Introduction

Deciding to sell an agency is a monumental step, often culminating from years of hard work, dedication, and investment. The process, while rewarding, can be intricate and demands meticulous preparation. A well-devised strategy not only ensures a smooth transition but also maximises the value of the sale.

This article delves into the nuances of selling an agency, offering insights and guidance to navigate this significant phase in a business owner’s journey.

Preparing Your Business for Sale

Selling an agency is a significant undertaking, and the groundwork laid before the sale can greatly influence the outcome. Here’s a structured approach to ensure you’re well-prepared:

Assessing Motivations

Before diving into the logistics, it’s crucial to introspect and understand the underlying reasons for selling. Whether it’s a change in personal circumstances, industry shifts, or a desire for a new venture, being clear on your motivations provides direction and clarity throughout the process.

Financial Housekeeping

A potential buyer will scrutinise your financial health. Ensure all accounts, ledgers, and financial statements are up-to-date. This instils confidence in the potential buyers and streamlines the due diligence process.

Organised Documentation

Maintaining orderly records goes beyond just financials. Contracts, employee records, operational processes, and client agreements should be easily accessible. Well-organised documentation can expedite the sale process and reduce unnecessary back-and-forths.

Addressing Foreseeable Challenges

Every agency has its set of challenges, be it operational hiccups, client dependencies, or industry-specific issues. Identifying and addressing these before the listing can enhance the agency’s appeal and reduce potential negotiation points for buyers.

Valuing Your Business

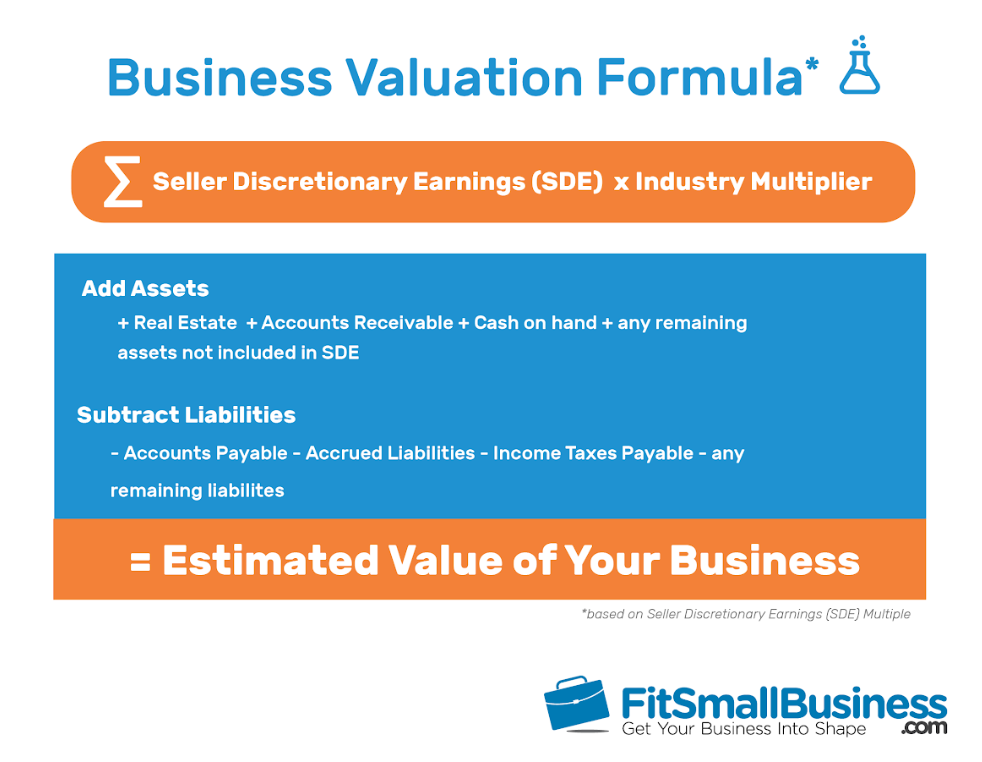

Understanding the worth of your agency is a cornerstone in the process of selling. The valuation isn’t merely a reflection of numbers on a balance sheet; it encapsulates the value of every decision, strategy, and effort invested in building the business over the years. Let’s delve deeper into the intricacies of the valuation process:

The Importance of Accurate Valuation

A realistic valuation is pivotal for several reasons:

- It provides a solid foundation for making informed decisions. Business owners can assess whether it’s the opportune moment to sell or if there’s potential for further growth and value to be unlocked.

- A well-researched valuation offers leverage during negotiations. It sets a clear benchmark, ensuring that discussions are anchored around a justifiable figure, preventing undervaluation.

- A grounded valuation acts as a magnet for genuine buyers.

Those who are sincerely interested in acquiring an agency will recognise and respect a fair valuation, leading to more streamlined and productive discussions.

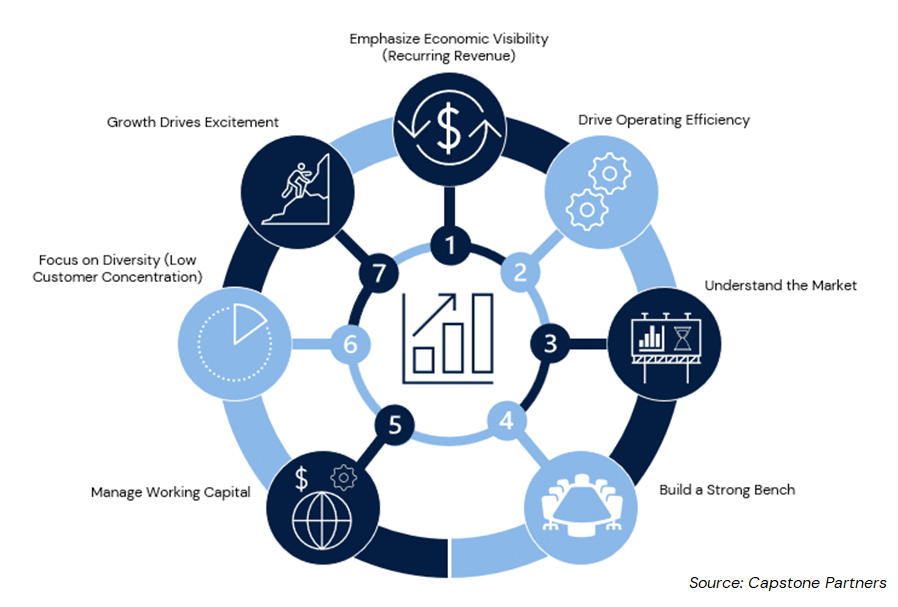

Key Factors Influencing Value

Financial health is a paramount consideration when valuing an agency. Consistent revenue over the years indicates stability, with recurring revenue models, such as retainers or subscriptions, adding further value. However, it’s not just about the revenue an agency generates but also the profit margins, indicating how much is retained after expenses. Furthermore, financial projections showcasing the agency’s future potential, backed by tangible data, can enhance its value. This includes projected growth based on current contracts or well-defined market expansion strategies.

Client contracts are another significant factor. Long-term contracts suggest a semblance of future stability and guaranteed revenue. However, an agency’s reliance on a few major clients can be a risk. A diverse client base, on the other hand, can increase the agency’s appeal to potential buyers. Moreover, not all clients contribute equally to the bottom line. Contracts that yield higher profitability margins are inherently more valuable.

In terms of assets, both tangible and intangible ones play a role in valuation. Tangible assets encompass property, equipment, and other physical entities the agency owns. On the other hand, intangible assets, such as brand recognition, proprietary processes, tools, and intellectual property, can significantly augment the agency’s value. However, it’s essential to balance assets against liabilities. Outstanding loans or financial obligations can detract from the agency’s overall value. Similarly, any pending or potential legal disputes can deter potential buyers.

Lastly, an agency’s position within its industry cannot be overlooked. Its market share, reputation, awards, and recognition can all enhance its standing and, by extension, its value.

Collaborating with Valuation Specialists

Engaging with valuation specialists offers several advantages. They bring an objective lens to the process, ensuring that the valuation lacks owner biases and is grounded in reality. These experts employ methodological approaches, be it the earnings multiplier method, net asset valuation, or a combination of several, to derive a value that’s both fair and defendable. Moreover, their industry insights, often derived from recent sales or acquisitions, provide a clearer picture of the current market dynamics, ensuring the valuation is competitive and realistic.

Assembling Your Team

Selling an agency is a multifaceted endeavour, and while the owner possesses an intimate understanding of the business, often navigating the complexities of a sale requires a diverse set of skills. Assembling the right team is paramount to ensuring a smooth and beneficial transaction.

Business Brokers

Business brokers act as intermediaries between sellers and potential buyers. Their role is pivotal for several reasons:

- Market Knowledge: They have a finger on the pulse of the current business sale landscape, understanding both buyer expectations and seller objectives.

- Network Access: With a vast network of contacts, brokers can introduce sellers to a wider pool of potential buyers, increasing the chances of finding the right match.

- Negotiation Skills: Brokers are adept at handling negotiations, ensuring that the terms of sale are favourable and that both parties reach a mutually agreeable conclusion.

Choosing the right broker is essential. A mismatch can lead to prolonged sale durations or unfavourable terms. It’s vital to select a broker with a proven track record in your industry, ensuring they understand the nuances and specific challenges your agency might face.

Specialist Advisors

Navigating the complexities of selling a business requires the expertise of various professionals. Here are some of the crucial roles of legal, financial, and business advisors, highlighting their significance in ensuring a seamless and beneficial sale.

- Legal Advisors: The sale of a business is riddled with legal intricacies. From drafting sale agreements to ensuring regulatory compliance, legal advisors safeguard against potential pitfalls and ensure all transactions are above board.

- Financial Advisors: They provide clarity on the financial implications of a sale. This includes tax considerations, structuring the payment terms, and ensuring the financial health of the business is transparently presented to potential buyers.

- Business Advisors: These professionals offer insights into the operational aspects of the sale. They can provide guidance on transition processes, ensuring continuity and minimal disruption post-sale.

Tapping into Industry Expertise

While generic advice has its place, the sale of an agency demands industry-specific insights. Professionals who have experience in your sector can offer invaluable guidance. They understand your industry’s challenges, growth potential, and intricacies, ensuring that the agency is positioned optimally for sale. This expertise can highlight the agency’s strengths, address potential concerns, and ultimately command a better sale price.

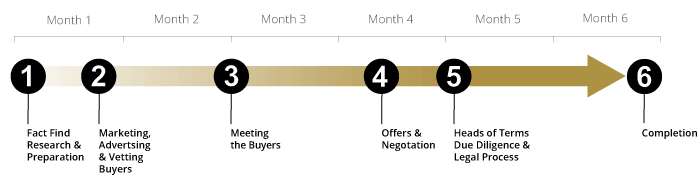

Marketing Your Business

Promoting an agency for sale is a delicate balance of showcasing its value while maintaining discretion. The process demands a strategic approach, ensuring the right message reaches the right audience.

Crafting a Compelling Business Narrative

Every agency has a story. This narrative encapsulates its journey, achievements, and potential. When selling, it’s essential to articulate this story in a way that resonates with potential buyers. Highlighting milestones, showcasing the agency’s culture, and emphasising its future potential can make it more appealing. This narrative serves as a foundation for all promotional efforts, ensuring consistency and clarity in the message being conveyed.

The Imperative of Confidentiality

While it’s crucial to promote the agency, discretion is paramount. Revealing too much or to the wrong audience can lead to unintended consequences, from unsettling existing clients and employees to giving competitors undue advantage. You will want to ensure that sensitive information is shared only with those genuinely interested and committed to discretion. To ensure discretion, be sure to consider:

- Using Non-Disclosure Agreements (NDAs): Before sharing detailed information with potential buyers, have them sign an NDA.

- Limiting Public Advertisements: Avoid disclosing the name or specific details of the agency in public listings.

- Internal Communication: Inform key staff members about the sale at an appropriate time, ensuring they hear it from you rather than external sources.

Leveraging Multi-Channel Marketing Strategies

In today’s interconnected world, relying on a single channel to promote the sale can limit reach. Utilising a mix of channels, from industry-specific platforms to business sale websites, can widen the net. Additionally, engaging with professional networks and tapping into the broker’s contacts can further amplify the message.

Some of the most effective channels include:

- Industry Publications: Advertise in trade magazines or websites specific to your sector.

- Business Sale Platforms: Websites dedicated to listing businesses for sale can attract a niche audience of potential buyers.

- Networking Events: Industry conferences or seminars can be platforms to discreetly discuss the sale with interested parties.

- Direct Outreach: If there are known investors or businesses that might be interested, consider reaching out to them directly, ensuring confidentiality.

Before using any marketing channel, make sure that it aligns with your agency’s narrative and targets the right audience segment.

Engaging with Potential Buyers

Selling an agency is a multifaceted journey, with the engagement phase with potential buyers being one of the most critical. This phase requires a meticulous approach, ensuring the agency’s interests are safeguarded while maximising its appeal to genuine buyers.

Vetting and Understanding Buyer Profiles

Engaging with the right buyer is paramount. Here’s a deeper look into understanding buyer profiles:

- Financial Capacity: Before delving into detailed discussions, it’s prudent to ascertain the buyer’s financial capability. This could involve requesting bank statements, proof of funds, or references from financial institutions. A buyer’s willingness to provide such evidence is often an early indicator of their seriousness.

- Motivation: Different buyers have varied reasons. Some might see your agency as a strategic fit for their existing portfolio, while others might want to enter the industry afresh. Engaging in open dialogue about their intentions can provide clarity and help you gauge if their vision aligns with your agency’s ethos.

- Background Checks: Beyond financials and motivations, understanding a buyer’s history is crucial. Research their past acquisitions, industry reputation, and any red flags. This can be done through online searches, industry forums, or even discreet enquiries within your professional network.

The Role of NDAs When Vetting a Buyer

Protecting your agency’s confidential information is non-negotiable. Here’s a more detailed look at the significance of NDAs during this stage of sale:

- Implement NDAs: Before sharing any detailed operational, financial, or strategic information, ensure the potential buyer signs an NDA. This legal document binds them to maintain confidentiality.

- Detail the Scope: An effective NDA should clearly define what constitutes confidential information. This could range from client lists and financial data to business strategies and proprietary processes. The clearer the scope, the easier it is to enforce.

- Duration and Consequences: An NDA should specify its validity period, ensuring protection even if discussions stall or the sale doesn’t materialise. Additionally, outline the repercussions of any breaches, which could include financial penalties or legal action.

Navigating Negotiations and Offers

The negotiation phase is where the rubber meets the road. Here’s a more in-depth approach to this crucial stage:

- Set Clear Boundaries: Before entering negotiations, have a clear understanding of your agency’s worth. This involves its current financial standing, potential growth, client relationships, and industry positioning. Having a minimum acceptable offer in mind provides a solid foundation for discussions.

- Be Open to Dialogue: While having set boundaries is essential, negotiations require a degree of flexibility. Listen to the buyer’s perspective, understand their concerns, and be willing to make concessions where it makes sense. However, always ensure that any compromises don’t undermine the agency’s value or your post-sale objectives.

- Consider All Aspects: Financial considerations, while significant, are just one facet of the sale. Look at other elements like the proposed payment structure (lump sum, instalments, or a combination), any earn-outs based on future performance, and non-compete or post-sale involvement clauses. Sometimes, a comprehensive offer with favourable terms might be more advantageous than a higher monetary offer with stringent conditions.

Structuring the Deal

Finalising the sale of an agency is a significant milestone, but the manner in which the deal is structured can have lasting implications for both the seller and the buyer. The deal’s structure determines how the transaction is executed, the financial implications, and the responsibilities of both parties post-sale.

Different Deal Structures and Their Implications

The choice of deal structure when selling an agency is multifaceted, with each option presenting its own set of benefits and challenges. It’s crucial for sellers to understand these nuances, seek appropriate advice, and choose a structure that aligns with their objectives and risk appetite.

The table below provides a structured overview of the different deal structures, allowing you to compare and contrast the advantages, disadvantages, and implications of each.

| Deal Structure | Advantages | Disadvantages | Implications |

| Asset Sale | Sellers might find it easier to segregate and sell off non-core assets or divisions. Buyers can pick and choose assets, avoiding potential liabilities. | Seller might face higher tax implications. Buyer might not benefit from existing operational synergies or client relationships. | Employees, contracts, and leases might need transfer. Intellectual property and other intangibles should be clearly listed and valued. |

| Share Sale | Seller benefit from a straightforward transaction and favourable tax treatment. Buyers acquire the entire business entity, benefiting from existing synergies and relationships. | Sellers lose control over the entire business entity. Buyers assume all liabilities, including hidden ones. | Due diligence is paramount for buyers. Sellers need to be transparent about all business aspects. |

| Earn-outs | Helps bridge valuation gaps. Provides an incentive for the seller to ensure post-sale business performance. | Sellers are tied to post-sale agency performance. Can lead to disputes if performance metrics are not clearly defined. | Agreement needed on clear performance metrics and payment calculations. Provisions detailing responsibilities and decision-making powers are essential. |

| Seller Financing | Sellers might negotiate a higher sale price. Makes the agency appealing to a wider pool of buyers. | Sellers assume the risk of buyer default. Ties the seller’s finances to post-sale agency success. | Sellers should conduct thorough due diligence on the buyer’s financial health. Clear terms regarding interest rates, repayment schedules, and actions on default should be established. |

The Importance of Clear Terms and Conditions

In the realm of business transactions, particularly when selling an agency, the terms and conditions serve as the bedrock of the agreement. They delineate the rights, responsibilities, and expectations of both parties involved. Ensuring clarity in these terms is not just a matter of legal prudence; it’s fundamental to the success and smooth progression of the deal. Here’s a deeper exploration of their significance:

- Risk Mitigation: Ambiguous terms can lead to misunderstandings, which in turn can result in disputes or even legal battles. Clear terms and conditions minimise these risks by ensuring that both parties have a shared understanding of the deal’s specifics.

- Financial Clarity: The terms and conditions lay out the financial aspects of the deal, from the payment structure and timelines to any contingencies like earn-outs or performance-based bonuses. This clarity ensures that both parties are on the same page regarding the financial commitments and expectations.

- Operational Transition: When selling an agency, there’s often a period of transition where the seller might still be involved in some capacity. Clear terms can outline the extent of this involvement, detailing roles, responsibilities, and durations. This ensures a smoother handover and minimises disruptions to the agency’s operations.

- Protection of Interests: For both buyers and sellers, the terms and conditions serve as a protective measure. For sellers, they can include clauses that protect their legacy or the agency’s ethos. For buyers, they can ensure that they’re getting the value they’ve paid for, with warranties or representations about the agency’s current status.

- Basis for Remedies: In the unfortunate event that things don’t go as planned, the terms and conditions provide a framework for recourse. They can stipulate remedies for breaches, from financial penalties to corrective actions, ensuring that both parties have a pre-agreed path to address issues.

- Guidance for External Parties: Clear terms and conditions can also serve as a guide for external entities, such as banks or other financial institutions. For instance, if a deal involves seller financing or a loan from a bank, the clarity in the agreement can expedite the approval process.

A lack of clarity in terms and conditions can have tangible, real-world consequences. For instance, an agency sale might have terms that vaguely address client transitions. Post-sale, if major clients, unsure of the new direction, choose to depart due to the ambiguity, it could lead to significant revenue loss. Similarly, unclear terms about staff retention could result in a talent drain, affecting the agency’s operations and value.

Post-Sale Considerations

Selling an agency is a monumental decision, often resulting in financial and emotional outcomes. Once the sale is complete, the former owner is presented with a new set of considerations, primarily centred around managing the sale’s proceeds and transitioning to their next adventure.

Managing Financial Proceeds from the Sale

The financial gain from the sale can be significant, and its management is pivotal for long-term financial health.

- Investment: Diversifying the proceeds is essential. Instead of placing funds in a single asset class, consider a mix. Common choices include equities, government bonds, mutual funds, and real estate. Each has its risk profile, so balancing the portfolio based on one’s risk appetite is crucial. Engaging with a financial advisor can help in crafting a portfolio that aligns with future financial goals and current market conditions.

- Debt Settlement: If there are any outstanding debts, mortgages, or other financial obligations, now might be an opportune time to settle them. Clearing debts can provide peace of mind and reduce monthly outgoings, allowing for more flexible financial planning.

Estate Planning, Gifting, and Asset Protection

With an increase in assets, safeguarding them becomes paramount.

- Estate Planning: An updated will or trust ensures that assets are distributed as desired in the event of one’s passing. It’s also a way to minimise potential inheritance tax, safeguarding the inheritance for beneficiaries.

- Gifting: Transferring a portion of the assets as gifts to loved ones or charitable organisations can be fulfilling. It’s also a strategic move to reduce the size of one’s estate, potentially lowering future inheritance tax liabilities.

- Asset Protection: Protecting assets from unforeseen events, such as legal challenges or economic downturns, is crucial. This might involve setting up family trusts, offshore accounts, or other protective financial structures.

Transitioning to New Ventures or Retirement

Life post-sale can be a new beginning, offering avenues previously unexplored. For example:

- New Ventures: With the experience of running an agency, transitioning to a new business or investment opportunity can be a natural progression. This could be in a related field or something entirely new, driven by personal passion or identified market gaps.

- Retirement: Planning becomes essential if stepping away from active work life is the choice. This includes ensuring a steady income stream from investments, deciding on a retirement location, and even charting out activities to stay engaged and active.

Checklist for Post-Sale Considerations

Below is a simple check-list of the main areas you run through to prepare for the post-sale of your agency.

- Consult a financial advisor for investment and tax guidance.

- Review and diversify investment portfolio.

- Settle outstanding debts or liabilities.

- Update or draft a new will.

- Consider strategic gifting for family or charitable causes.

- Explore legal structures, such as trusts, for asset protection.

- Reflect on future pursuits: new business ventures or retirement planning.

- If desired, negotiate an advisory or consultancy role with the sold agency.

Conclusion

Selling an agency is a substantial undertaking. It’s more than a business decision resulting from years of effort and commitment. The process, while straightforward on paper, is complex in practice. Preparation is key. Knowing your business’s worth, having a post-sale plan, and setting a clear strategy are all essential steps.

However, even with the best plans, the value of expert advice can’t be underestimated. A business consultant provides more than just guidance; they offer a pragmatic view, helping to navigate challenges and capitalise on opportunities. Their role is to simplify the complex, making the sale process more transparent and manageable.

For anyone considering selling their agency, it’s worth noting that while challenges are part and parcel of the process, the outcomes can be immensely rewarding. And as you consider this significant step, remember the value of expert input. A seasoned business consultant can distinguish between a good deal and a great one.

If you want to sell and ensure you’re on the right track, reach out. Making informed decisions now can set the stage for a successful sale and a promising future.

FAQ

What is the best way to sell your agency?

The optimal way to sell an agency involves thorough preparation, accurate valuation, and engaging with potential buyers through trusted networks or brokers. Seeking expert advice can also streamline the process.

How much does it cost to sell a business?

The cost to sell a business varies based on factors like the business’s size, the chosen method of sale, and professional fees. Typically, expenses can range from broker commissions to legal and accounting fees.

Is it a good idea to sell your company?

Deciding to sell your company depends on personal goals, the company’s health, and market conditions. If aligned with long-term objectives and done at the right time, it can be beneficial.

What are the risks of selling a company?

Selling a company can pose risks such as undervaluation, potential legal disputes, loss of proprietary information, or cultural misalignment with new ownership. Proper due diligence and expert guidance can mitigate these risks.

Do you need a solicitor to sell a business?

While not mandatory, employing a solicitor when selling a business is advisable. They ensure legal compliance, draft agreements, and protect the seller’s interests throughout the transaction.