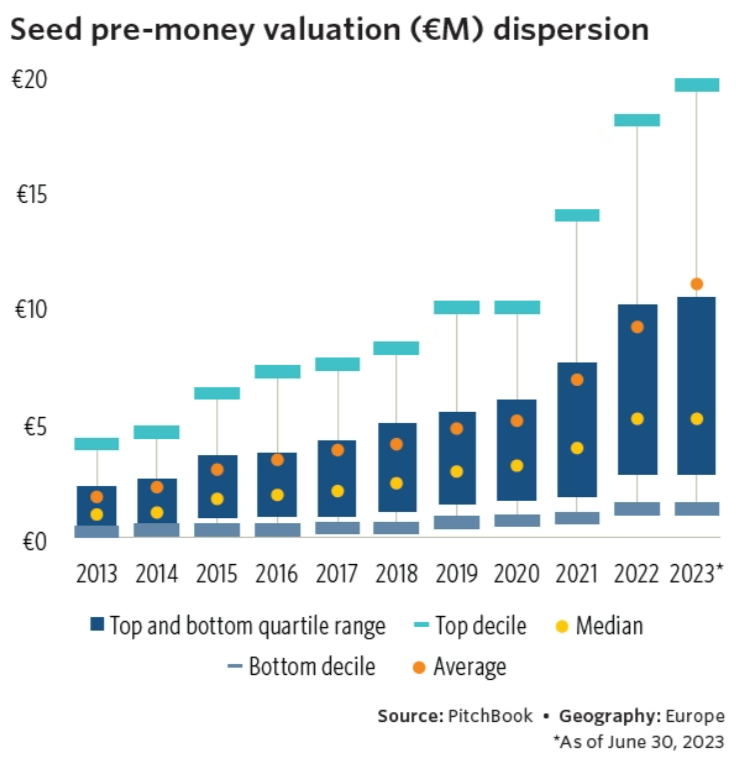

- Valuation: The valuation range is between $5 and $15 million. This valuation often reflects not just the product or service idea but also the team’s capability and the market opportunity. Despite a lot of the negative noise on investment activity slowing down, pre-money valuations for Seed rounds in Europe according to Pitchdeck (June, 2023) shows an increase in the average valuation to approximately EUR 10 million and median valuation being pretty much the same as in 2022 with close to EUR 5 million (as outlined in the chart below).

- Round Size: Investment rounds are expected to range from $750,000 to $1.5 million. This capital is often used for product development, initial marketing, and other foundational business activities.

Key Investor Criteria

Team

Investors at this stage are essentially investing in the team. They look for founders with specialised industry or domain insights and technical expertise. Members should not only understand the problem they are solving but also have the skills to develop a viable solution. Increasingly, the background and track record of the founder(s) are under scrutiny. Investors often consider educational qualifications, previous entrepreneurial ventures, and even the founder’s network while making investment decisions.

Product/Market

During pre-seed, the product is often in its infancy. However, there should be strong indications of a large market opportunity. Investors look for evidence that the market need is real and substantial, often validated through user interviews, surveys, or pilot projects. The goal is to assess whether the startup is solving a genuine problem or fulfilling an unmet need in a way that is scalable.

Moat

A ‘moat’ refers to a startup’s ability to maintain competitive advantages over its competitors in the long term. During this stage, it often translates to unique, innovative ideas. Investors are keen to back startups that have the potential to carve out a unique space in the sector, making it difficult for competitors to challenge them directly.

Seed Stage: Early Growth

The seed stage represents a pivotal moment in a startup’s lifecycle. It’s the phase where the initial concept has been validated, and the focus shifts towards scaling and growth. The benchmarks for 2023 have been meticulously outlined to guide startups through this crucial stage, helping them meet investor expectations and secure the necessary funding for expansion.

2023 Benchmarks

- ARR: The expected ARR ranges from $0 to $1.5 million. While some startups may still be pre-revenue, those that have started generating income should aim for this benchmark.

- Valuation: The valuation is projected to be between $8 and $20 million. This is often a reflection of the startup’s growth prospects, the strength of the team, and the market opportunity.

-

Round Size: Investment rounds at this stage are expected to range from $2 to $5 million. This funding is typically allocated towards further product development, scaling marketing efforts, and expanding the team.

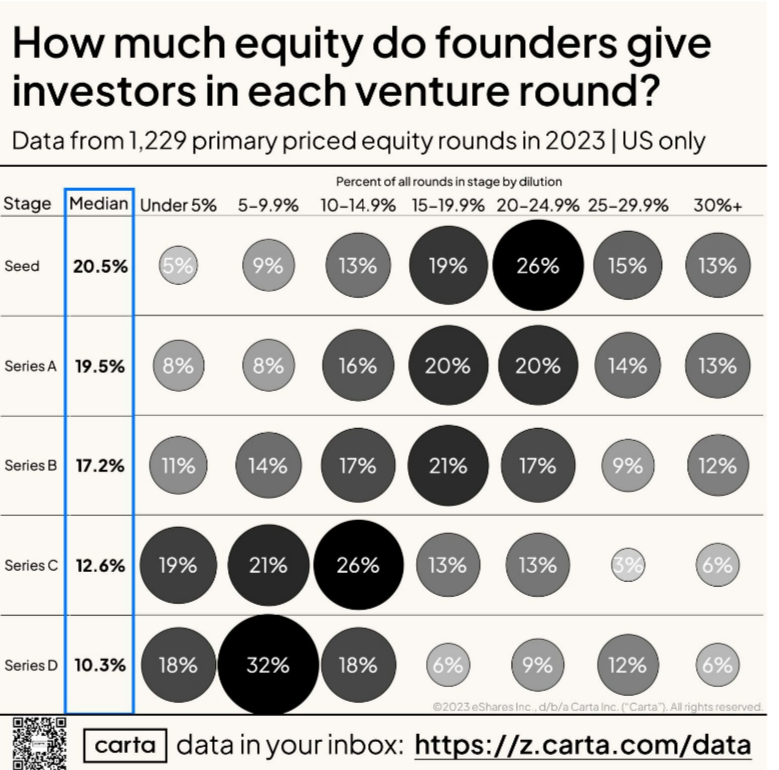

Carta published data from 1,229 primary priced equity rounds in 2023 for the US and one can see the median amount of ownership that founders give away during their Seed round is 20.5%.

Key Investor Criteria

Team

Investors are looking for more than just a competent team; they want one that can adapt and evolve. Agility in building and iterating upon the product is vital. Additionally, the team’s ability to attract key stakeholders—be it customers, partners, or even future employees—is a significant factor in investment decisions.

Product/Market

By the seed stage, the product should not only exist but also exhibit strong user engagement. Investors are keen to see a compelling strategy to tap into a large Total Addressable Market (TAM). Metrics such as user retention rates, customer lifetime value, and engagement ratios often come under scrutiny.

Sales/Marketing

Organic growth is highly valued at this stage. Investors look for evidence of successful founder-led sales and the beginnings of a scalable customer acquisition strategy. The ability to acquire clientele without excessive spending is a strong indicator of future profitability.

Capital Efficiency

Resourcefulness is key. Investors appreciate startups that can achieve significant milestones without burning through capital at an unsustainable rate. Metrics like the “burn rate” and “runway” become increasingly important, as they indicate how efficiently the startup is using its capital to grow.

Series A Stage: Scaling Up

The series A stage is often considered the “make or break” phase for startups. It’s the point where the rubber meets the road, and startups must prove that they can scale their operations and sustain growth. The 2023 benchmarks for series A have been carefully delineated to guide startups through this challenging yet exciting stage.

2023 Benchmarks

- ARR: The expected ARR is between $1 and $5 million. This benchmark serves as a strong indicator of a startup’s growth trajectory and market acceptance.

- Valuation: This is projected to be between $20 and $60 million. The valuation often reflects the startup’s proven ability to scale and capture market share.

- Round Size: Investment rounds are anticipated to range from $5 to $15 million. This capital is generally used for aggressive scaling, including team expansion, product development, and market penetration.

Key Investor Criteria

Team

By series A, investors expect to see a well-rounded tech team in place, along with excellent individual contributors in product, marketing, and sales. The team’s collective experience and ability to execute the company’s vision are critical factors in investment decisions.

Product/Market

Clear evidence of Product-Market Fit (PMF) is non-negotiable at this stage. Investors look for strong customer references and engagement metrics as proof. Additionally, a compelling “why now” narrative is crucial. This could be related to market trends, technological advancements, or regulatory changes that create a unique opportunity for the startup.

Sales/Marketing

Investors expect to see demonstrable success in at least one customer acquisition channel by series A. Whether it’s content marketing, paid advertising, or partnerships, the startup needs to show that it has a scalable and repeatable customer acquisition strategy.

Capital Efficiency

Capital efficiency becomes increasingly important. A burn multiple of less than 3-4x is generally considered desirable. This indicates that the startup is growing efficiently, without burning through capital at an unsustainable rate.

Moat

Investors are increasingly looking for signs of defensibility in your business model. This could be through proprietary technology, network effects, or unique partnerships. The idea is that your business should have certain aspects that are difficult for competitors to replicate, ensuring your long-term market position.

Series B Stage: Accelerated Growth

By the time a startup reaches the series B stage, it’s no longer a question of viability but one of scalability and market leadership. The benchmarks in 2023 are designed to guide startups through this phase of accelerated growth and expansion into new markets or verticals.

2023 Benchmarks

- ARR: The expected ARR is between $6 and $12 million. This substantial revenue indicates a strong market presence and the ability to generate consistent income.

- Valuation: This is projected to range between $80 and $200 million. It reflects the startup’s proven market leadership and growth potential.

- Round Size: Investment rounds at this stage are expected to be sizable, ranging from $10 to $40 million. This capital is generally allocated for further scaling, international expansion, and possibly even acquisitions.

Key Investor Criteria

Team

Investors expect to see a team with proven leadership skills. The presence of at least 1-2 experienced VPs in key areas like technology, marketing, or sales is considered essential. The team’s ability to manage a larger workforce and complex operations is scrutinised.

Product/Market

A strong PMF in a multi-billion dollar market is a must. Investors are looking for startups with the potential to generate $300M+ in ARR. This often involves having a diverse customer base and the ability to adapt the product to meet varying market needs.

Sales/Marketing

Startups should have scalable and profitable customer acquisition strategies. Investors will look at metrics like CAC, Customer Lifetime Value (CLV), and NRR to assess the effectiveness of sales and marketing efforts.

Capital Efficiency

Capital efficiency is critical at this stage. A burn multiple of less than 2x is considered ideal, signifying that the startup is utilising its capital efficiently to fuel growth without excessive spending.

The AI Factor in Fundraising: A Game-Changer in 2023 and 2024

As we move further into the digital age, AI is no longer just a buzzword; it’s a fundamental aspect of modern business strategies. In the context of B2B SaaS fundraising end of 2023 and for 2024, AI has become a cornerstone in discussions with venture capitalists and investors.

Whether AI is the central element of your startup’s value proposition or a supplementary feature, it’s crucial to be well-prepared to discuss its role in your business.

Understanding of Customer Problems Solved by AI

Investors are keen to understand how deeply you’ve considered the customer problems that your AI solutions are designed to solve. Are you using AI to automate mundane tasks, enhance data analytics, or perhaps provide more personalised customer experiences? The ability to articulate the specific pain points addressed by your AI technology is crucial.

Impact on CoGS and Pricing

The impact of AI on the Cost of Goods Sold (CoGS) and pricing strategy is another critical discussion point. The technology can often reduce operational costs by automating tasks but may also require significant investment in data acquisition and processing. How does this balance out in your pricing strategy? Are the cost savings passed on to the customer, or are they used to fuel further R&D?

Access to Proprietary Data

Having access to proprietary data that can enhance your AI algorithms is a significant advantage. Investors will want to know if your startup has unique statistical sets that can’t be easily replicated by competitors. This could be anything from user behaviour data to industry-specific metrics that make your AI algorithms more accurate or efficient.

Integration Level of AI Features

The depth to which AI is integrated into your product also matters. Is AI a core component of your product architecture, or is it an add-on feature? The more deeply integrated it is, the more defensible your product is against competitors who might want to add similar features later on.

Overcoming Challenges in SaaS Fundraising

In today’s SaaS fundraising landscape, resilience, adaptability, and a focus on key efficiency metrics are essential for success. Coupled with sustainable practices and AI-driven capabilities, companies must also navigate market volatility, differentiate themselves from competitors, and address regulatory hurdles to secure long-term funding.

Market Volatility and Uncertainty

SaaS companies, especially those in the cybersecurity software space, must demonstrate agility and resilience in the face of market volatility. This uncertainty can impact both sales and fundraising efforts.

To thrive in such an environment, companies should remain agile, adapting to industry changes while being mindful of their own business needs and potential market developments. Flexibility is key, especially when price fluctuations or sudden market shifts could affect capital-raising strategies.

By staying adaptable, companies can better position themselves to find the right support and boost their overall growth, regardless of economic uncertainties.

Competition for Investor Attention

The SaaS sector is highly competitive, making it crucial for companies to differentiate themselves to capture investor interest. This involves creating unique products and services, highlighting strong growth metrics like ARR, and clearly communicating a compelling vision.

Companies should also focus on customer service excellence, proper utilisation of integrations, and building a strong brand reputation. By doing so, they not only lay the foundation for securing funding but also position themselves for potential expansion in an already crowded market.

Regulatory and Compliance Issues

Investors are keen on ensuring compliance to avoid fines, penalties, or reputational damage that could affect funding opportunities. Therefore, it’s essential for companies to stay updated on all relevant regulations and implement robust data privacy and security protocols.

Regular assessments of compliance levels and a demonstrated commitment to regulatory adherence can mitigate risks and increase the likelihood of securing the necessary investment capital for growth.

Tips for Crafting a Compelling Pitch

Crafting a compelling pitch is crucial for SaaS businesses seeking investment. In this section, we’ll explore key techniques that can make your proposal irresistibly appealing to investors, thereby increasing your chances of fundraising success.

Showcasing Product Differentiation

In the crowded SaaS landscape, product differentiation is essential for capturing investor attention. Companies can set themselves apart by offering unique features, exceptional service quality, and innovative solutions.

Taking Salesforce’s CRM platform or Slack’s team collaboration application into account. Both have succeeded in making an impression on investors thanks to how they made use of differentiating qualities within their products along with favourable brands that are associated with them now. By clearly showcasing what sets your company apart, you increase your chances of securing funding.

Demonstrating Traction and Growth

Investors are keen to see evidence of market traction and growth. Key metrics like ARR, growth rate, CAC, and churn and retention rates should be prominently featured in your pitch. Take, for example, Calendly, which achieved a remarkable 1,180% year-on-year growth, or Customer Labs, which boasts a user base of over 1,500 businesses.

These success stories vividly illustrate how effectively leveraging key metrics can make a compelling case for investment opportunities, serving as a blueprint for other businesses aiming to do the same. By focusing on measurable milestones that highlight both short-term wins and long-term goals, you can attract the right investment opportunities.

Highlighting Team Expertise and Vision

The strength of your team is often a deciding factor for investors. Your pitch should highlight the skills, achievements, and vision of each team member. Demonstrating industry experience can instill confidence in investors, assuring them that your business goals are attainable.

Prominent success stories from companies like Salesforce, Slack, and Zoom underscore this importance. These examples demonstrate how focusing on team expertise and a clear vision for the future can significantly enhance a company’s ability to secure investment.

Creating Urgency

Creating a sense of urgency during the fundraising process can be a pivotal factor in securing investment in a timely manner. One effective strategy is to sequence your outreach efforts, targeting different groups of investors in stages rather than all at once.

For instance, you could first approach angel investors, followed by family offices, and then venture capitalists. This staged approach not only allows you to refine your pitch based on early feedback but also creates a sense of scarcity and competition among potential investors.

Employing scarcity tactics, such as announcing limited spots on your cap table, can further expedite commitments by instilling a fear of missing out. By carefully orchestrating your outreach and employing these urgency tactics, you can significantly enhance the momentum of your fundraising efforts.

Storytelling

A compelling narrative does more than just outline the facts; it creates an emotional connection with potential investors, making your pitch memorable and impactful. Instead of merely presenting data and financial projections, focus on crafting a story that addresses the problem you’re solving, your unique solution, and why your team is the right one to bring this vision to life.

Structure your story in a way that flows logically, but also includes elements of surprise or intrigue to keep your audience engaged. Highlight key milestones and future plans to give investors a roadmap of your company’s journey.

Common Pitfalls to Avoid in B2B SaaS Fundraising in 2024

While the potential for growth and innovation is significant, there are several common pitfalls that entrepreneurs often encounter in B2B SaaS fundraising. Being aware of these can save you time, effort, and potentially, your business. Here are some pitfalls to steer clear of:

Lack of Preparation

Jumping into the fundraising process without adequate preparation can lead to a host of problems. From incomplete financial models to a poorly articulated value proposition, it can send red flags to potential investors. Before you even think about reaching out to investors, make sure you have all your ducks in a row.

Spend ample time preparing all required documents, financial projections, and a compelling pitch deck. Conduct market research to solidify your business case and understand your competitive landscape.

Poor Workload Management

Fundraising is a full-time job in itself. Trying to manage it along with your regular responsibilities can lead to burnout and mistakes. When you’re stretched too thin, you can’t give the fundraising process the attention it deserves, which can be detrimental to your efforts.

Delegate day-to-day tasks to trusted team members or consider bringing in a temporary executive to handle operations while you focus on fundraising.

Neglecting Relationship Building

Investors don’t just invest in ideas; they invest in people. If you haven’t built any relationships within the investment community, you’re starting at a disadvantage. Cold calls and emails are rarely as effective as introductions from mutual contacts.

Long before you start your fundraising efforts, network extensively. Build relationships with potential investors, industry veterans, and other founders who can vouch for you when the time comes.

Inadequate Narrative Refinement

Your story matters. A compelling narrative can be the difference between catching an investor’s interest and your pitch deck gathering digital dust in their inbox. If your narrative is weak, incomplete, or uninteresting, it won’t matter how good your product is.

Continuously refine your pitch. Use feedback from initial meetings to improve your narrative and make it more compelling. Consider hiring a storytelling expert or consultant to help craft a more effective pitch.

The Future of B2B SaaS Fundraising

With the global SaaS market projected to reach an astounding $720.44 billion by 2028, companies aiming to stay competitive and successfully secure funding will need to excel in areas of operational efficiency. This includes the adoption of cutting-edge solutions powered by AI or Machine Learning Models (MLMs).

Additionally, a commitment to sustainability, such as green energy initiatives, will not only elevate a company’s appeal to investors but also make a positive impact on the environment. In this evolving landscape, these elements will become critical factors in attracting investment and ensuring long-term success.

The Added Advantage of Partnering with a Growth Agency

Navigating the intricacies of SaaS fundraising can be a daunting task, especially when you’re focused on growing your brand. That’s why it’s often beneficial to bring in experts who can help you achieve the metrics that make your company more appealing to investors.

If you’re looking for a tailored strategy to scale your SaaS business, consider partnering with a full-stack growth agency like NUOPTIMA. Their expertise could be the game-changer you need to meet and exceed investor expectations.

Final Thoughts

The landscape of B2B SaaS fundraising continues to be both dynamic and challenging. The benchmarks have evolved, and investor expectations have shifted to accommodate market trends and technological advancements. 2023 required much better metrics than 2022 and with the various external headwinds, 2024 will be closer to 2023 and probably a notch tougher.

Whether you’re at the pre-seed stage or gearing up for a series B round, understanding these factors is crucial for success.

However, it’s essential to remember that while benchmarks and metrics are vital, they are not the be-all and end-all. The quality of your team, the strength of your product, and your company’s unique value proposition are equally significant. These intangible elements often make the difference between a successful fundraising round and a missed opportunity.