Market size is one of the key factors founders need to evaluate and take into account when they want to start a new venture, launch a new product, or branch out into a new market. Understanding how to identify the biggest opportunities in the market can help founders make more informed decisions and ensure they’re targeting the right niche for growth. Assuming that the target market is much larger than it actually is is one of the biggest mistakes a founder can make. Below, we will explain how you can accurately evaluate the size of your market.

Evaluating the Size of Your Target Market

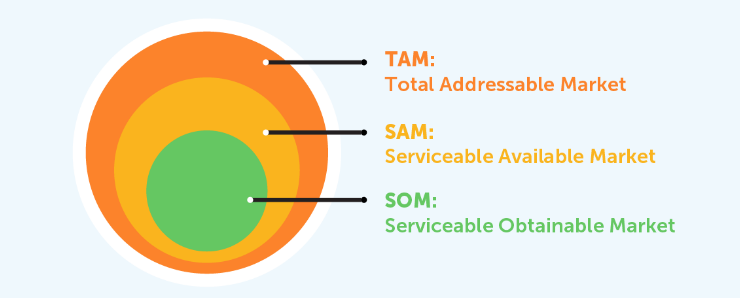

There are several metrics you need to calculate when determining the size of your market:

- Total addressable market (TAM)

- Serviceable addressable market (SAM)

- Serviceable obtainable market (SOB)

Calculating the Total Addressable Market

Before you can start measuring the total addressable market for your product, you need to determine who your key target customers are. Then you can use a top-down or bottom-up method to carry out the market size evaluation.

The Top-Down Method

The top-down method involves using publicly available information to calculate your market size. While this method can be quite convenient and easy to use, it can often cause you to overestimate the size of your market, so you need to be extremely careful and diligent.

Let’s discuss this approach using an example. For instance, let’s assume that you’re considering developing new inventory tracking software that will be used in small and mid-sized convenience stores managed by small business owners. In this case, a lot of the publicly available data you may find will lead you to overestimate your market share. For example, if you see reports stating that the convenience store industry in the UK is worth £50 billion, you can’t simply assume that that is your market size. This is because this number constitutes the revenue earned by the entire industry. So it doesn’t represent the amount of money convenience store owners spend on inventory tracking software. Plus, this number includes revenue from convenience store chains, which are not part of your key target customer demographic.

However, you will be in a much better situation if you can find information regarding the amount of money convenience store owners spend on software in general, or better yet, on inventory tracking software. Then you can try to calculate your total addressable market by taking into account the proportion of independent convenience stores in the industry.

The Bottom-Up Method

As you can see from the previous section, the top-down method leaves a lot of room for mistakes and overestimation. As a result, most business experts and investors prefer to use the bottom-up method when calculating the total addressable market. When you’re ready to scale your business, learning how to find small business investors can be a crucial part of your growth strategy. Under this approach, you will need to calculate the number of your key target customers, estimate the average annual revenue your company can get from one customer, and multiply the two values together to get the total addressable market. When valuing a business, another reliable approach is to use a revenue-based valuation to get a more accurate picture of its potential.

The first step is to determine the number of key target customers for your product. For example, you may be able to find the total number of convenience stores in your country. From that, you can estimate what percentage of these stores are owned by small business owners and use this number in your addressable market calculations. Alternatively, you can and should use the data obtained by your own team to carry out accurate calculations. For example, if you know how many convenience stores there are in your region and what percentage of them is owned by independent businessmen, you can then use this data to estimate the number of key target customers in the entire country. Once you have this data, you will need to multiply the number of key target customers in the market by the average annual revenue one customer brings to your company.

Evaluate Results Obtained Using Both Methods

If you have done your calculations using both the top-down and bottom-up methods and got drastically different numbers, you will need to use your intuition and knowledge of the field to figure out which number closer represents the truth. Of course, you can always simply take the average, but it can sometimes lead you to overestimate your market size. Remember that being overly optimistic with your market sizing efforts can lead you to develop a faulty business model that doesn’t work, which will likely cause your company to have a hard time raising money from investors. It’s much better to underestimate your market size than to overestimate it if you want to ensure that your business stays afloat.

Calculating the Serviceable Addressable Market

Unfortunately, there is no universal set of instructions for calculating the serviceable addressable market, as this process will largely depend on the nature of your business and the market where you operate. Thus, you and your team will need to use your understanding of the market to evaluate what portion of the total addressable market your company can theoretically service. For example, if you have found a product-channel fit and discovered that certain channels absolutely don’t work for your business model, you will need to exclude customers that can be attracted through those channels from your serviceable addressable market.

Calculating the Serviceable Obtainable Market

While every company generally strives to capture as much of the market as possible, you will never be able to sign on 100% of the serviceable addressable market as your customers. As a result, you need to realistically evaluate what market share your company can capture. For example, you can use your conversion rate as a rough estimate of the potential market share your company can reach, provided you are able to get in touch with all businesses that make up the serviceable addressable market. You should also keep a close eye on your competitors and understand what portion of the market they can capture.

Think About the Bigger Picture

Having a good understanding of the market size is crucial for creating a robust business plan, but it’s not the only thing you need to take into account. It’s also important to consider profit margins and market dynamics. Naturally, a business with large profit margins and a growing market will be much more viable than a company entering a diminishing market with razor-thin margins.

You should also keep in mind that most tech markets are ultimately left with one leader and a few much smaller followers. So unless you can achieve market leadership, it will be very difficult to create a massively valuable company. This is why you need to be extremely rigorous and realistic when sizing up your market and planning your business strategy, as it is your key to success.

Key Conclusions

- One of the biggest mistakes a founder can make during the early stages of building a business is assuming that their target market is much larger than it actually is.

- You need to define your key target customers before you can calculate the total addressable market, serviceable addressable market, and serviceable obtainable market.

- It’s crucial to remain as realistic as possible and avoid inflating your numbers when evaluating market size. Otherwise, you risk betting your time, effort, money, and reputation on a business that’s not viable from the start.