Introduction

In an ever-evolving business world, the concept of your agency valuation stands as a cornerstone for decision-makers across the board.

For agency owners, investors, and potential buyers, comprehending the true worth of an agency is not just about numbers; it’s about recognising its position in the market, its potential for growth, and its resilience in the face of challenges.

A recent study by a US bank found that 98% of business owners surveyed didn’t know the value of their companies. This is pretty shocking, considering this calculation is needed for many reasons. For example, it’s critical for succession planning, tax and estate planning, capital raising, implementing a buy-sell agreement, the issuance of stock options, insurance needs, obtaining business funding, or a transition plan.

This article aims to demystify the intricate process of determining the worth of your business. From exploring various valuation methods and key influencing metrics to providing actionable insights for enhancing company value, we will look at the best valuation multiple to use. As we navigate through these facets, readers will be equipped with the knowledge to make informed decisions, whether they’re contemplating a sale, seeking investment opportunities, or strategising for future expansion.

Factors That Determine How Much Your Digital Agency Is Worth

Valuation multiples are metrics used in the business world to determine the value of a company. Essentially, it represents how much a potential buyer is willing to pay for every pound of earnings or revenue that the agency generates.

For marketing and advertising agencies alone, valuation multiples can vary based on several factors. Firstly, the agency’s financial health plays a significant role. Agencies with a consistent revenue stream and a history of profitability often command high valuation multiples. Additionally, the nature of the agency’s contracts, especially the presence of long-term agreements, can influence the multiple. Agencies with secured future revenue are often seen as less risky investments.

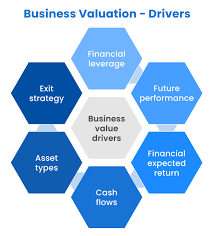

Several factors play a role in determining business valuations. Here’s a breakdown of these crucial determinants:

- Financial Health: A thorough assessment of financial statements, including profit and loss accounts, balance sheets, and cash flow statements, offers insights into the monetary stability of an agency. Consistent revenue, manageable debts, and a history of profitability can enhance perceived value.

- Client Portfolio: The diversity and quality of an agency’s clients can significantly influence its worth. For example, advertising agencies with a varied and high-profile client base may be deemed more valuable due to the potential for sustained revenue.

- Service Offerings: The breadth and depth of services provided can impact valuation. Agencies that offer a wide range of digital services may be seen as more versatile and resilient against industry shifts.

- Intellectual Property: Proprietary tools, software, or methodologies can add significant value. These assets can provide a competitive edge and open up additional revenue opportunities.

- Contract Stability: Long-term contracts with clients suggest a degree of predictability in future revenue. The terms, duration, and value of these contracts can be pivotal in assessing worth.

- Geographic Reach: An agency’s ability to serve clients across different regions or even globally can be a positive indicator. This reach suggests adaptability and the potential to tap into diverse markets.

- Employee Talent and Retention: A skilled workforce is a valuable asset. High retention rates and well-trained staff can indicate a positive work culture, continuity in service delivery, and a potential for sustained growth.

- Industry Recognition: Accolades, awards, and recognitions from industry bodies or peers can bolster an agency’s standing, thereby influencing its valuation.

- Scalability: The potential for an agency to expand its operations, whether by diversifying its services or entering new sectors, can be a key determinant of its worth.

- External Factors: Broader economic conditions, potential regulatory changes, or industry-specific challenges can impact valuation. Being aware of these external influences and their potential effects is crucial.

- Client Feedback: Positive testimonials, reviews, and feedback can enhance an agency’s perceived value, serving as a testament to its service quality and client relationships.

- Technological Infrastructure: The systems and technologies in place, especially those that allow for efficient operations and scalability, can be significant contributors to an agency’s value.

Using Annual Sales

![Here's How to Value a Company [With Examples]](https://alexejpikovsky.com/wp-content/uploads/2023/09/image-2.png)

Annual sales, often referred to as annual revenue or turnover, represent the total sales of a company over a fiscal year. This metric is a straightforward indicator of a company’s size and its ability to generate income from its operations. In the context of agency valuation, annual sales can serve as a foundational metric upon which other valuation methods are built.

The simplicity of using annual sales lies in its clarity. It provides a direct snapshot of the agency’s financial performance over a year without the intricacies of deductions or adjustments. For many potential buyers or investors, this figure serves as an initial gauge of the agency’s scale and market position.

To use annual sales in valuation, one typically applies a multiplier, which is determined based on various factors such as the industry the agency operates in, its growth rate, and its competitive positioning. For digital agency valuation, for instance, if an agency has annual sales of $1 million and a chosen multiplier is 2.5, the estimated value of the agency would be $2.5 million.

However, while annual sales provide a clear picture of an agency’s income, they don’t account for expenses, profitability, or other financial intricacies. Therefore, relying solely on annual sales might not offer a comprehensive view of an agency’s worth. It’s often used in conjunction with other metrics, such as net profit or EBITDA multiple, to provide a more rounded valuation.

Furthermore, it’s essential to consider the consistency of an agency’s annual sales. An agency with steady or increasing sales year-on-year might be seen as more stable and potentially more valuable than one with fluctuating sales.

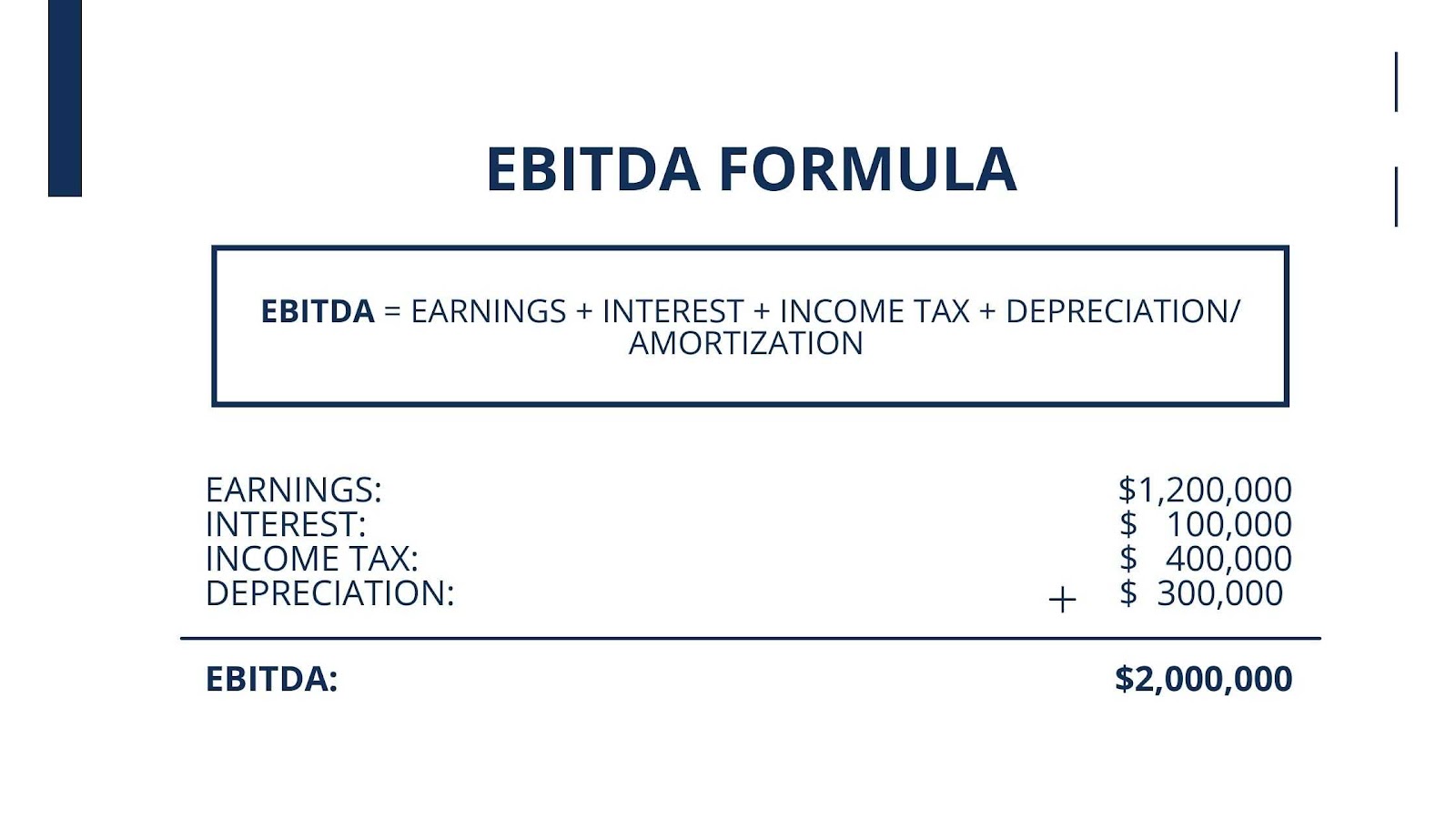

Calculating EBITDA Value

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation, is a widely used metric to assess a company’s operational profitability. It offers a clearer picture of a company’s financial performance by focusing on earnings from its core business operations, excluding the effects of financing costs, tax environments, and non-cash expenses.

To calculate EBITDA multiples, one starts with the net income of the company and then adds back interest, taxes, depreciation, and amortisation. The formula is as follows:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortisation

For many investors and buyers, EBITDA serves as a more transparent measure of a company’s ability to generate profit from its operations. It removes the variability that can come with different tax structures, capital structures, and non-cash accounting practices, providing a more consistent metric for comparison across companies or industries.

In the context of agency value, EBITDA can be a pivotal metric. A higher EBITDA multiple can indicate that an agency is effectively generating revenue from its primary operations, making it an attractive proposition. Conversely, a lower multiple might suggest challenges in the core operations of the agency.

When considering the sale of an agency, the EBITDA value often plays a role in determining the asking price. This multiple, when multiplied by the EBITDA, gives an indication of the agency’s value. It’s worth noting that the appropriate multiple can vary based on industry norms, the agency’s growth prospects, and other relevant factors.

Working With Seller’s Discretionary Earnings (SDE)

Seller’s Discretionary Earnings (SDE) is a crucial metric used in the valuation of small to medium-sized businesses, including agencies. It represents the total earnings available to a business owner before accounting for interest, taxes, depreciation, amortisation, and the business owner’s compensation. SDE provides a clearer picture of a business’s true earning potential, especially when the owner’s salary might be higher or lower than what a typical manager would earn.

To calculate SDE, one starts with the net income and adds back the owner’s salary and benefits, interest, taxes, depreciation, and amortisation. Any one-off or non-recurring expenses are also added back. The formula is:

SDE = Net Income + Owner’s Salary and Benefits + Interest + Taxes + Depreciation + Amortisation + Non-recurring Expenses

For possible buyers or private equity investors, SDE offers a more realistic view of an agency’s profitability. Since many small business owners pay themselves a salary that doesn’t necessarily align with market rates, adjusting for this discrepancy ensures that the earnings reflect the agency’s true operational performance.

When valuing an agency, SDE is often used in conjunction with a multiplier, which varies based on industry norms, the agency’s size, and its growth prospects. The product of the SDE and the multiplier provides an estimate of the agency’s value.

For instance, if an agency has an SDE of $500,000 and the chosen multiplier is 3, the estimated value of the agency would be $1,500,000.

Agency owners need to understand SDE, especially when considering a sale. By ensuring that financial records are accurate and that all discretionary and non-recurring expenses are well-documented, many business owners can present a more precise and potentially higher SDE to buyers.

How to Calculate Your Digital Marketing Agency’s Valuation

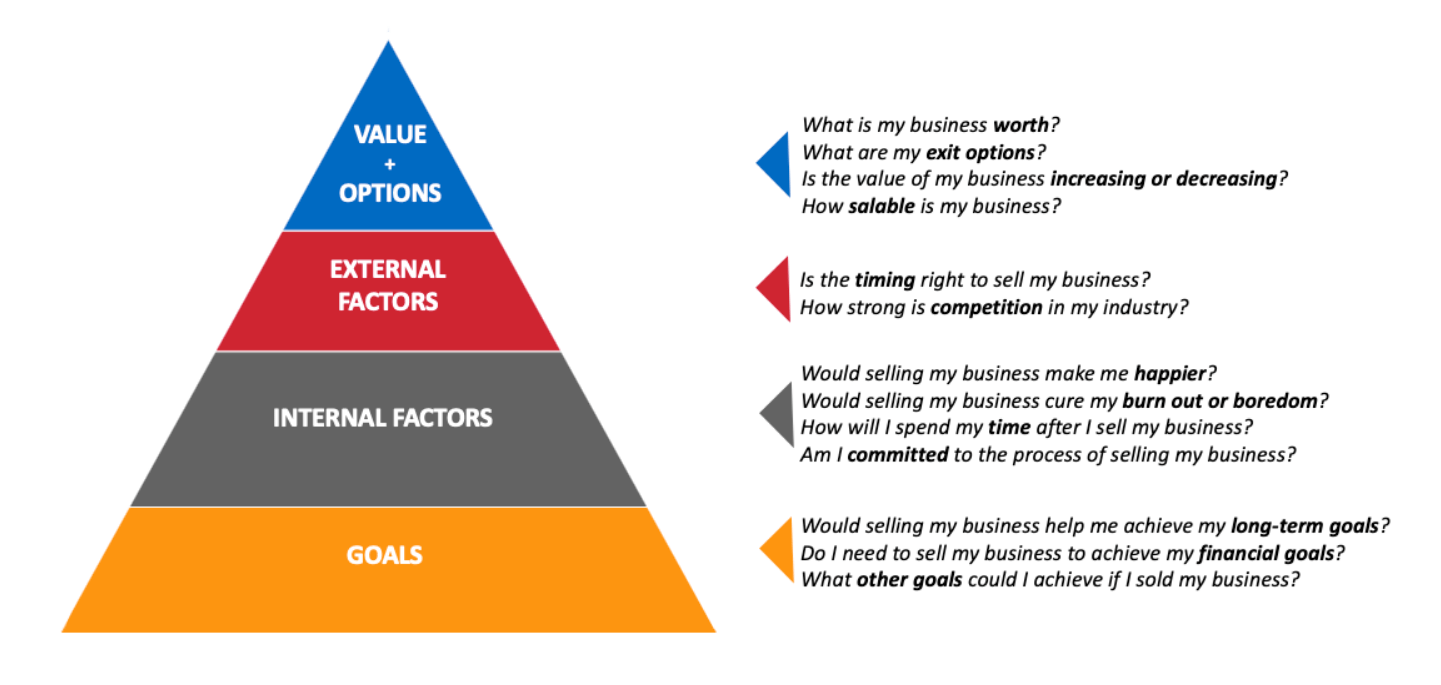

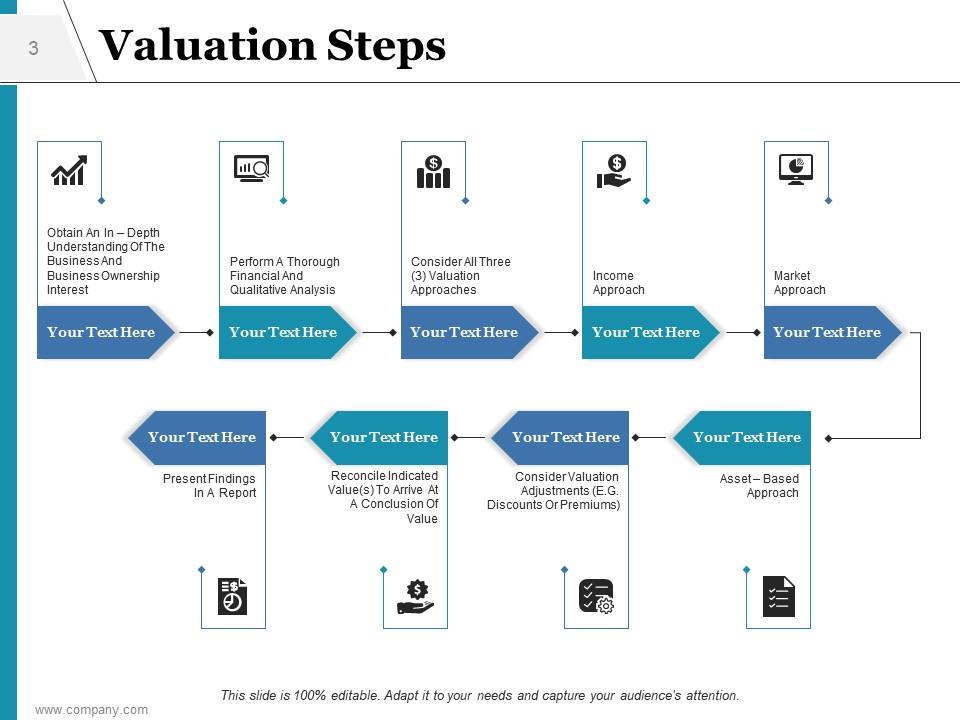

Valuing a digital marketing agency can be a complex process, given the myriad of factors that come into play. However, understanding this calculation is crucial for business owners, especially when considering a sale, merger, or investment opportunity. Here’s a step-by-step guide to help you determine the worth of your digital marketing agency:

Step 1: Financial Analysis

Begin by delving deep into your agency’s financial statements. This foundational step involves a meticulous examination of your income statements, balance sheets, and cash flow statements. By understanding your consistent revenue streams and their historical stability, you can gauge the financial health of your agency. Additionally, scrutinise your profit margins to determine the agency’s profitability post-expenses. Lastly, account for any outstanding debts or liabilities, as these can impact the overall business valuation.

Step 2: Asset Evaluation

Assets, both tangible and intangible, play a pivotal role in the valuation experts determining your agency’s worth. Tangible assets encompass physical items like office equipment, properties, and any other tools or resources owned by the agency. On the other hand, intangible assets can include intellectual properties, proprietary methodologies, or any software developed in-house. Assigning a monetary value to these assets is crucial for an accurate valuation.

Step 3: Client Contracts Assessment

Existing client contracts, especially those that are long-term, can significantly influence your agency’s valuation. Thoroughly review all active agreements, paying particular attention to their duration, monetary value, and stipulated terms. Long-term contracts can be indicative of future revenue, providing a sense of stability and predictability.

Step 4: Competitive Positioning

Understanding your agency’s position within the industry is paramount. Analyse your market share within your specific niche or service offering. Additionally, identify any barriers or challenges that new entrants might face when trying to establish themselves in your sector. A dominant position or significant barriers to entry can enhance your agency’s valuation.

Step 5: Operational Efficiency Review

The internal workings of your agency, including its processes and systems, can impact its valuation. Assess the efficiency of your operational processes, from client onboarding to project delivery. An agency that operates seamlessly and can swiftly adapt to changes is often perceived as more valuable due to its potential for sustained profitability.

Step 6: Future Earnings Potential

While historical data is essential, buyers and investors are also keenly interested in the future. Project your agency’s earnings based on current trends, planned initiatives, and possible market shifts. Consider factors such as scalability, potential to diversify service offerings, and opportunities to tap into new markets or sectors.

Step 7: External Factors Evaluation

External elements, often beyond the control of any valuation alone, can influence its valuation. This includes broader economic conditions, potential regulatory changes, or any industry-specific challenges. Staying abreast of these factors and understanding their potential impact on your digital agency’s valuation is crucial for an informed valuation.

Step 8: Previous Sales Comparisons

If possible, research the sale prices and terms of similar agencies within your sector. This comparative data can serve as a valuable benchmark, providing context and a reference point for your valuation. While every agency is unique, understanding the market rate can offer additional clarity.

Step 9: Seek Professional Valuation

While the aforementioned steps provide a comprehensive framework, the nuances of business valuation often require expert insight. Engage the services of a professional valuer or accountant who has experience in the digital marketing sector. Their expertise can help refine your valuation multiple, ensuring it’s both accurate and reflective of your business value and current market conditions.

Closing Thoughts

Navigating the complexities of your agency’s value requires both knowledge and foresight. As we’ve explored throughout this article, understanding the true worth of an agency goes beyond mere figures; it encapsulates its market position, growth potential, and the various factors that contribute to its overall standing in the business landscape. With the ever-changing dynamics of the industry, staying informed and proactive is key to ensuring that an agency’s value is not just maintained but continually enhanced.

For those wanting a more precise and tailored assessment, free valuation calculators serve as invaluable tools, offering insights based on specific parameters and industry benchmarks. However, while these tools provide a starting point, the expertise of a business valuation consultant cannot be overstated. We understand market trends, industry-specific challenges, and growth strategies and offer an unparalleled depth of analysis.

While understanding and enhancing an agency’s business value is intricate, it is by no means impossible. With the right tools and expert guidance, you can plan a path for sustained growth and success. If you’re looking to delve deeper into your agency’s valuation or explore strategies for growth, contact one of our business valuation consultants and start making more informed decisions to increase what your agency is worth.

FAQs

How do you calculate agency value?

Agency value is calculated using various methods, including earnings multipliers, asset-based approaches, and comparable sales, among others. The chosen method often depends on both the buyer or agency’s specific circumstances and the purpose of the agency valuation.

How is a marketing agency valued?

A marketing agency is valued based on several factors, including its earnings, assets, market position, and growth prospects. Common methods include applying valuation multiples to earnings or sales figures.

How much can you sell your agency for?

The sale price of an agency depends on valuation factors: its financial health, industry benchmarks, client portfolio, and growth potential. It’s best to consult with a business valuation expert to determine an accurate sale price. You can also use a marketing agency valuation calculator to help calculate how much your agency is worth.

How much should I sell my marketing agency for?

You should sell your marketing agency based on its current valuation, which considers factors like earnings, assets, market position, and future growth prospects. Seeking advice on the sale process from a valuation expert can provide clarity.

What is the valuation of a company if 10% is $100,000?

If 10% of a company is valued at $100,000, the entire company’s valuation would be $1,000,000. This is derived by dividing the value of the percentage (in this case, $100,000) by the percentage itself (0.10 or 10%).