If you’re reading this, you’re probably a busy CEO of a growing business. And you’re debating if the benefits from hiring a Fractional CFO are worth the cost.

For most businesses, it is! For a small to medium retainer (anything from $2k to $6k per month), you can hire in senior leadership that can unlock huge financial gain.

We’re going to weigh up:

- Benefits of hiring a Fractional CFO

- Arguments to not hire a Fractional CFO

- The best businesses that benefit from a Fractional CFO

- When is the right time to hire a Fractional CFO

- Typical costs and return on investment (ROI)

But before that, here’s a quick rundown of why many businesses do hire a Fractional CFO:

- Cost-Effective: Far less expensive than a full-time CFO.

- Time-Saving: Frees up CEOs and Founders from complex financial tasks.

- Financial Opportunities: Identifies avenues for cash flow improvement and fundraising.

- Flexibility and Expertise on Demand: Enjoy the ease of contract-based employment, allowing you to quickly hire or let go of high-level financial skills without the constraints of a full-time commitment.

- Risk Mitigation: Minimises financial errors and compliance issues.

- Investor Relations: Enhances reporting and communications with stakeholders.

If you’re targeting $1m–$40m in annual revenue, need sharper cash‑flow visibility, or plan to exit in 3–5 years, booking a discovery call with Alexej Pikovsky is the fastest next step. On the call, Alexej will vet your needs and match you with a hand‑picked fractional CFO from his network.

Hire an expert now. Tell us what you need, and we’ll deliver a shortlist of fully vetted fractional CFOs within 7 days.

Want to learn more about the benefits of a Fractional CFO? Dive deeper below.

What Does a Fractional CFO Do? (Hint: It’s Not Bookkeeping)

A true fractional CFO is future‑focused—the strategic partner who asks, “Your brand is here today; where do you want it in five years? Let’s map each week, month, and quarter to make that future inevitable.” That means:

- Financial Road‑Mapping: Building granular 13‑week cash‑flow forecasts and 5‑year models aligned to your personal goals, whether that’s a life‑changing exit or consistent owner dividends.

- Margin Expansion: Drilling into SKU‑level contribution margins, ad spend efficiency, and 3PL costs to boost gross margin by 2–8 pp.

- Capital Strategy: Advising on debt vs. equity, negotiating flexible inventory financing, and preparing investor decks that resonate with DTC‑savvy VCs.

- Tax Optimisation: Structuring inventory purchases, R&D credits, and cross‑border sales to minimise liabilities.

- Exit Readiness: Guiding you from “curious” to fully prepared for acquisition—clean data room, QoE report‑ready statements, and valuation‑optimized metrics (think LTV/CAC, repeat rate, and EBITDA add‑backs).

Founder‑First Alignment: A great fractional CFO starts with your personal objectives—a seven‑figure exit, passive dividends, or global expansion—and then reverse‑engineers the financial road map. A less‑effective CFO focuses only on historical statements and misses the life‑goal context.

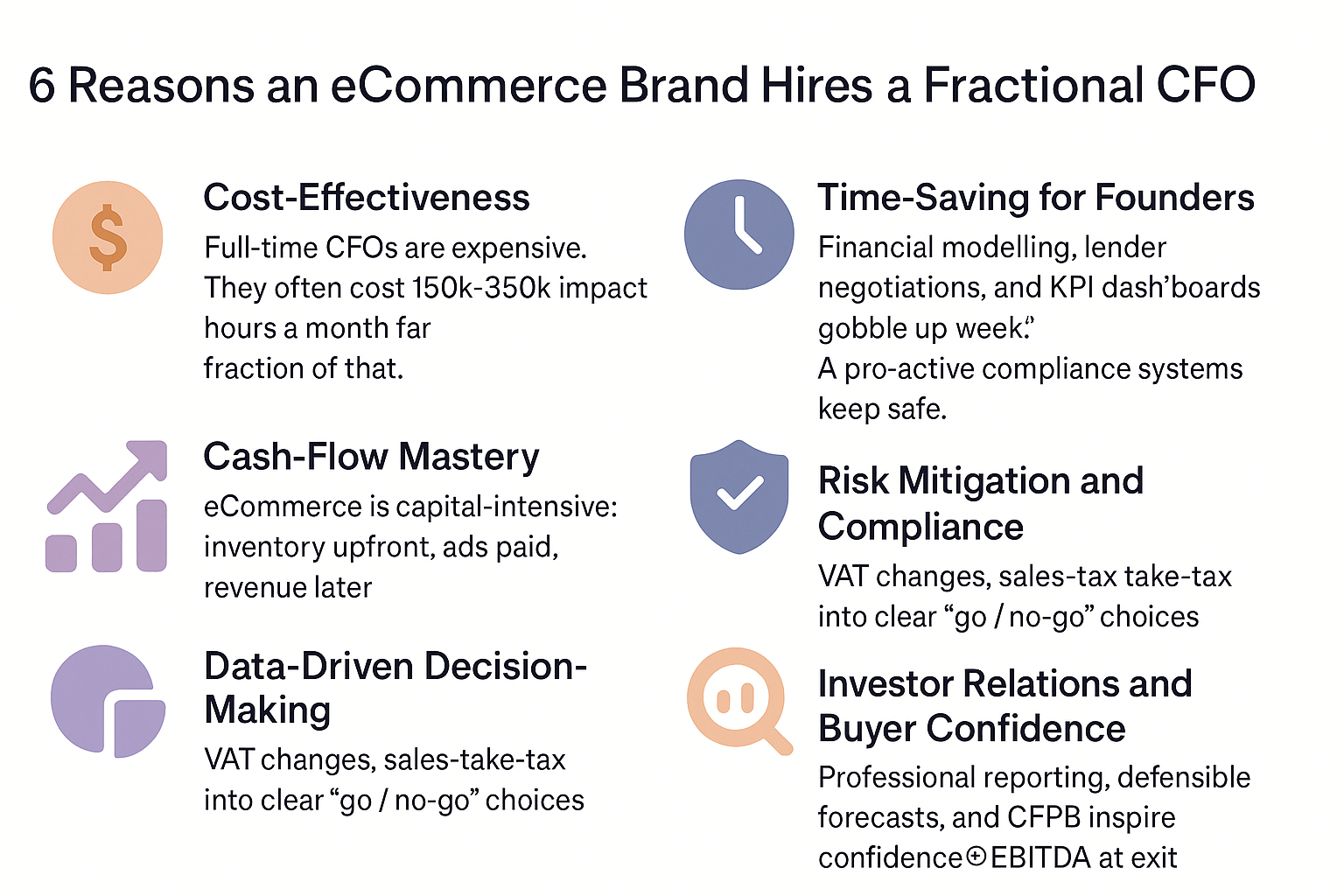

6 Reasons Businesses Hires a Fractional CFO

1. Cost-Effectiveness

Full-time CFOs are expensive. They often cost $150k–$350k plus options. A fractional model gives you 15–40 high‑impact hours a month for a fraction of that.

This flexibility is a game-changer. It frees up funds for growth channels. Use them for marketing or product development. It’s your choice.

But it’s not just about cost savings. The value is immense. A Fractional CFO brings expertise. They spot financial opportunities that others might miss.

In short, a Fractional CFO is a high ROI. They give expert financial management without breaking the bank.

2. Time-Saving for Founders

Financial modelling, lender negotiations, and KPI dashboards can devour your week. Offload the complexity so you can refocus on product development and community building.

In essence, a Fractional CFO is a time multiplier. They handle the financial intricacies so you can focus on what you do best.

3. Cash-Flow Mastery

Running a business is capital‑intensive: inventory upfront, ads paid now, revenue later. A fractional CFO plugs leaks, shortens the cash‑conversion cycle, and structures inventory finance so you never stock‑out—or overstock.

Think cash flow improvements or better terms with suppliers—even fundraising avenues you haven’t considered. They also spot risks early, before they become financial sinkholes.

4. Data‑Driven Decision‑Making

From ROAS to blended CAC and Contribution Margin after ad spend (CM3), you’ll get dashboards that translate raw data into clear “go / no‑go” choices.

They come with a rich background. Think investment banking, venture capital, or accountancy. That’s not just expertise; that’s expertise on demand. No waiting for quarterly reviews. No long-term strings attached.

5. Risk Mitigation and Compliance

VAT changes, sales‑tax nexus, new FCA rules on BNPL—you can’t afford fines or stock delistings. They can even be fatal for a business. Proactive compliance systems keep you safe and sale‑ready.

A Fractional CFO helps you sidestep these pitfalls. Identifying risks early can lead to new opportunities.

7. Investor Relations and Buyer Confidence

Professional reporting, defensible forecasts, and a CFO in your corner inspire confidence, often adding several multiples to your EBITDA multiple at exit.

Investors aren’t just looking for numbers; they want a story. A Fractional CFO knows how to tell it. They craft financial narratives that resonate with stakeholders, serving as a liaison between you and your investors.

As a result, you get stronger investor relationships and more confidence in your financial management.

When Not to Hire a Fractional CFO (Yet)

While Fractional CFOs offer many perks, they’re not for everyone. Let’s explore some reasons you might hesitate:

Business Size and Revenue

Not every business needs a Fractional CFO right out of the gate. If your annual revenue is below the $250k mark, the cost might outweigh the benefits. At this stage, basic bookkeeping and financial management might suffice.

However, it’s worth noting that as you approach the $1m revenue mark, the complexity increases. That’s when a Fractional CFO can truly add value. They can help you navigate the financial intricacies that come with scaling.

In-House Expertise

Some businesses may feel they already have sufficient in-house financial expertise. Especially if the founder or CEO has a strong financial background. In such cases, the immediate need for a Fractional CFO might seem less urgent.

However, it’s crucial to remember that even financial experts can benefit from specialised guidance. A Fractional CFO can provide a second set of eyes. They can ensure that no opportunities or risks are overlooked. Plus, their external perspective can offer invaluable insights that internal team members might miss.

Complexity of Business Operations

Some businesses operate in sectors where financial operations are relatively straightforward. In such cases, the argument could be made that a Fractional CFO might be an overkill. However, it’s worth noting that even “simple” businesses face complex challenges as they grow.

Regulatory changes, market volatility, and expansion into new areas can quickly complicate your financial landscape. A Fractional CFO can help you navigate these complexities, ensuring you’re not caught off guard.

Which Businesses Benefit the Most from a Fractional CFO?

Not all businesses are created equal. Different types have unique financial needs, making them ideal candidates for a Fractional CFO.

Startups

Startups operate on tight budgets where every penny counts. A Fractional CFO is a growth catalyst for startups by helping you allocate resources efficiently.

They’re not just about cutting costs; they’re about smart spending. They can also be invaluable during fundraising rounds, helping you present a compelling financial story to investors.

SMEs

SMEs often lack the financial structure of larger corporations. They’re juggling multiple roles, from operations to finance. A Fractional CFO fills this gap.

They bring expertise in cash flow management, ensuring you’re neither overextended nor missing opportunities.

Regulatory compliance is another maze they help you navigate, keeping you in line with laws and industry standards.

High-Growth Companies

Scaling quickly is thrilling, but it’s risky too. A Fractional CFO mitigates those risks.

They establish scalable financial processes. This covers everything from payroll to procurement.

Their expertise is invaluable. It ensures you can expand into new markets and add product lines seamlessly.

In essence, a Fractional CFO is the architect behind your financial growth strategy.

Companies Facing Financial Challenges

Facing financial headwinds like debt or declining revenue? A Fractional CFO can be your lifeline.

They offer turnaround strategies tailored to your situation. This isn’t one-size-fits-all advice.

Cost-saving measures are identified. Think renegotiating contracts or optimising supply chains.

But it’s not just about cutting costs. They also pinpoint new revenue streams. Maybe it’s a neglected customer segment or an underutilised asset.

Businesses Preparing for Sale or Merger

Considering a sale or merger? Valuation is your focal point. A Fractional CFO can elevate it.

They prepare meticulous financial statements. These aren’t just numbers; they’re your business story, quantified.

Negotiations are another arena in which they excel. They don’t just represent you; they strategise for you.

From due diligence to deal closure, a Fractional CFO is your advocate. Their goal is to maximise your valuation and secure favourable terms.

Seasonal Businesses

Seasonal businesses face unique challenges. Revenue peaks and valleys are just the start. A Fractional CFO can help you prepare for all business climates.

Budgeting for peak and off-peak seasons? They’ve got a tailored plan. It’s about more than just surviving the slow months; it’s about thriving year-round.

But what about cash flow? They ensure you’re not just solvent during the off-season but ready to seize opportunities during peak times.

Inventory management is another forte. No more overstocking or understocking. Just the right amount, right when you need it.

6 Trigger Moments Signalling It’s Time to Hire a Fractional CFO

1. When You’re Scaling

Expanding your business brings new financial challenges. A Fractional CFO is your guide through this intricate landscape.

They assist in resource allocation. It’s not just about spending more; it’s about spending wisely. They’ll help you decide where to invest for maximum impact.

Liquidity is another key focus. A Fractional CFO ensures you’re financially agile, ready to pivot or accelerate as opportunities arise.

2. When Cash Flow Is Tight

Cash flow problems can cripple a business. A Fractional CFO offers more than a quick fix; they offer a strategy.

They scrutinise your accounts receivable and payable. Delays in either can be disastrous. They’ll implement systems to speed up collections and negotiate better terms with suppliers.

Working capital is optimised. This means you have the cash you need, when you need it, without relying on expensive short-term loans.

3. When Fundraising

Fundraising is a high-stakes game and your financial model is your ace. A Fractional CFO ensures it’s a winning one.

They craft a model that’s not just accurate but compelling. It’s about showcasing your business’s potential, backed by data.

Due diligence is another area they excel in. They prepare you for the rigorous financial scrutiny investors will put you through.

4. When Facing A Merger or Sale

Mergers and sales are pivotal moments in which the financial stakes are high. A Fractional CFO is your negotiator and strategist.

They prepare exhaustive financial statements. These documents become your negotiation tools, helping you secure favourable terms.

Valuation is another key focus. A Fractional CFO employs multiple methods to ensure you’re not undervalued.

5. When Compliance Gets Complicated

Navigating a shifting regulatory landscape? It’s a maze. A Fractional CFO is your guide.

They stay ahead of legislative changes. Whether it’s tax codes or industry-specific regulations, they ensure you’re not caught off guard.

Compliance audits are streamlined. A Fractional CFO prepares you for them, reducing the risk of penalties.

6. When You’re Overwhelmed

Business is demanding enough without financial headaches. A Fractional CFO lightens your load.

They handle complex financial tasks. From budgeting to forecasting, they take it off your plate. You focus on what you do best: running your business.

Stressful financial decisions? They provide data-backed insights, making those decisions easier and more effective. Allowing you to lead with clarity and confidence.

Cost of a Fractional CFO (and Why It’s ROI‑Positive)

A part‑time CFO costs <10 % of a full‑time hire yet can add 5–10× that outlay in profit, cash‑flow resilience, or exit value.

Engagement Models and Price Ranges

| Model | Typical Scope | Price Guide* |

| Monthly Retainer | Ongoing strategic finance leadership—cash‑flow forecasting, board reporting, KPI dashboards, lender/investor calls. | $2k–$6k / month |

| Hourly / Project‑Based | Deep dives such as SKU margin audit, 3PL contract tender, or fundraising deck. | From $140 / hour depending on complexity and data hygiene |

| Equity / Success Fee | Optional kicker for capital raise or M&A. Aligns incentives around outcome. | 1–3% of capital raised or 0.5–1.5 × monthly retainer at deal close |

*Pricing varies by data cleanliness, team size, transaction readiness, and time‑zone requirements.

What Drives the Cost?

- Data Complexity – Multiple sales channels (Shopify, Amazon, B2B) and messy chart‑of‑accounts increase analysis time.

- Urgency and Availability – A brand aiming to close funding in 30 days will need more senior hours than one planning a Q4 raise.

- Deliverable Depth – Weekly 13‑week forecasts, cohort LTV models, and board‑ready packs push costs toward the upper range.

- Team Training – Upskilling internal staff (Ops, Finance Assistant) can add workshop hours but reduces long‑term dependency.

Hidden Savings vs. a Full‑Time CFO

- Salary and Bonus Saved: Full‑time US eCommerce CFO = $150k–$350k base + 20 % bonus. Hiring full-time abroad is also an option and would be $100k-250k base + a discretionary bonus.

- No Employer Taxes and Benefits: NI contributions, pension, private healthcare ≈ 25 % overhead.

- No Equity Dilution: Keep cap‑table clean—fractional CFOs rarely ask for options unless tied to a specific exit mandate.

Total annual cash saving depending on the hours and the seniority: $120k–$270k while still accessing senior expertise.

ROI Scenarios

| Initiative | Typical Win | Example Impact* |

| Margin Optimisation | Reduce COGS by renegotiating 3PL & supplier terms. | +4 pp gross margin → $400k extra gross profit on $10m revenue |

| Ad Spend Reallocation | Shift budget to higher LTV cohorts, cut wasted FB/Google ads. | 15 % lower blended CAC → $150k annual savings on $1m ad spend |

| Inventory Finance | Secure 6‑month revolving credit at 11 % vs. MC rate of 18 % APR. | $70k interest saved on $1m facility |

| Exit Multiple Lift | Clean data room + CFO narrative adds 0.75× EBITDA at sale. | $600k extra on $800k EBITDA business |

*Examples based on anonymised client outcomes; individual results vary but illustrate 5–10× ROI potential.

Payback Timeline

Most founders recoup the first 12 months of fees within 3–6 months through quick‑win cash‑flow gains (payment‑terms renegotiation, sku‑level profitability fixes) and see compounding returns as strategic projects (margin expansion, valuation uplift) mature.

Why Work With Alexej’s Vetted Fractional CFO Network

Years of investing, acquiring brands, and sitting in the operator’s seat taught Alexej a hard truth: most founders waste months cycling through generic “finance talent” before they land a CFO who actually understands growth-stage reality. In today’s market—where profits and cash flow matter more than vanity ARR—bringing in a values-driven strategist is non-negotiable.

Alexej solved the gap by curating a vetted Fractional-CFO collective built specifically for profit-oriented founders and C-suite operators.

What sets this bench apart

-

Founder-First Vetting: Alexej hand-screens every CFO for a track record scaling 7- to 9-figure brands—no résumé keyword scans, no junior recruiters.

-

Industry Specialization: Our fractional CFOs arrive with 5+ years of C-suite experience in your exact niche—whether that’s SaaS (SQLs, MQLs, NRR), eCommerce (contribution margins, SKUs, cohort retention), or construction & real estate (project cash flow, WIP schedules). They hit the ground running on day one, so you spend zero time coaching and 100% of your time scaling.

-

Speed to Value: Average match in 10–14 days; first margin-impact initiative shipped within 2–6 weeks.

-

Transparent Pricing: Flat monthly retainers—no hidden recruiter mark-ups, no surprise change-orders.

- Values Alignment: Integrity, transparency, and owner-like thinking are non-negotiable filters, ensuring your sensitive financial data is in principled hands.

Hire an expert CFO. Tell us what you need and we’ll deliver a shortlist of fully-vetted fractional CFOs within 7 days.

Is a Fractional CFO Worth It?

Is investing in a Fractional CFO a wise move? For many businesses, the answer is a resounding yes:

- Saves Time: Delegate financial complexity and regain strategic focus.

- Finds Money: From tax credits to supplier terms, hidden profit surfaces.

- Reduces Risk: Compliance and cash‑flow missteps get neutralised early.

- Adds Flexibility: Scale hours up or down as your brand evolves.

- Boosts Valuation: Professional finance ops translate to higher multiples.

FAQ

A Fractional CFO goes beyond basic accounting. They’re experts in financial modelling, equity fundraising, and strategic planning, offering a level of expertise that a regular accountant can’t match.

The key difference is commitment and cost. A Fractional CFO offers the same level of expertise but on a contract basis, making it a more cost-effective solution for smaller businesses.

With Alexej’s streamlined onboarding, your fractional CFO is operational within 7 days:

Week 1 – Discovery & Data Audit: Secure data‑room setup, review of P&L, balance sheet, inventory turns, and ad‑platform metrics.

Week 2-6 – First Deliverables: Delivery of a 13‑week cash‑flow forecast, SKU‑level margin analysis, and an action plan prioritized by ROI.

Most brands start seeing quantifiable wins—for example, tighter inventory purchases or re‑allocated ad spend—inside the first 30–60 days. Larger strategic outcomes such as gross‑margin expansion and valuation uplift typically compound over 1–3 quarters.

Possibly. Book a short call; if a fractional CFO isn’t right yet, Alexej will point you to bookkeeping and dashboard resources to bridge the gap.