Introduction

An exit strategy, at its core, is a plan that outlines how business owners or investors can sell their stake in a company or how they can terminate their investment in a manner that will either mitigate losses or maximise profit. Its significance cannot be understated. For many, it’s the culmination of years, if not decades, of hard work, dedication, and foresight.

The role of an exit strategy extends beyond just a financial transaction. It shapes the trajectory of a business’s future, determining its sustainability, legacy, and impact on stakeholders. Whether it’s a transition to new ownership, a merger, or even a decision to cease operations, the chosen path can have profound implications on employees, clients, and the industry at large.

In this article, we will delve into the various facets of exit strategies tailored for agencies. We will explore the reasons behind their adoption, the different types available, and the considerations one must take into account when crafting one. By the end, readers will gain a holistic understanding of the topic, equipped with the knowledge to make informed decisions for their own enterprises.

Why Every Agency Needs an Exit Strategy

In the world of business, the future is often uncertain. While agencies may be thriving today, external factors such as economic downturns, industry shifts, or even personal circumstances can change the trajectory of an enterprise. It is in these moments that the value of an exit strategy becomes evident.

Importance of Planning Ahead

The essence of an exit strategy lies in its proactive nature. By planning for the future, agency owners can anticipate potential challenges and navigate them with minimal disruption. It’s a bit like having a roadmap for a journey; while the destination might be known, the exact path and potential obstacles are not. An exit strategy provides a clear route, ensuring that even in the face of unforeseen events, there’s a plan in place to safeguard the agency’s interests and those of its stakeholders.

Moreover, planning an exit isn’t solely about foreseeing challenges. It’s also about recognising opportunities. For instance, if a lucrative offer for acquisition comes along, having an exit strategy ensures that the agency is in a position to capitalise on that opportunity, having already laid the groundwork for a smooth transition.

Ensuring Business Continuity

An exit strategy plays a pivotal role in ensuring business continuity. Whether it’s a transition to new leadership, a merger, or a sale, the plan ensures that the agency’s operations remain uninterrupted. This is crucial not just for the agency’s financial health but also for its reputation and relationships. Clients, employees, and partners seek stability. Knowing that there’s a plan in place for the future can bolster their confidence in the agency’s resilience.

Furthermore, in the event of unforeseen circumstances, such as the sudden departure of a key leader, an exit strategy can act as a contingency plan. It ensures that there’s a succession plan in place and that the agency can continue to operate without major disruptions.

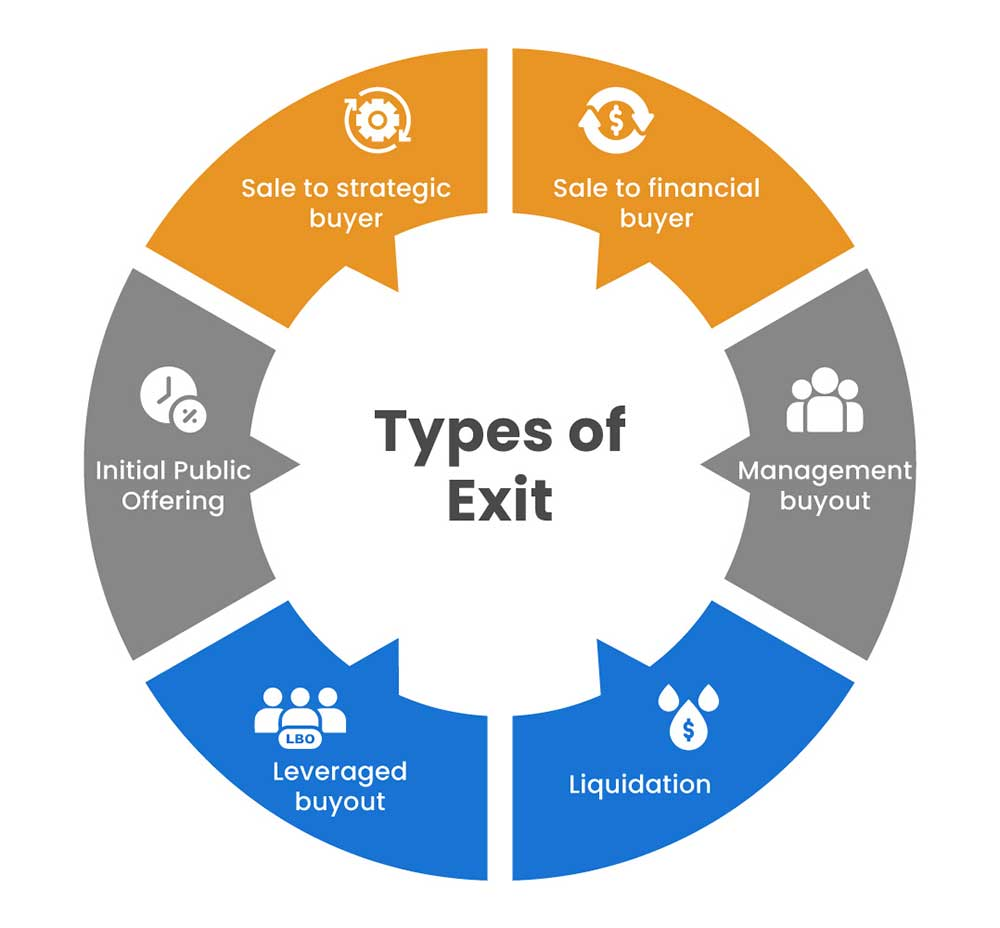

Common Exit Strategies for Agencies

An agency’s journey can take many different paths. While growth and expansion are often at the forefront of an agency’s objectives, there comes a time when owners and stakeholders must contemplate the best route for concluding their involvement or reshaping the agency’s future. This juncture, often termed the ‘exit’, is not merely an end but a strategic pivot that can determine the legacy and future trajectory of the agency. Whether it’s passing the torch to the next generation, merging with a like-minded entity, or even taking the bold step of going public, each exit strategy comes with its own set of considerations. In this section, we delve into the most common exit strategies for agencies, shedding light on their intricacies and the scenarios in which they might be most apt.

- Passing the Business to a Family Member

For many agency owners, their business is more than just a source of income; it’s a legacy, a testament to years of hard work, dedication, and passion. One of the most time-honoured ways to ensure that this legacy lives on is by transitioning the business to a family member. This method, deeply rooted in tradition, offers both emotional and practical benefits but also comes with its set of challenges.

Here are some of the pros and cons of passing an agency over to a family member:

| Advantages | Disadvantages |

| Continuity and Legacy Preservation: The business remains within the family, ensuring that its history and values are upheld. | Family Disputes: Mixing family and business can sometimes lead to disagreements, which can impact both familial relationships and business operations. |

| Familiarity with Operations and Culture: Family members often have an inherent understanding of the business ethos, having been exposed to it for years. | Skill and Interest Mismatch: The chosen successor might not possess the required skills or even have a genuine interest in the business, which can affect its future prospects. |

| Smoother Transition: Emotional ties and established trust can facilitate a more seamless transition process. | Nepotism Concerns: Other employees might perceive the successor’s appointment as favouritism, which can affect morale and team dynamics. |

| Upholding Business Values: Family members are more likely to retain and respect the foundational values upon which the business was built. | Resistance from Staff: Non-family employees might be sceptical or resistant to changes introduced by the new leadership, especially if they perceive a lack of merit in the successor’s appointment. |

Transitioning leadership within the family is not a mere handover; it’s a process that requires foresight, planning, and meticulous execution. Here are some steps to consider if you do want to pass your agency over to a family member to take over:

- Early Identification: Recognise potential successors early on. This allows ample time for grooming and ensures that they are well-prepared when the time comes.

- Tailored Training: Depending on the successor’s current skill set, design a training programme that addresses gaps and enhances their capabilities.

- Mentorship: Regular one-on-one sessions with the current leader can provide invaluable insights, guidance, and a deeper understanding of the business’s nuances.

- Gradual Responsibility Increase: Start by giving them smaller responsibilities and gradually increase their involvement in major decision-making processes. This phased approach can help in building their confidence and ensuring they are ready for the role.

- Feedback Mechanism: Establish a system where employees can provide feedback about the successor without fear of repercussions. This can offer insights into areas of improvement.

- Mergers and Acquisitions

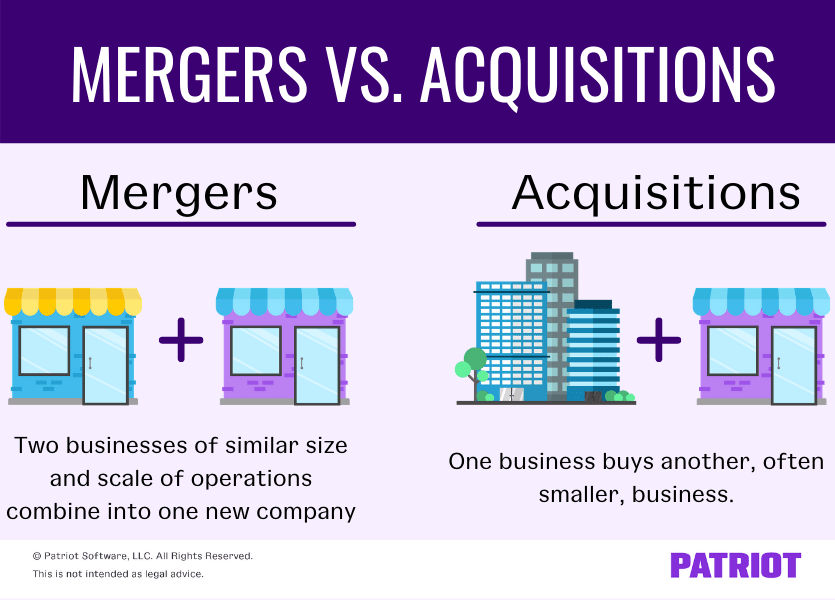

For agency owners contemplating their next strategic move, mergers and acquisitions (M&A) present strategic avenues to amplify their impact, reach, and profitability. While these terms are often used interchangeably, they signify different business arrangements, each with its own set of implications and benefits.

A merger is akin to a partnership where two companies decide to come together to form a single, more robust entity. In this arrangement:

- Both companies voluntarily unify their operations.

- The resulting entity often takes on a new identity, combining the strengths and resources of both companies.

- Shareholders from both companies become shareholders of the newly formed entity.

- It’s a strategy often pursued to expand reach, consolidate resources, or enter new market segments.

An acquisition, on the other hand, is more of a takeover. In this circumstance:

- One company (the acquirer) purchases another company (the target).

- The target company becomes a part of the acquirer. It can retain its identity as a subsidiary or be fully integrated and lose its original identity.

- The acquisition can be friendly (with mutual agreement) or hostile (where the acquirer aggressively pursues the acquisition, often without the target company’s consent).

- Acquisitions are typically driven by the desire to access new technologies, eliminate competition, or quickly gain a significant market presence.

If a merger and acquisition is an option you want to consider for your agency, here are some of the potential benefits and challenges associated with mergers and acquisitions as an exit strategy.

| Advantages | Disadvantages |

| Increased Market Share: Quickly gain a larger footprint in the market. | Integration Challenges: Merging different company cultures and systems can be complex. |

| Diversification: Broaden service offerings, client base, or geographical presence. | High Costs: M&A activities can be expensive, with costs for due diligence, advisory fees, and integration. |

| Operational Synergies: Combine knowledge, technologies, and best practices for enhanced efficiency. | Potential Job Losses: Redundancies might lead to layoffs, affecting morale. |

| Cost Efficiencies: Achieve reduced overheads and benefit from economies of scale. | Regulatory Hurdles: M&A activities might face scrutiny from regulatory bodies, delaying or even halting the process. |

| Risk Mitigation: Spreads risk by diversifying operations and client portfolios. | Cultural Clashes: Differences in company cultures can lead to internal conflicts and reduced productivity. |

| Access to New Technologies: Acquiring companies can provide access to advanced technologies or intellectual property. | Overvaluation Risks: There’s a potential risk of overpaying for the target company. |

| Elimination of Competition: Acquiring competitors can reduce market competition. | Hidden Liabilities: The acquired company might have undisclosed debts or legal issues. |

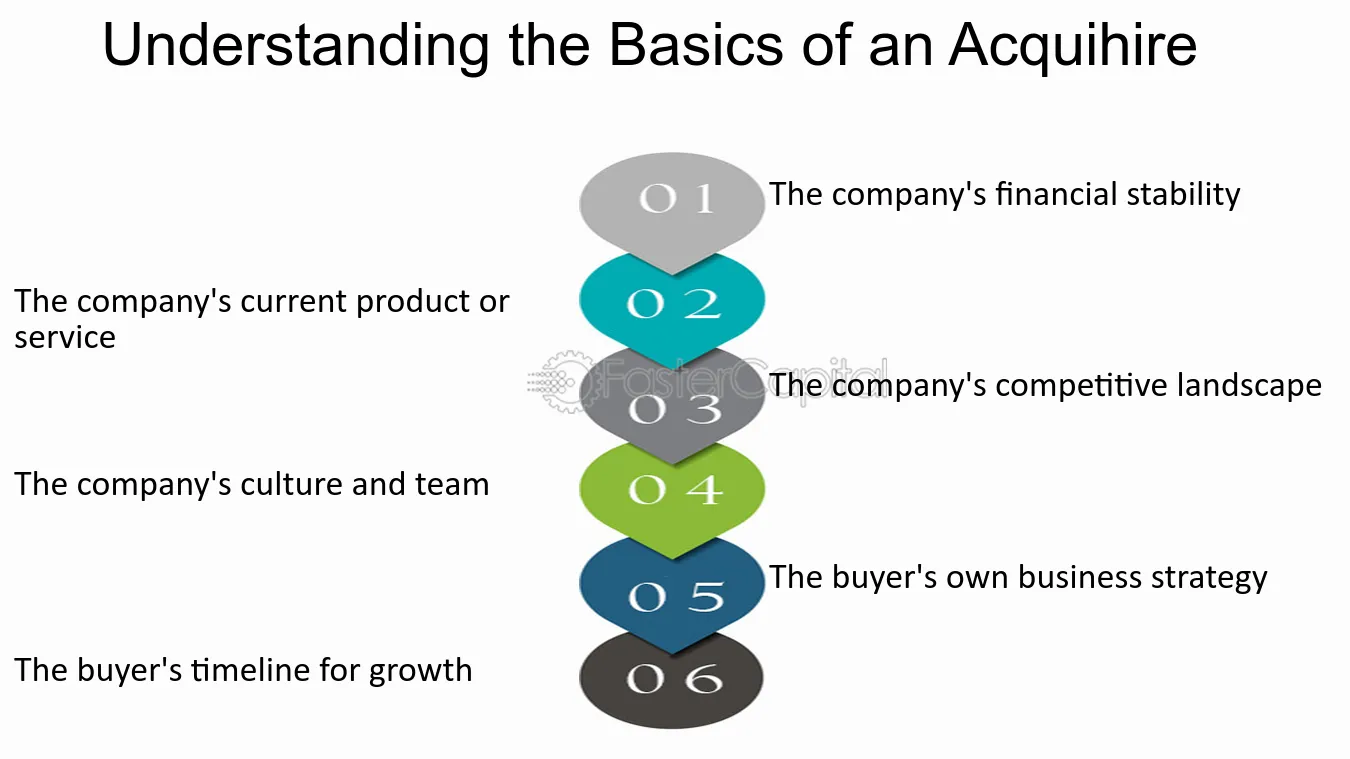

- Acquihire

In the competitive landscape of the agency world, talent is often the most valuable asset. Recognising this, the concept of ‘acquihire’ has emerged as a strategic move for companies looking to bolster their team’s strength and expertise. But what exactly does this entail, and how can it serve as a viable exit strategy for agency owners?

At its core, an acquihire is a fusion of ‘acquisition’ and ‘hire’. It’s a strategy wherein a company is acquired not for its operational assets, client base, or product offerings, but predominantly for its team’s skills, expertise, and potential. The focus shifts from tangible assets to the intangible value that a talented team brings to the table.

It’s the uniqueness that sets this exit option apart from others. Traditional acquisitions often involve a comprehensive takeover, encompassing assets, client contracts, intellectual property, and more. In contrast, an acquihire zeroes in on one primary asset – human capital. The emphasis is on integrating talented individuals into the acquiring company’s fold.

The rationale behind the strategy of acquihire for agency owners includes:

- Rapid Talent Onboarding: In industries where hiring and training top-tier talent can be time-consuming, acquihires offer a shortcut. By acquiring a whole team, companies can swiftly onboard experienced professionals.

- Filling Skill Gaps: If a company identifies a specific skill or expertise gap in its team, an acquihire can be a strategic move to fill that void.

- Competitive Edge: By bringing in a team with a proven track record, companies can gain an edge in the market, especially if the acquired team possesses niche skills.

Employees also benefit from this exit option as it provides:

- Career Opportunities: Joining a larger or more established company can open doors to new roles and responsibilities for the acquired team.

- Professional Growth: Employees can benefit from broader resources, training programmes, and mentorship opportunities in the acquiring company.

- Exposure to New Technologies and Work Environments: Transitioning to a new company often means access to advanced tools, technologies, and methodologies, enriching the employee’s professional toolkit.

- Job Security: In cases where the acquired agency might be facing operational challenges, an acquihire can provide job security for its team.

While acquihire presents a unique exit strategy, it’s essential for agency owners to ensure that the acquiring company aligns with their team’s values, culture, and long-term goals. Open communication with the team about the transition, potential changes, and the benefits of the move can ease the process and ensure a smoother integration.

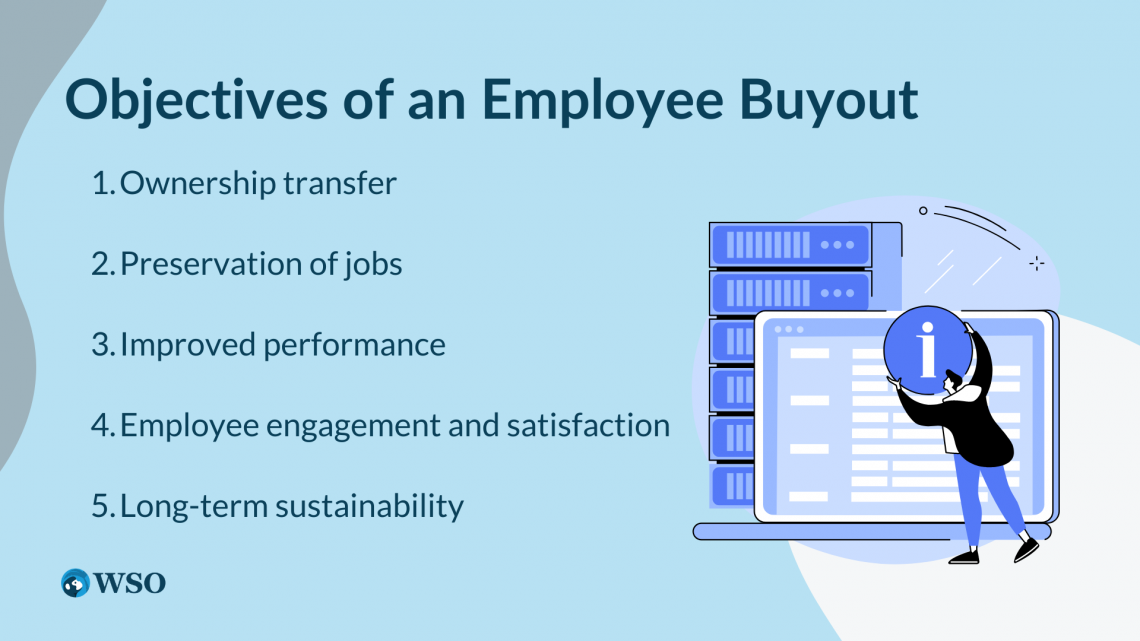

Management or Employee Buyout

For agency owners contemplating an exit, the idea of handing over the reins to an external entity can be daunting. The uncertainty of how the business will be steered, the potential change in company culture, and the fate of long-serving employees can be significant concerns. This is where the concept of a Management or Employee Buyout (MBO/EBO) comes into play, offering a solution that keeps the business in familiar hands.

An MBO or EBO is a structured strategy wherein the existing management team or the broader employee base acquires a significant stake or the entirety of the company. This transition ensures that the business remains with those who understand its intricacies, values, and vision.

Here is a simple breakdown of how it works:

- Initiation: The idea of a buyout can be proposed either by the agency owner looking to exit or the employees/management themselves.

- Valuation: An independent valuation of the company is conducted to determine its market worth.

- Financing: Employees or the management team form a new entity to facilitate the purchase. This entity then seeks financing, which can come from personal contributions, bank loans, or external investors.

- Negotiation: Terms of the buyout, including the price, payment structure, and transition timeline, are negotiated and agreed upon.

- Finalisation: Legal documents are drawn up, and the transfer of ownership is formalised.

This table provides a concise overview of the potential benefits and challenges associated with MBOs and EBOs. It’s essential for agency owners to consider the potential benefits and challenges associated with MBOs and EBOs before proceeding with this exit strategy. Here are some of the main factors to consider:

| Advantages | Disadvantages |

| Boosted Morale: Employees are more invested due to a direct stake in the company’s success. | Financial Strain: Acquiring the necessary funds can place significant financial pressure on employees or management. |

| Business Continuity: Minimal disruption to operations and client relationships. | Complex Negotiations: The process can involve intricate negotiations, potentially leading to disagreements. |

| Retention of Company Culture: The company’s ethos and values remain intact with internal leadership transition. | Potential Skill Gap: The existing team might lack certain skills or expertise required for ownership and management. |

| Incentivised Performance: Direct stake in financial success leads to a heightened focus on efficiency and profitability. | Risk of Bias: Decisions post-buyout might favour certain employee groups, leading to internal conflicts. |

| Strengthened Client Relationships: Clients often appreciate continuity in management, fostering trust. | Debt Burden: If the buyout is heavily leveraged, the company might face challenges in managing debt repayments. |

Selling Stake to a Partner or Investor

In the journey of an agency, there may come a time when external collaboration becomes a strategic move, either to infuse fresh capital, tap into new markets, or leverage external expertise. Selling a stake to a partner or investor is one such avenue that offers both immediate and long-term benefits. However, it’s a decision that requires careful consideration and understanding of the entire process.

Selling a stake doesn’t necessarily mean relinquishing control. It’s about sharing a portion of the ownership, often in exchange for capital or strategic advantages. The extent of the stake sale can vary, from minority stakes, where the original owner retains majority control, to majority stakes, where the investor or partner might have a more significant say in the business operations.

The process of a stake sale involves the following steps:

- Business Valuation: Before any negotiations, it’s crucial to understand the worth of the agency. Engaging a professional for an accurate business valuation can provide a realistic figure and set the stage for negotiations.

- Identifying the Right Partner/Investor: Not all investors are the same. It’s essential to identify partners or investors whose vision aligns with the agency’s goals. This could be venture capitalists, angel investors, industry peers, or strategic investors.

- Due Diligence: Once a potential investor is identified, they will conduct a thorough examination of the agency’s financial records, client contracts, operational processes, and more.

- Negotiation: Terms of the stake sale, including the price, future involvement, and any conditions, are discussed and agreed upon.

- Legal Formalities: Contracts are drawn up, detailing the terms of the stake sale, and are signed by both parties to formalise the agreement.

Agency owners should weigh up the main factors carefully to make an informed decision that aligns with their long-term goals and the company’s vision. The table below provides a comprehensive overview of the potential benefits and challenges associated with selling a stake to a partner or investor.

| Advantages | Disadvantages |

| Capital Infusion: Immediate influx of funds for business growth or debt clearance. | Diluted Control: Selling a significant stake can reduce the original owner’s control over business decisions. |

| Access to Networks: Opens doors to new client segments, industry contacts, and markets. | Potential Misalignment: Differences in vision or strategy between the owner and the investor can arise. |

| Operational Expertise: Investors often bring industry insights and strategic guidance. | Profit Sharing: A portion of the profits will now go to the new stakeholder. |

| Risk Sharing: Shared ownership means shared risks, offering a safety net in volatile times. | Loss of Autonomy: The original owner might have to consult the investor before making major decisions. |

| Business Expansion: Opportunity to diversify offerings and enter new markets. | Cultural Shifts: The introduction of a new major stakeholder can lead to changes in company culture or ethos. |

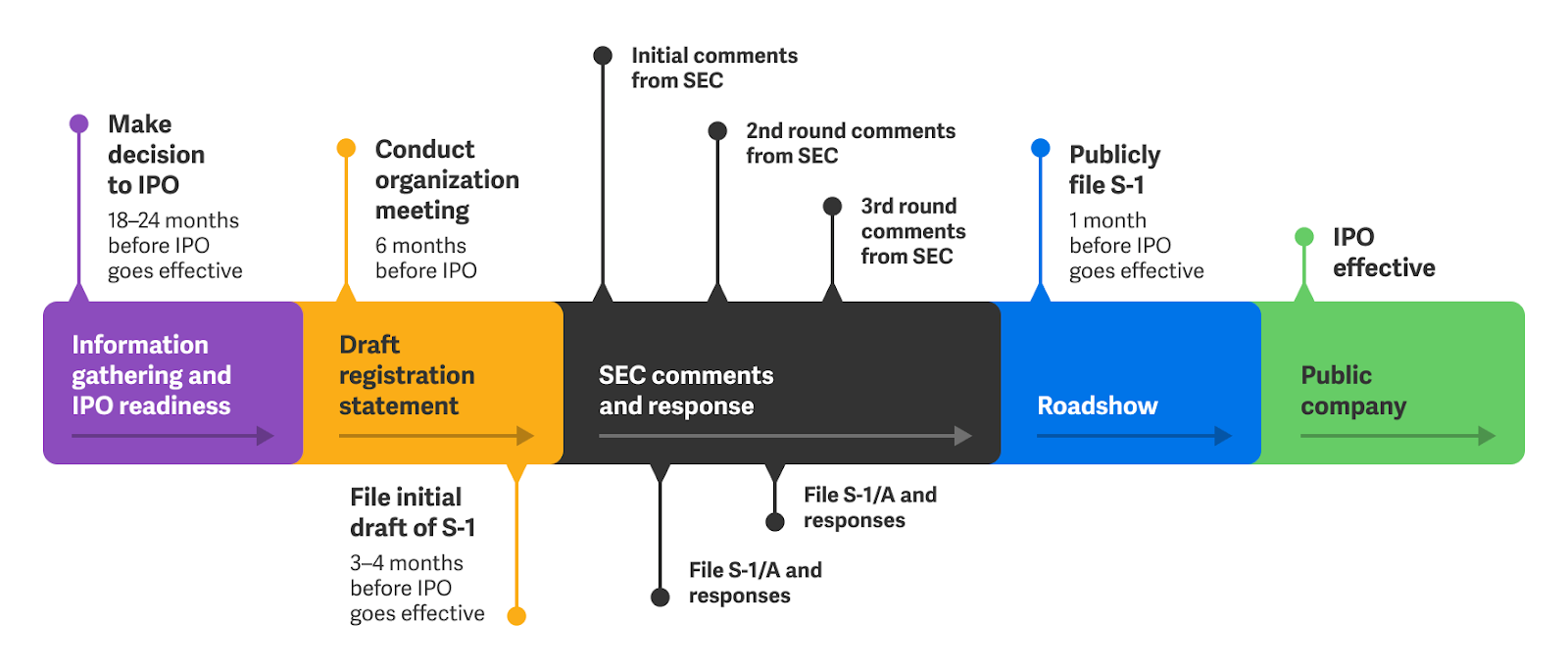

Going Public (IPO)

For many agency owners, the journey from inception to growth is marked by milestones that signify evolution and progress. One such significant milestone is the decision to go public through an Initial Public Offering (IPO). While this move can offer unparalleled financial opportunities and market visibility, it also brings with it a new set of challenges and responsibilities.

An IPO is a transformative event for any agency. It involves transitioning from a privately held entity to one whose shares are publicly traded on a stock exchange. This allows the broader public to invest in the company, providing the business with access to a vast pool of capital.

The key requirements for an IPO include:

- Rigorous Financial Audits: Before listing, the company must undergo thorough financial audits to ensure transparency and accuracy in its financial declarations.

- Adherence to Regulatory Standards: Regulatory bodies, depending on the country and specific stock exchange, have stringent standards and requirements that the company must meet.

- Strong Business Model: Public investors seek companies with a proven track record and a sustainable business model that promises future growth.

- Robust Governance Structure: The company needs to have a solid governance framework in place, including a board of directors, to ensure accountability and strategic direction.

- Transparent Communication: Regular communication with shareholders, including annual reports and quarterly updates, becomes mandatory.

It’s essential for agency owners to be well-prepared and proactive in navigating the complexities of the IPO process. The following table provides a concise overview of the challenges faced by businesses when going public and potential solutions to address them.

| Challenges | Solutions |

| Loss of Privacy: Financials and strategies become public, leading to increased scrutiny. | Strategic Communication: Develop a robust communication plan to manage public relations and address stakeholder concerns proactively. |

| Potential Loss of Control: Dilution of original owner’s decision-making power. | Retain Key Voting Rights: Structure share classes to ensure that founders or key stakeholders retain significant voting rights. |

| Increased Costs: High expenses related to legal, audit, and regulatory compliance. | Budgeting and Financial Planning: Allocate funds in advance for IPO-related expenses and seek cost-effective service providers. |

| Vulnerability to Market Fluctuations: Stock price can be affected by external factors. | Diversified Business Strategy: Ensure a well-diversified business model to mitigate risks and reduce dependency on one revenue stream. |

| Short-term Pressure: Pressure to meet quarterly targets can overshadow long-term goals. | Educate Investors: Regularly communicate the company’s long-term vision to shareholders, emphasising sustainable growth over short-term gains. |

| Rigorous Regulatory Compliance: Stringent standards and requirements for public companies. | Dedicated Compliance Team: Establish a team or hire experts to ensure continuous adherence to regulatory standards. |

Liquidation

In the lifecycle of a business, not all journeys lead to expansion and growth. Some paths, often influenced by external factors or internal challenges, may lead to the decision to close the business. Liquidation is one such endpoint, marking the conclusion of a company’s operations. For agency owners, understanding the nuances, implications, and processes involved in liquidation is crucial.

Liquidation is the formal process of winding up a company’s affairs. It involves ceasing all business operations, selling off assets, settling outstanding liabilities, and distributing any remaining funds to shareholders. It signifies the end of the company’s existence.

Here are some of the main circumstances and reasons that might lead an agency owner to consider liquidation as an exit strategy:

Agency owners may want to consider liquidation when:

| When to Consider | Why Consider Liquidation |

| Financial Distress: The business’s debts significantly outweigh its assets and revenue. | Debt Settlement: Liquidating assets can generate funds to pay off outstanding debts and prevent further financial decline. |

| Operational Challenges: Persistent issues such as loss of key clients or inability to adapt to market changes. | Business Unviability: Continuing operations might lead to further losses, making liquidation a pragmatic choice. |

| Strategic Shift: Stakeholders decide to focus on another venture or opportunity. | Resource Allocation: Liquidation frees up resources, both financial and human, to be redirected to more promising ventures. |

| Legal or Regulatory Issues: Facing insurmountable legal challenges or regulatory restrictions. | Risk Mitigation: Liquidation can prevent further legal complications or penalties and provides a clear end to potential liabilities. |

| Consistent Underperformance: The business consistently fails to meet targets or generate expected revenue. | Minimise Losses: Liquidation can be a way to halt continuous financial drain and protect remaining assets. |

| Market Saturation or Decline: The industry or market the business operates in is shrinking or becoming obsolete. | Future Uncertainty: Liquidation can be a proactive step in the face of an uncertain or declining future market scenario. |

If you do decided that liquidation is the best exit strategy for your agency, the process is relatively simple in most cases and involves the following six steps:

- Decision Making: The decision to liquidate can be voluntary (decided by the company’s stakeholders) or compulsory (forced by creditors or legal mandate).

- Appointment of a Liquidator: A professional, often an insolvency practitioner, is appointed to oversee the process.

- Asset Valuation and Sale: The company’s assets are evaluated and sold off. This includes tangible assets like property and equipment, as well as intangible assets like intellectual property.

- Debt Repayment: Proceeds from the asset sale are used to repay creditors.

- Distribution to Shareholders: Any remaining funds after all debts are settled are distributed to shareholders.

- Dissolution: Once all processes are complete, the company is formally dissolved.

Tips for a Successful Exit Strategy

Navigating the complexities of an exit strategy requires a blend of introspection about one’s agency and an outward understanding of the market dynamics. Here are some pivotal considerations to ensure a smooth and beneficial transition.

Seeing the Business Through the Eyes of the Buyer

Understanding the buyer’s perspective is paramount in positioning the agency attractively. This involves:

- Value Proposition Assessment: Identify the core strengths of the agency. Is it a robust client base, proprietary processes, or perhaps a niche market presence? Recognising these can help in highlighting them during negotiations.

- Buyer’s Motivations and Concerns: Different buyers come with varied motivations. Some might be looking for strategic expansion, while others might be keen on the agency’s talent pool. Simultaneously, understanding potential concerns a buyer might have and proactively addressing them can smoothen the sale process.

- Market Dynamics: Being aware of the current market trends, valuations, and the competitive landscape can provide insights into what buyers might be looking for and the potential challenges they foresee.

Maintaining Control for Optimal Outcome

The negotiation phase is a delicate balance between showcasing the agency’s value and ensuring the terms are favourable.

- Setting Clear Terms from the Outset: Before delving deep into negotiations, it’s beneficial to outline the non-negotiables. Whether it’s the minimum sale price, transition periods, or potential roles post-sale, having these terms clear can streamline discussions.

- Flexibility with Foresight: While it’s essential to have clear terms, being rigid can sometimes be counterproductive. Being flexible in certain areas while keeping the bigger picture in mind can lead to a more favourable outcome.

- Being Prepared to Walk Away: Not all negotiations culminate in a sale. If discussions veer away from what’s beneficial for the agency or its employees, having the resolve to walk away can be a strategic move. It leaves the door open for better opportunities or even revisiting the negotiation table under better terms.

Life After the Exit

The conclusion of a sale doesn’t signify the end of responsibilities or emotional ties for agency owners. The post-sale phase is a critical juncture, marked by transition responsibilities and personal adjustments to a new chapter in life.

Managing Wealth Post-Exit

The influx of capital post-sale presents both opportunities and responsibilities. Effective wealth management post-exit is paramount:

- Diversification: Avoid putting all financial resources into one investment. Spreading wealth across various assets can mitigate risks.

- Seeking Expertise: Engaging with financial advisors or wealth management professionals can provide insights into investment opportunities and tax implications.

- Planning for the Future: Whether it’s setting up a trust, planning for retirement, or investing in new ventures, having a clear vision for the future can ensure the wealth generated from the sale is utilised optimally.

Transitioning

The immediate aftermath of a sale often involves the former owner playing a pivotal role in the handover process. This period is characterised by:

- Operational Handover: Ensuring that daily operations, from client communications to project deliveries, continue without hitches.

- Knowledge Transfer: Sharing insights about client preferences, historical data, and internal processes with the new management.

- Team Integration: Facilitating introductions and fostering a collaborative environment between the existing team and new leadership.

Adjusting to Post-Exit Life

Leaving behind an agency, especially one that has been a significant part of one’s life, can be a profound experience. As former owners move forward, several considerations come into play:

- Emotional Transition: Recognising and addressing the mix of emotions, from relief to nostalgia, is essential for mental well-being.

- New Ventures: While some may choose to explore consultancy, others might be drawn to start fresh projects or even delve into entirely different industries.

- Personal Growth: This period can also be an opportunity for self-reflection, skill enhancement, and personal development.

- Retirement Considerations: For those leaning towards retirement, it’s a time to plan for financial security, leisure activities, and perhaps even philanthropic endeavours.

The Takeaway

The journey of building and nurturing an agency often culminates in the crucial phase of deciding its future trajectory. A well-thought-out exit strategy is not merely a final step but a testament to the foresight and responsibility of the agency owner. Beginning the planning process early can offer a myriad of benefits, from ensuring a smoother transition to achieving optimal valuation.

While the intricacies of exit strategies can be daunting, seeking guidance can be invaluable. Engaging with an exit consultant can provide clarity, streamline processes, and offer insights drawn from a wealth of experience. Such collaboration can be the difference between a good exit and a great one. Contact us today to discuss your agency’s exit strategy.

FAQ

What is a good exit strategy for business?

A good exit strategy aligns with the business owner’s personal and financial goals, ensures the continuity of the company, and maximises its value upon departure, whether through a sale, merger, or succession planning.

What is the simplest exit strategy?

The simplest exit strategy is often a straightforward sale of the business to an interested party, where the owner relinquishes all responsibilities and ties to the business post-sale.

How do you exit a failing business?

Leaving a failing business requires assessing its financial health and considering options like selling at a reduced price, merging with another entity, or, in extreme cases, liquidation to settle outstanding debts.

How do most startups exit?

Most startups aim for an exit through acquisition by a larger company or by going public through an IPO. However, the majority might end operations due to various challenges.

What are the key elements of an exit strategy?

The key features of an exit strategy include defining clear objectives for the decision, understanding the business’s valuation, preparing the agency for the transition, and considering the timing and market conditions for the departure.