“When you talk about a fractional CFO in the purest sense, it is forward‑looking strategic guidance. It’s a trusted partner who charts your path from where you are today to where you want to exit in five years.” — Alexej Pikovsky

Running an online brand is capital‑intensive: long cash‑conversion cycles, inventory stuck at ports, fast‑moving ad costs, and razor‑thin margins. A fractional CFO gives you C‑suite financial firepower—without the full‑time price tag—to navigate those challenges, raise profitability, and accelerate your exit timeline.

Below is an in‑depth, yet actionable guide designed for founders scaling six‑ to nine‑figure brands. We’ll cover:

- What a fractional CFO is

- What are the focus areas of a CFO

- What are the 23 things a fractional CFO does in their first 90 days

- Core strategic deliverables

- Operational vs. Fundraising/M&A services

- Key profit and cash‑flow KPIs every CFO should track

- How much a fractional CFO costs in 2025

- When to hire and how Alexej’s vetting process de‑risks the decision

What Is a Fractional CFO?

A fractional CFO is a senior finance leader engaged part‑time, often 1‑6 days per month, under a contract or retainer. Unlike bookkeepers or controllers who report on the past, fractional CFOs live in the future: scenario planning, risk mitigation, and margin expansion.

- Financial Expert: A Fractional CFO typically has at least 3+ years experience in the finance sector. Usually, they are qualified chartered accountants but can also include investment bankers and private equity directors.

- Cost Effective Hire: Fractional CFOs can be hired on a project, hourly or monthly retainer basis. Typically, a startup would hire a Fractional CFO for 1 to 6 days per month. This makes them an attractive option for smaller businesses that currently do not employ a full-time in-house financial department or have the budget for a full-time hire.

- Focused Deliverables: Full-time CFOs usually oversee a complete financial department. aspects. Whereas Fractional CFOs operate independently, potentially with the resource of a couple of junior staff. Therefore, they usually concentrate on specific areas such as financial reporting, modelling, forecasting, debt and equity fundraising, acquisitions, bookkeeping, payments, and payroll.

- Problem-Solver: Fractional CFOs are often brought in to address particular financial challenges or to help achieve growth and optimize strategy Their targeted approach allows them to provide solutions tailored to a company’s unique situation.

- Collaborator: A Fractional CFO is comfortable working alongside all team units and brings together department-specific metrics to build good financial models. They’re usually strong team players, and the best CFOs can bring focus teams on the biggest revenue drivers.

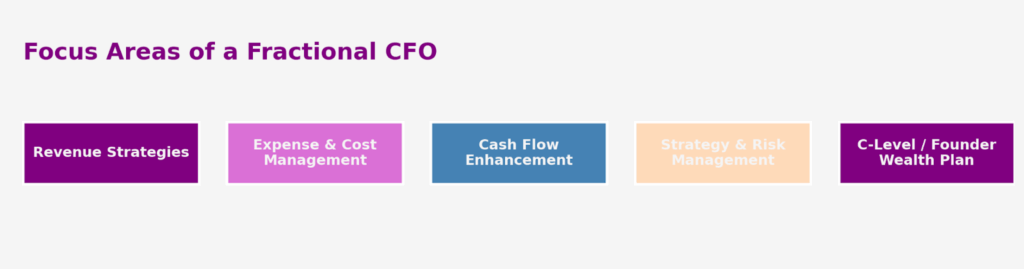

What are the Focus Areas of a Fractional CFO?

A fractional CFO’s mandate compresses into five core domains—from growing top‑line revenue to fortifying runway—so every financial decision ladders up to profit and long‑term value.

Contrary to popular belief, a great fractional CFO can begin driving these 23 activities across the five core focus areas, even before your books and tax filings are 100% clean.

1. Revenue Strategies

A CFO’s first mandate is accelerating top-line growth without waiting for “perfect” books—messy data can be cleaned on the fly, but lost revenue is gone forever. Key analytics and actions:

| # | Metric / Analysis | CFO Focus | Typical Outcome |

| 1. Cost-per-Acquisition (CPA) | Compare marketing + sales spend to new-customer revenue. | Cut high-cost channels, double-down on high-ROI campaigns. | Lower blended CAC, higher marketing ROI. |

| 2. Client Retention | Track churn %, average lifespan, repeat-purchase rate. | Flag service gaps; launch retention campaigns or loyalty perks. | Higher LTV and steadier cash flow. |

| 3. Lead-to-Close Conversion | Funnel ratios from MQL → SQL → Deal. | Pinpoint weak stages (e.g., demo-to-proposal) and fix scripts or incentives. | More closed deals from the same lead volume. |

| 4. Transaction Volume per Customer | Pareto analysis of customer revenue. | Protect top-20 % accounts, re-engage at-risk buyers, plan upsells. | Safeguarded core revenue; upsell lift. |

| 5. Average Transaction Value (ATV) | Current ATV vs. target. | Introduce bundles, minimum-order values, premium tiers. | Larger basket sizes without new customers. |

| 6. Revenue-Stream Breakdown | Revenue by product, service, region. | Focus investment on high-margin streams; fix or sunset low-margin lines. | Cleaner portfolio and better gross margin. |

| 7. Pricing Strategy Review | Price vs. perceived value, discount leakage. | End “set-and-forget” pricing, curb discount abuse, test price lifts. | Margin expansion without volume loss. |

| 8. Profitability by Line | Contribution margin per SKU/service. | Redirect resources to profit leaders, restructure or drop laggards. | Strategic resource allocation, higher blended margin. |

Quick win mindset: the CFO prioritizes 1-to-3 of these levers each quarter—shipping revenue fixes fast while the accounting cleanup runs in parallel.

2. Expense & Cost Management

The objective is to cut bloat, protect margins, and drive smarter spending across the business.

| # | Metric / Analysis | CFO Focus | Typical Outcome |

| 9. Team Compensation Review | Total payroll burden vs. output; incentive alignment. | Spot over‑staffing; tie bonuses to KPIs. | Lean headcount, performance‑driven culture. |

| 10. Expense Audit | Scan last 6‑12 months’ major spend. | Kill waste; redirect cash to growth. | Immediate cost savings, capital re‑allocation. |

| 11. Vendor Spend Review | Top suppliers by spend; contract terms. | Remove duplicates; renegotiate or exit. | 5‑15 % procurement savings. |

| 12. Debt Structure & Rates | Portfolio mix, covenants, interest costs. | Refinance expensive notes; optimise amortisation. | Lower interest burden, improved cash flow. |

| 13. Inventory Management | Turnover ratio, aging stock. | Clear slow movers; tighten re‑order points. | Cash unlocked from trapped inventory. |

Rule of thumb: savings ≥ 2 % of revenue are achievable in the first 180 days when a CFO runs a systematic cost‑review playbook.

3. Cash‑Flow Enhancement

Liquidity is survival: a CFO’s job is to protect the runway at all costs and keep growth plans funded.

| # | Metric / Analysis | CFO Focus | Typical Outcome |

| 14. 13‑Week Cash‑Flow Forecast | Rolling weekly inflows/outflows. | Prioritise must‑pay expenses; flag cash risks early. | Zero “surprise” shortfalls; timely funding decisions. |

| 15. Break‑Even Analysis | Revenue required to cover all fixed and variable costs. | Re‑calculate after staffing or price changes; set clear sales targets. | Team aligned on minimum daily/weekly sales. |

| 16. Owner Distributions vs. Business Health | Track draws/dividends vs. cash buffer. | Balance owner payouts with oxygen for operations. | Healthy reserves + well‑timed distributions. |

| 17. Capex Planning | Road‑map upcoming big‑ticket spends. | Phase capex to cash‑flow, evaluate leasing or loans. | Major purchases without liquidity crunch. |

4. Strategy & Risk Management

A forward‑looking CFO safeguards the future, not just cleans up the past.

| # | Metric / Analysis | CFO Focus | Typical Outcome |

| 18. Risk Map (Clients & Vendors) | Concentration by revenue or spend; single‑point dependencies. | Mitigation plans—diversify suppliers, multi‑year contracts, contingency inventory. | Reduced revenue volatility and supply‑chain shocks. |

| 19. Interim Operating KPIs | Simple weekly pulse: cash on hand, net sales, churn. | Keep leadership laser‑focused on what moves the needle right now. | Faster course‑corrections; early warning signals. |

| 20. Strategic Tax Planning | Missed deductions, entity structure, year‑end manoeuvres. | Proactive conversations with CPAs; optimise for after‑tax cash. | Lower effective tax rate; more cash retained. |

5. C-Level / Founder Wealth Plan

A great CFO doesn’t stop at the P&L—they help founders turn operating success into personal wealth and life-style freedom.

| # | Metric/Analysis | CFO Focus | Typical Outcome |

| 21. Founder & Leadership Vision | Clarify personal wealth, lifestyle, and impact goals. | Translate goals into numeric targets (net-worth, charity commitments, time-off). | Decision-making aligned with what truly matters. |

| 22. Grow or Exit Map | Evaluate three tracks—(1) scale core brand, (2) create a hold-co, (3) plan a timed exit. | Run time-value scenarios, apply EOS/OKR frameworks, set “freedom number” milestones. | Founders win back time and choose growth vs. sale from a position of data-driven clarity. |

| 23. Exit Readiness | Prepare for a strategic or PE exit: KPI cleanup, QoE checks, valuation ranges, term-sheet education. | De-risk diligence surprises, tighten EBITDA add-backs, stage warm buyer conversations. | Maximised valuation and a smoother transaction when the founder decides to sell. |

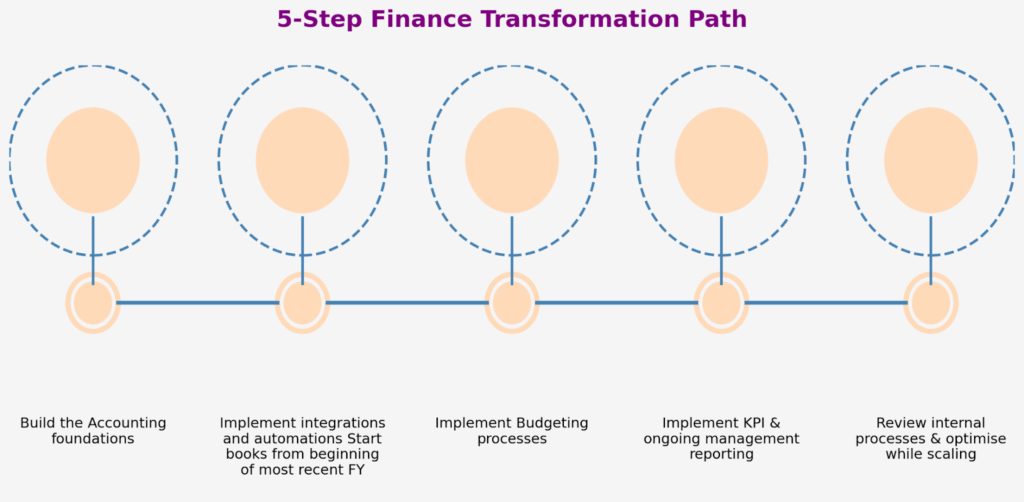

5 Key Changes to a World‑Class Finance Stack

Below is a quick‑scan infographic summarising the five structural upgrades our fractional CFOs implement in every engagement—think of it as the “finance transformation checklist” you’ll move through in your first 180 days.

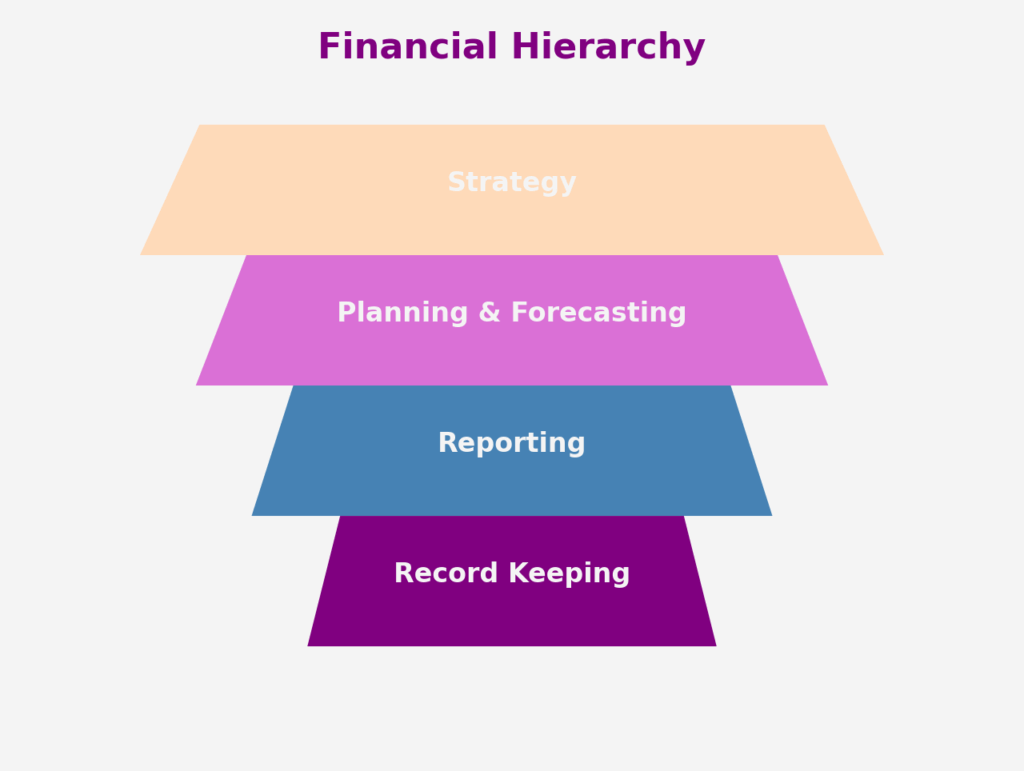

Financial Hierarchy Ladder

Your finance stack builds upward. The ladder graphic below shows how a solid foundation supports deeper analysis, which in turn enables forward‑looking direction.

How the levels work together:

- Direction (Tier 1) – Strategy‑setting: steering the business forward using past data, current performance, and future estimates.

- Planning & Forecasting (Tier 2) – Forward‑looking budgets and scenario models built on accurate historical numbers.

- Reporting (Tier 3) – Interpreting finalised records; this is where KPIs surface and drive decisions.

- Record Keeping (Tier 4) – The foundation: timely, accurate bookkeeping without which higher tiers collapse.

Finance KPIs Your CFO Should Own

The metrics below form the source of truth a fractional CFO reviews every week to spot margin leaks, cash‑flow pinch points, and growth opportunities before they hit your P&L.

| KPI | Why It Matters | Source |

| Gross Margin % | Core profit driver; guides pricing & COGS cuts | Shopify / Accounting |

| Contribution Margin per SKU (eCom specific) | Identifies hero vs. cash‑drain products | ERP / Accounting |

| Cash‑Conversion Cycle (CCC) | Measures months cash is locked in inventory | Accounting |

| Customer Acquisition Cost (CAC) | Determines break‑even payback on ads | Ads / Analytics |

| Lifetime Value (LTV) | Sets ceiling for how high CAC can go | CRM |

| Runway | Months of cash left if growth stalls | Cash‑flow forecast |

| Current Ratio | Quick test of liquidity | Balance sheet |

| Working‑Capital Turnover (WCTO) | Revenue generated per dollar of working capital | Balance sheet |

| Free Cash Flow | Cash available after capex and financing costs | Cash‑flow statement |

| Marketing ROI | Profit per dollar of ad spend | Marketing dashboards |

| Top‑5 Customer Concentration | Flags over‑reliance risk | CRM / ERP file |

A vetted CFO will build a Power BI or Looker studio pulling these metrics live, plus custom dashboards like A/R aging, COGS breakdown, and ad‑spend ROI.

What Is a Good Profile of a Fractional CFO?

A poor-performing CFO can cause disaster for a business. Here’s a detailed look at the profile of a good Fractional CFO so you can avoid a bad hire.

Professional Background

- Finance Expertise: A strong foundation in finance, often with qualifications such as CPA or experience in investment banking, private equity, or venture capital.

- Industry Experience: Direct experience in several industries and business models, allowing them to tailor their approach to different business contexts.

- Leadership Roles: Experience in leading financial teams, managing complex projects, and guiding businesses through significant transitions or growth phases.

Skills and Competencies

- Strategic Thinking: Ability to develop and implement progressive financial strategies, aligning financial goals with business objectives.

- Analytical Skills: Proficient in financial analysis, modelling, forecasting, and interpreting complex financial data to make informed decisions.

- Problem-Solving: Aptitude for identifying financial challenges and devising targeted solutions, often in high-pressure or rapidly changing environments.

- Communication: Strong communication skills to articulate financial insights to non-financial stakeholders, build relationships, and negotiate effectively.

- Adaptability: Flexibility to work with different business sizes, industries, and cultures, adapting their approach to the specific needs and goals of each client.

Personal Attributes

- Integrity: Commitment to ethical practices, transparency, and accountability, building trust with clients and stakeholders.

- Collaborative Mindset: Willingness to work closely with existing financial teams, other departments such as sales and marketing, leadership, and external partners.

- Results-Oriented: Focused on delivering tangible outcomes, whether it’s overcoming financial challenges, achieving growth, or enhancing financial management.

Understanding of Modern Business Challenges

- Technology Savvy: Familiarity with modern financial tools, software, and technologies, leveraging them to enhance efficiency and insights.

- Global Perspective: Awareness of global economic trends, regulations, and market dynamics, enabling them to navigate complex international landscapes.

7 Characteristics of a Top-Tier Fractional CFO

A true fractional CFO combines hard skills with the judgment and presence of a trusted C-suite partner. Look for these seven traits before you sign an engagement letter:

1. Integrity and Values

When someone handles your bank access, investor decks, and board minutes, moral fault lines turn into financial sinkholes. A vetted CFO should embody clear, written values— be honest, be transparent, be agile, be ambitious, be an owner. That kind of ethics-first mindset ensures full disclosure, zero conflicts, and the courage to surface bad news early.

2. Technical Competency

Forward-looking models, 13-week cash waterfalls, debt-refinance scenarios—the craft demands razor-sharp finance skills. Vet this by giving a modelling test and confirming a track record in FP&A, M&A, or Big-Four audit.

3. Microscopic Attention to Detail

One transposed digit can overstate runway by a quarter. Elite CFOs reconcile to the penny, sanity-check formulas, and never sign off on numbers they can’t trace.

4. Coaching Mindset and Emotional Intelligence (EQ)

Founders aren’t spreadsheets; they have stress, bias, and blind spots. A high-EQ CFO coaches through tough decisions, listens before prescribing, and upskills ops managers so finance becomes a company-wide language.

5. Strategic Thinking

Numbers are the vehicle, not the destination. Your CFO should translate variances and ratios into clear priorities that ladder up to the founder’s personal mission—whether that’s a legacy brand or a five-year exit.

6. Executive Presence

Gravitas matters when fronting lenders, PE partners, or a restless board. Expect concise recommendations, comfort with imperfect information, and the diplomacy to challenge executives without sparking defensiveness.

7. Operational Fluency

Great CFOs walk the warehouse floor, sit in on ad-buy meetings, and quiz CX on ticket trends. They connect unit economics to daily workflows, proving they’re far more than “just another spreadsheet jockey.”

Industry Example – Strategic Deliverables for eCommerce

The core breakdown above applies to any business. Below is how those deliverables translate into the eCommerce world, where inventory cycles, SKU‑level margins, and rapid ad spend place unique demands on your CFO.

A world‑class eCommerce CFO gets granular—SKU‑level contribution margin, supplier terms, CAC payback—while never losing sight of the five‑year valuation target.

Forward‑Looking Guidance (Core)

- Multi‑scenario financial modeling: base, growth, and aggressive expansion

- Working‑capital optimization: shorten the cash‑conversion cycle, negotiate 30–60‑day supplier terms, and unlock dead stock

- Gross‑margin expansion: pricing strategy, landed‑cost analysis, 3PL negotiation

- Tax and entity structuring for global selling (US, EU, UK, UAE)

- Exit readiness: EBITDA normalization, QofE support, and data‑room prep

Operational Finance (Ongoing)

- Cash‑flow budgeting & rolling forecasts

- KPI dashboard: real‑time feed from Shopify, Amazon, Xero/QBO, and banks

- P&L and balance‑sheet cleanup, managerial chart of accounts, automated categorization

- Dedicated FP&A Manager — WhatsApp response SLA < 8 hours, up to 6 on‑demand FP&A hours monthly, and a shared Asana board for ticket triage

- Weekly KPI Flash & Cash‑Flow Snapshot — a Monday morning Loom walk‑through so you start the week with numbers, not guesses

- Founder & Team Finance Up‑Skilling — monthly 45‑minute training sessions covering scenario planning, runway math, and margin diagnostics

Fundraising & M&A (Transactional)

- Equity fundraising: investor narrative, deck financials, valuation defense

- Debt financing: revenue‑based financing, revolving credit lines, eCom‑friendly banks

- Acquisitions or brand roll‑ups: buy‑side diligence, deal modeling

Risks of Hiring a Bad Fractional CFO

An ineffective CFO, whether full-time or fractional, can have serious consequences for a business. Here are some of the potential risks and challenges:

- Limiting Growth Potential: An overemphasis on cost control, without considering investment in growth opportunities, can decimate a company’s ability to expand and innovate. Yes, cost management is essential. But, a good CFO knows a balanced approach that prioritises growth is vital for success.

- Misunderstanding the Business Model: Not understanding a company’s unique business model and industry dynamics can lead to misguided decisions. This misunderstanding can result in financial strategies that are misaligned with the company’s goals. Leading to missed opportunities and potential financial missteps.

- Inadequate Risk Management: An ineffective CFO may fail to identify and mitigate potential risks. Leaving the company vulnerable to unexpected challenges and threats. Proactive risk management is essential to safeguard the company’s assets and ensure stability.

- Poor Communication and Collaboration: A good CFO needs to clearly communicate with other stakeholders. A failure here can create misunderstandings, hinder cross-functional initiatives, and negatively impact culture.

- Ethical Concerns: A CFO who does not adhere to the highest ethical standards can expose the company to legal and reputational risks. Transparency, integrity, and compliance with regulations are non-negotiable aspects of the role.

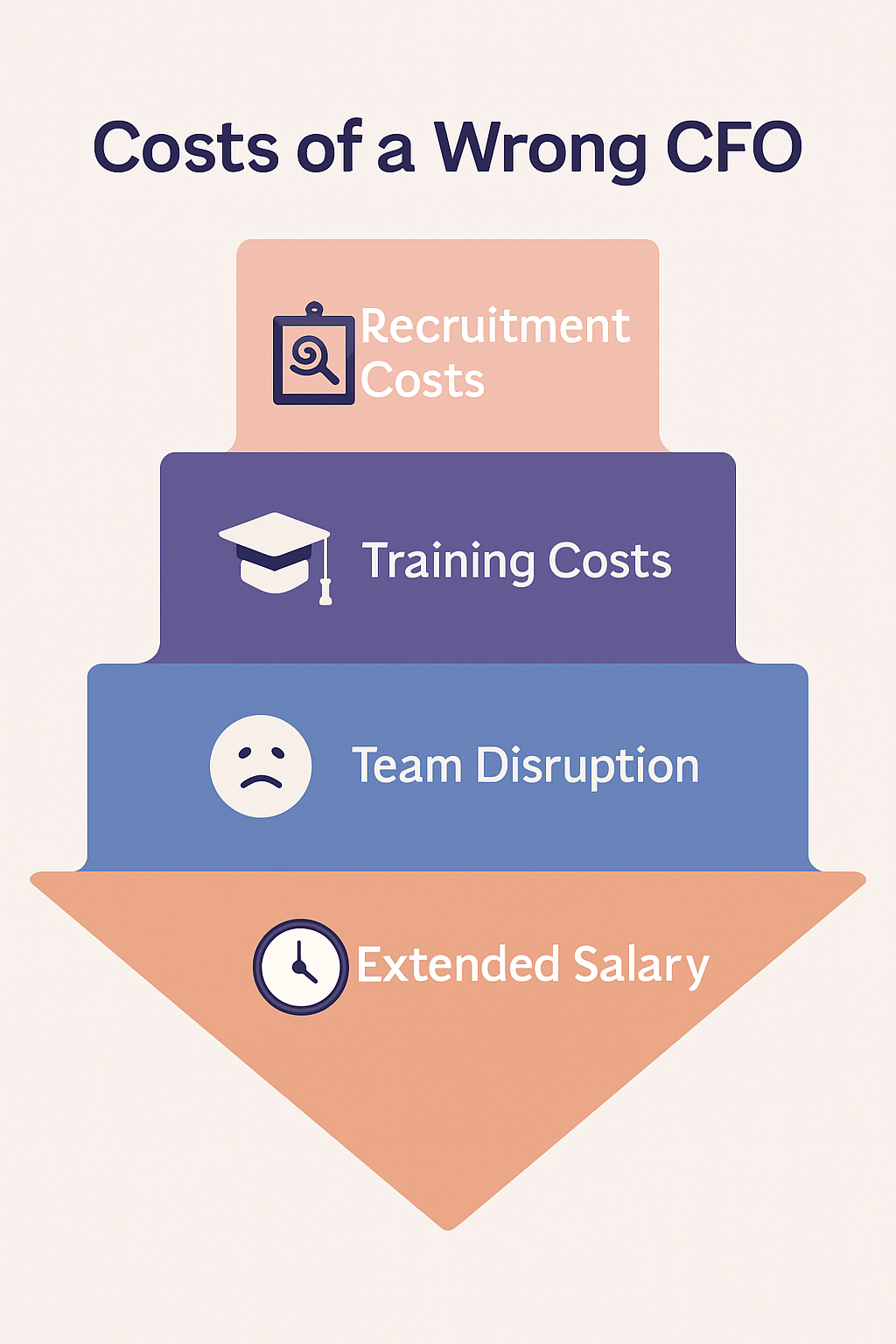

The Hidden Costs of Hiring the Wrong CFO

Replacing a finance leader isn’t like swapping a SaaS tool—by the time you discover the mistake, the damage is already baked into cash flow, culture, and valuation. Here’s what typically gets lost when a company onboards a B- or C-level CFO.

Up-front mis-hire costs

-

Recruitment spend. Retained-search fees run 25-33% of first-year comp; job-board ads and background checks pile on. Filling a $240k seat can burn $30k–$90k before day one.

-

Leadership time. CEOs, founders, and board members log 25–40 hours in interviews, reference calls, and offer negotiations—time that should compound growth.

-

Onboarding drag. Licenses, SOP walkthroughs, and shadowing cost another $10k–$25k in hard dollars, plus four to six weeks of slowed decision-making.

- Early morale dip. A-players cover gaps, question leadership judgment, and start peeking at LinkedIn job alerts.

The slow bleed of keeping a mediocre CFO

-

Payroll waste. Even if you spot the problem quickly, you’re often on the hook for one to twelve months of salary, bonus, and benefits—anywhere from $20k to $250k+.

-

Bad calls and missed opportunities. Weak debt negotiations, overlooked tax deductions, or stop-gap cost cuts can shave 3–5 % off net margin and derail fund-raising or exit windows.

-

Opportunity cost. Growth launches stall while leadership rescues finance; investors smell smoke and push valuations down.

-

Culture damage. High performers in accounting and FP&A disengage; replacing them costs another one to two times their annual comp.

Rule of thumb: HR studies peg the true price of a mis-hire at two to three times the executive’s annual salary. For a $240k CFO, that’s a $500k–$750k hit once the dust settles.

Should You Hire a Fractional CFO?

Choosing to hire a Fractional CFO can be a difficult decision. Here’s a series of questions to help you better weigh the costs and benefits.

To note, for most businesses it’s worth hiring a Fractional CFO for three specific reasons:

- They will save your CEO / Founder time, which can be spent on growing the business

- They will uncover financial mistakes and opportunities, which will improve reporting and cash balances

- They’re cost-effective. They’re cheaper than a full-time hire and can be hired and fired on short notice periods.

Assessment of Current Financial Management

- Challenges and Pain Points: Are there specific financial challenges or bottlenecks that your business is struggling to overcome? A Fractional CFO can provide targeted solutions.

- Gaps in Expertise: If your existing financial team lacks specialised expertise in areas like financial modelling, fundraising, or mergers and acquisitions, a Fractional CFO can fill those gaps.

Business Growth and Transition

- Scaling Opportunities: If your business is in a growth phase, a Fractional CFO can guide strategic financial planning to ensure sustainable and profitable expansion.

- Transitional Phases: During mergers, acquisitions, or significant restructuring, a Fractional CFO’s expertise can be invaluable in navigating complex financial landscapes.

Cost Considerations

- Budget Constraints: Hiring a full-time CFO may be financially burdensome for some businesses. A Fractional CFO offers high-level expertise without the associated full-time costs.

- Value Proposition: Consider the return on investment (ROI) that a Fractional CFO can bring, such as improved financial efficiency, growth enablement, or problem resolution.

Strategic Alignment

- Alignment with Business Objectives: Evaluate how a Fractional CFO’s skills and services harmonise with your business’s long-term goals and immediate needs.

Industry and Market Considerations

- Industry-Specific Needs: Some industries may have unique financial requirements or regulations that a Fractional CFO with relevant experience can address.

- Competitive Landscape: In a highly competitive market, a Fractional CFO’s strategic insights and innovative approaches can provide a competitive edge.

Example of an eCommerce Specialist Fractional CFO

One of the quickest ways a top-tier fractional CFO boosts free cash is by compressing the cash-conversion cycle (CCC). A live case is 96NORTH, the candle and home-fragrance brand Alexej acquired in 2022:

-

Supplier-terms renegotiation.

-

Starting point (pre-acquisition): 50% paid upfront, 50% when goods cleared the U.S. border.

-

First improvement: after proving consistent order growth, terms moved to 30% on departure from China and 70% on U.S. arrival.

-

Current terms (2025): 50% due 90 days after order placement and the remaining 50% at 130 days, cutting the brand’s cash tie-up by more than two months.

-

Starting point (pre-acquisition): 50% paid upfront, 50% when goods cleared the U.S. border.

-

Revenue-based financing. The CFO layered in a low-friction RBF facility to bridge inventory purchases during Q4 demand spikes—keeping equity intact while smoothing cash flow.

- Extended payables with service partners. Through volume commitments and transparency, the team won 45-day terms from its performance-marketing agency and 60-day terms from its web-development partner—freeing additional working capital for paid-media scaling.

Result: CCC dropped from seven months to less than two months, freeing over $1.2 million in working capital for product launches.

Why Work with Alexej Pikovsky’s CFO Collective?

Years of investing, acquiring brands, and sitting in the operator’s seat taught Alexej a hard truth: most founders waste months cycling through generic “finance talent” before they land a CFO who actually understands growth-stage reality. In today’s market—where profits and cash flow matter more than vanity ARR—bringing in a values-driven strategist is non-negotiable.

Alexej solved the gap by curating a vetted Fractional-CFO collective built specifically for profit-oriented founders and C-suite operators.

What sets this bench apart

-

Founder-First Vetting: Alexej hand-screens every CFO for a track record scaling 7- to 9-figure brands—no résumé keyword scans, no junior recruiters.

-

Industry Specialization: Our fractional CFOs arrive with 5+ years of C-suite experience in your exact niche—whether that’s SaaS (SQLs, MQLs, NRR), eCommerce (contribution margins, SKUs, cohort retention), or construction & real estate (project cash flow, WIP schedules). They hit the ground running on day one, so you spend zero time coaching and 100% of your time scaling.

-

Speed to Value: Average match in 7 days; first margin-impact initiative shipped within 2–6 weeks.

-

Transparent Pricing: Flat monthly retainers—no hidden recruiter mark-ups, no surprise change-orders.

- Values Alignment: Integrity, transparency, and owner-like thinking are non-negotiable filters, ensuring your sensitive financial data is in principled hands.

Hire an expert CFO. Tell us what you need and we’ll deliver a shortlist of fully-vetted fractional CFOs within 7 days.

FAQ

A fractional CFO typically works on a part-time, contract, or project basis, offering specialised financial expertise tailored to specific needs or challenges. In contrast, a full-time CFO is a permanent employee responsible for overseeing all financial aspects of the business, often with a broader scope of responsibilities. The flexibility of a fractional CFO can be more cost-effective for smaller businesses or those with targeted financial needs.

Hiring a Fractional CFO provides businesses with expert financial leadership without the full-time commitment. Fractional CFOs provide cost-effective access to specialised skills such as strategic planning, financial forecasting, and investor relations. By working on a part-time or project basis, a fractional CFO can offer targeted solutions to specific financial challenges, enhancing efficiency and supporting growth. Engaging a fractional CFO also frees up the CEO or founder to focus on core business functions, ensuring that financial management doesn’t divert attention from essential operational goals.

Businesses across various industries, especially startups, small to medium-sized enterprises (SMEs), and companies in transitional phases, can benefit from a fractional CFO. Whether navigating growth opportunities, mergers and acquisitions, fundraising, or specific financial projects, a fractional CFO can provide the necessary expertise without the commitment of a full-time position. They can also be valuable in specific sectors such as tech, SaaS, eCommerce, agency, professional services, healthcare, manufacturing and more.

Most “virtual CFO” services are offshore bookkeeping shops with a focus on low-cost, basic compliance. The quality rarely matches a vetted fractional CFO. A fractional CFO, by contrast, embeds strategically at the C‑suite level.

Engagement of fractional is part-time (days or projects) while for virtual CFOs its full-time usually and offshore, always remote.

The focus of a strategic CFO is strategic roadmap, fundraising, exit preparation while for virtual CFOs its usually back-office related tasks incl. controlling & compliance.

Engagement model typical Range: $140+ per hour (specialized eCommerce expertise commands the upper tier), $2,000 – $6,000 per month (depends on days per month and complexity) and $15,000 – $50,000+ flat per project (includes QofE and data‑room build)

The cost of hiring depends on the following factors:

Engagement Model

Project Basis: Fractional CFOs can be bought in for project work such as mergers, acquisitions, disposals, one-time cash flow optimisations and financial model creation. This will typically result in higher hourly rates as the work will either require a specialist or be a shorter duration.

Ongoing Engagement: For continuous services, such as regular financial reporting or strategic planning, the cost may be structured as a monthly retainer or hourly rate. Longer term engagements usually result in lower effective hourly rates.

Experience and Expertise

Industry Specialisation: Fractional CFOs with specialised experience in a specific industry or financial area may command higher fees.

Years of Experience: The level of experience, qualifications, and proven track record can significantly influence the cost.

Geographical Location

Local vs Remote: The location of the Fractional CFO and whether they work on-site or remotely can impact costs, considering factors like travel expenses or local market rates.

Global Considerations: If your business operates across different countries or regions, the cost may vary based on local economic conditions, regulations, and currency fluctuations.

Value-Added Services

Additional Offerings: Some Fractional CFOs may provide value-added services such as access to their network, introductions to investors, technology tools, or strategic partnerships, which could influence the overall cost.

Pro Tip: Budget at least 1–2 percent of annual revenue for strategic finance if you are gunning for a sale within three years.

For a deeper dive, check out Alexej’s companion articles How Much Does a Fractional CFO Cost? and Is a Fractional CFO Worth It?.

Assessing the need for a fractional CFO involves evaluating your current financial management capabilities, identifying gaps or challenges, and considering your business’s growth stage and goals. If you find complexities in financial planning, reporting, investor relations, or other specific areas that your existing team cannot address, or if you’re seeking cost-effective expert guidance for specific projects, a fractional CFO may be an ideal solution.