The Amazon aggregator space has been a hotbed of activity, attracting significant investment and attention. Over the last four years, more than $15 billion of funding has been raised by aggregators.

Aggregators promised to target a $4.3 trillion eCommerce sales market, with brands listing on Amazon (FBA) accounting for more than $490 billion of Gross Merchandise Value (GMV). The space seemed particularly attractive due to the massive fragmentation and the large number of sellers, offering a lucrative opportunity for aggregation.

Hype vs Reality

- Multiple Arbitrage: Aggregators were raising at 10x Revenue (>50x EBITDA) and acquiring FBA brands on average for 2-5x EBITDA (or if using the Amazon language 2-5x SDE (Seller Discretionary Earnings). In essence, a group was getting a more than 10x valuation uplift by having the same financial metrics under its group ownership rather than the brand standalone. Assuming an aggregator would be able to exit for the 10x Revenue, that math would make it a no-brainer for investors to invest in aggregators. That is exactly what happened until markets started crashing in late summer 2021. In summer 2021, the Amazon aggregator bubble experienced its first cracks with the founding team of Thrasio leaving the business and the planned SPAC not happening either. Throughout 2022 more aggregators went bust and there has been no meaningful exits since.

- Monetary Influx: As with so many other asset classes and themes, the period after Covid, experienced a huge influx of central bank capital. The Amazon aggregator space was one of the big net beneficiaries from venture capital and private equity funds deploying their funds into this space. With so many players in the game raising so much capital, everybody was trying to acquire as many brands as possible, resulting in ultimately the winner’s curse.

-

Cheap Debt: All-time low interest rates meant that one can raise a big debt facility and invest in inventory and marketing, as well as use it to acquire even more brands. Debt facilities were raised at 10-15% interest rates with usually two year interest rate only periods and armotisation only kicking in year 3. On paper the math looked great as long as the acquired brands would only grow and margins would be stable. The reality however was that there was a big drop in sales, partly driven by a slow down in discretionary consumer spending and partly because of lack of competence of marketing teams sitting inside the aggregators. Combined with EBITDA margin compression driven by an increase in raw material costs, marketing costs and supply chain costs, aggregators experienced the perfect storm. With debt repayment schedules kicking in from early 2023, we are seeing many more negative headlines of aggregators filing for bankruptcy or being forced to merge by their debt providers.

Considered at some point as one of the top three aggregators, Perch is now being forced to roll into Razor Group with Apollo Global Management and Victory Park trying to save their debt. With debt holders fighting against equity holders such as Softbank, the drama is just starting to unfold. - Fragmented Market: Amazon’s third-party sellers account for more than $490 billion, and there are 35,000 Amazon FBA brands with more than $1 million in revenue. It was and still is one of the most fragmented industries out there. Acquiring a US based brand with a high review count and rating meant that one could also launch quickly in other international markets getting instant traction.

-

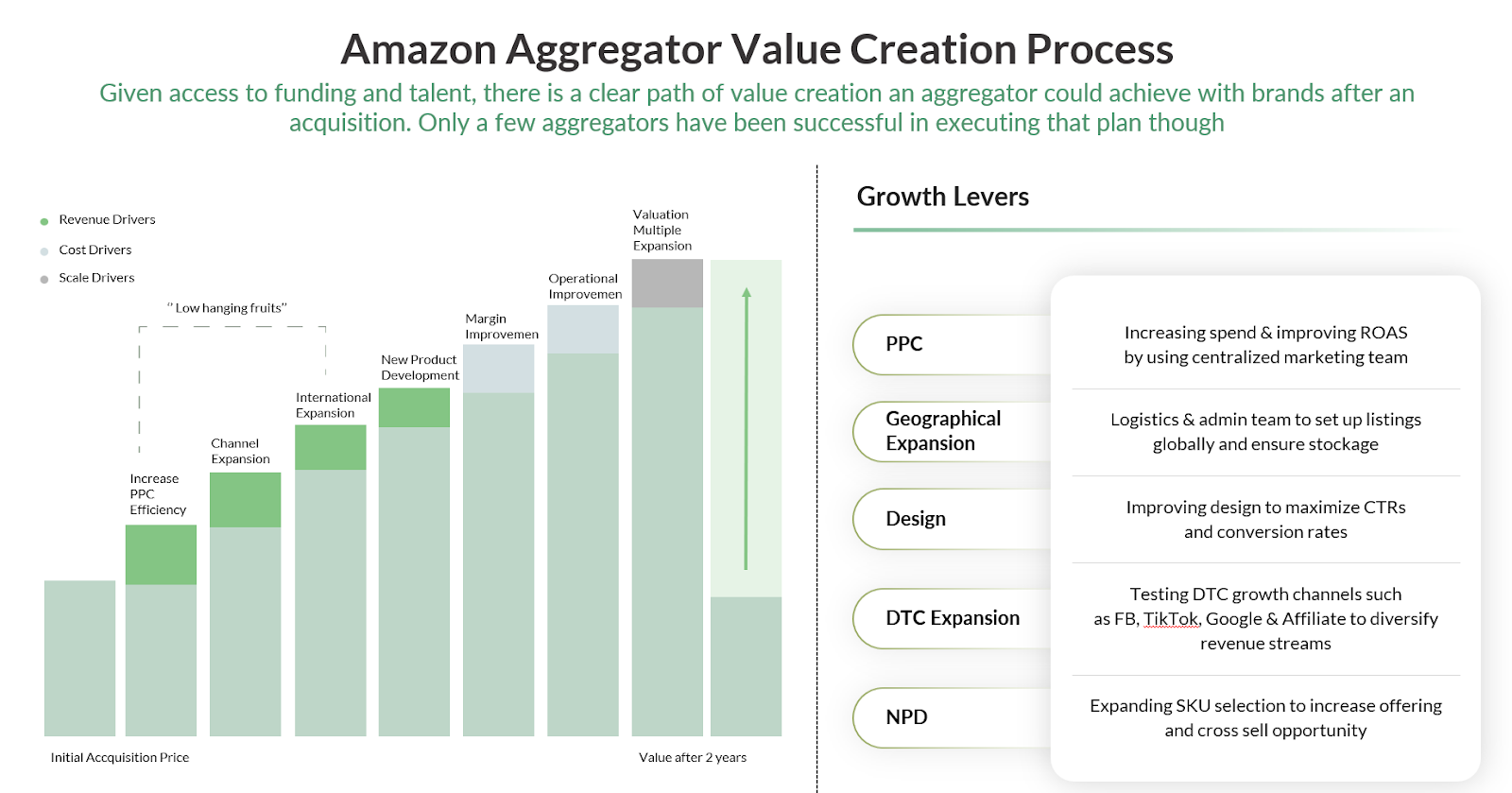

Value Creation Potential: As with so many rollups play, there is always a path to value creation by having more access to capital and talent. As outlined below, aggregators promised to create value add by tapping into revenue, cost and scale drivers.

On the revenue side, it is all about improving the Amazon listing itself, launching in other countries and launching more products. Initially all on Amazon, followed by the launch of a direct-to-consumer presence and listing on other marketplaces. Once a brand has presence beyond Amazon, one could action several other growth drivers such as SEO, Paid Traffic, Influencers and Collaborations.

In terms of cost drivers, the low hanging fruits are improving the cash conversion cycle by renegotiating supplier terms or changing suppliers altogether.

Having access to more capital and initially cheap debt, was another big value ad for aggregators.

Lessons Learned in the Aggregator Space: A Reality Check

The FBA aggregator industry has been through a tumultuous period, marked by mass layoffs, debt restructurings, and mergers. While the sector initially attracted high-calibre talent and high-profile investors, it has faced numerous challenges.

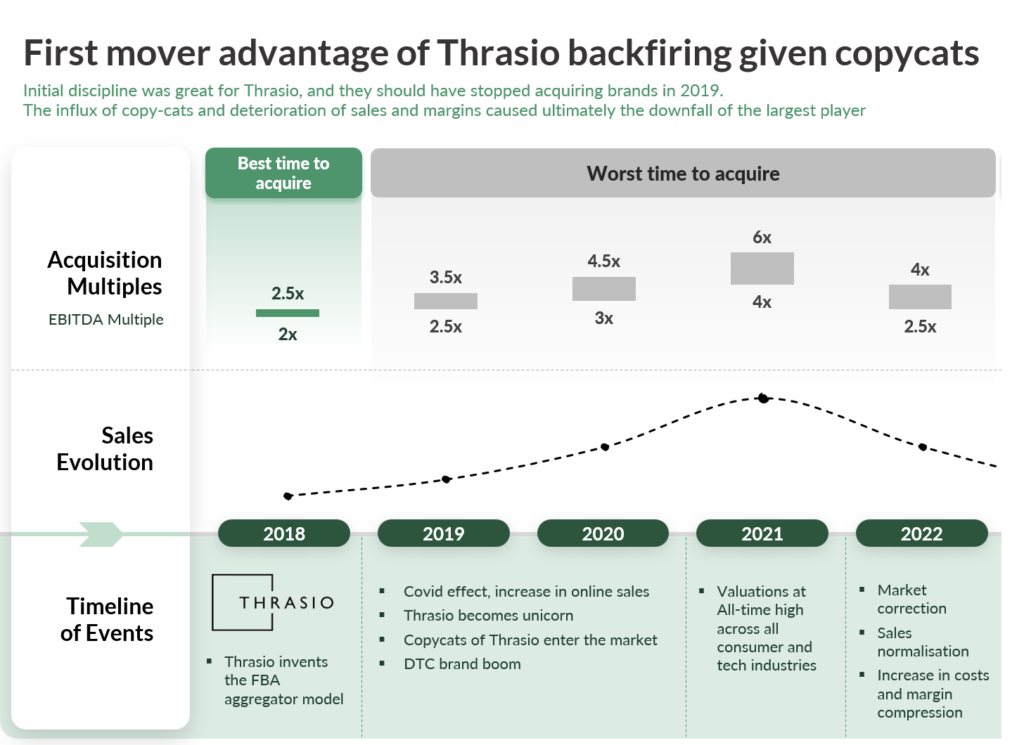

The infographic below encapsulates the tumultuous journey of Thrasio, a pioneer in the FBA aggregator model initially, now very close to bankruptcy.

Points to Note:

- First Mover Advantage Backfiring: Thrasio had the discipline and foresight to invent the FBA aggregator model. However, the entry of copycats into the market led to a dilution of this advantage.

- Acquisition Multiples & EBITDA: The infographic outlines the best and worst times to acquire, based on EBITDA multiples. It shows that acquisition costs have fluctuated significantly over the years, affecting the profitability of aggregators.

- Sales Evolution: The timeline from 2018 to 2022 illustrates key events, including the Covid effect on online sales, Thrasio becoming a unicorn, and the entry of direct-to-consumer (DTC) brands. It also highlights the market correction and the normalisation of sales.

- Margin Compression: One of the most crucial points is the increase in costs and the compression of margins, especially after the entry of Thrasio copycats and the DTC brand boom.

Key Insights:

- Underestimating COVID Tail Winds: Many firms were most acquisitive during a period when COVID-related restrictions artificially boosted the earnings of their purchasing targets. This led to difficult trading conditions when the boost receded.

- Leverage and Overhead: Aggregators were more highly leveraged than typical eCommerce businesses, increasing their risk. Many had substantial cash reserves but struggled due to their burn rate.

- Losing Founder Talent: Deals often required founders to stay on for only a brief handover period, leading to underperformance post-acquisition.

- Too Many Small Acquisitions, Too Quickly: The rush to acquire led many aggregators to lower their acquisition criteria and pay too much for targets that didn’t meet their ideal brief.

- Target Selection: Aggregators have been criticised for buying products rather than brands and for not focusing enough on defensibility and intellectual property.

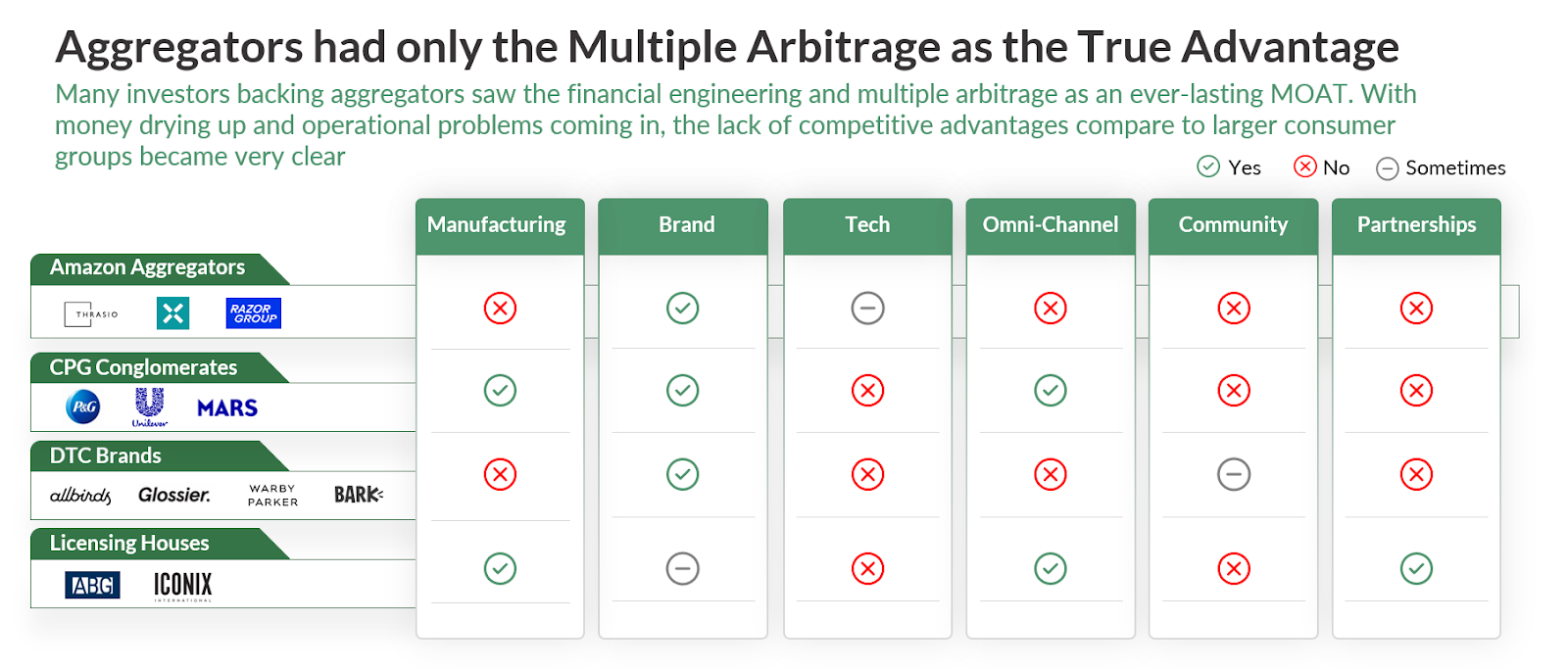

The Illusion of Multiple Arbitrage

As we navigate the complexities of the Amazon aggregator landscape, it’s crucial to understand the limitations of relying solely on financial engineering and multiple arbitrage as competitive advantages. The infographic below offers a comparative analysis that sheds light on this critical issue.

This infographic serves as a stark reminder that in a rapidly evolving marketplace, having a single point of competitive advantage is not sustainable. It emphasises the need for Amazon aggregators to broaden their strategic focus if they wish to remain viable in the long term.

Key Takeaways:

- Debt Overhang: The involvement of debt funds has led to a complex web of financial obligations and tight covenants, making it difficult for aggregators to navigate downturns.

- Investor Tensions: The industry’s downturn has pitted debt holders against equity stakeholders, each looking to protect their investments at the expense of the other.

- Forced Consolidation: Firms like Victory Park and Apollo are pressuring other aggregators they’ve backed to buy struggling companies, leading to potential legal disputes.

- High-Stakes Negotiations: The industry’s challenges have led to high-stakes negotiations involving major players, with potential mergers and acquisitions on the horizon.

The Pitfalls of Roll-Ups: How Things Can Go Wrong

While roll-ups offer a fast track to growth and market dominance, they come with significant risks. Here’s a look at some of the ways roll-ups can go wrong, both in the Amazon aggregator space and more broadly.

Overvaluation of Acquired Companies

One of the most common mistakes in a roll-up strategy is overvaluing the companies being purchased. This can lead to paying a premium that the future earnings of the acquired corporation cannot justify. Overvaluation can put financial strain on the aggregator, leading to debt accumulation and reduced profitability.

Integration Challenges

Merging multiple companies involves integrating different cultures, systems, and operations. If this process is poorly managed, it can result in inefficiencies, employee dissatisfaction, and even operational breakdowns. Moreover, the costs of integration are often underestimated, leading to budget overruns and delays.

Loss of Operational Focus

The process of acquiring and integrating companies can be so time-consuming that the core operations of the aggregator may suffer. This loss of focus can lead to declining quality, customer dissatisfaction, and ultimately, a damaged brand reputation.

Complexity and Lack of Transparency

As companies are rolled up, the resulting entity can become increasingly complex and difficult to manage. This complexity can make it challenging to maintain transparency, both internally and for investors, leading to poor decision-making and reduced investor confidence.

Financial Instability

Roll-ups often involve taking on significant debt to finance acquisitions. If the acquired companies do not perform as expected, or if market conditions change, the debt burden can become unsustainable. This financial instability can lead to a range of problems, from layoffs to bankruptcy.

Dilution of Company Culture

Each acquired company brings its own culture, and without careful management, the core values and practices that made the aggregator successful in the first place can become diluted. This can lead to a loss of identity and purpose, affecting employee morale and performance.

Regulatory Risks

Roll-ups, especially those that lead to significant market concentration, can attract the attention of regulatory authorities. Anti-trust laws and industry-specific regulations can pose challenges, leading to fines or even forced divestitures.

The Future of Amazon Aggregators: What Lies Ahead?

As the Amazon aggregator space continues to evolve, it’s crucial to consider what the future holds for this business model. While the initial hype has waned, the industry is at a crossroads, facing both opportunities and challenges.

Market Saturation and Competition

The influx of new players in the aggregator space has led to market saturation. With more companies vying for a piece of the pie, competition has intensified, putting pressure on profit margins and acquisition costs.

Technological Advancements

The role of technology in streamlining operations cannot be overstated. Aggregators that invest in advanced analytics, machine learning, and automation will likely have a competitive edge, enabling them to identify lucrative acquisition targets and optimise operations more effectively.

Diversification and Global Expansion

To mitigate risks and tap into new revenue streams, some aggregators are looking beyond Amazon. Expanding into other eCommerce platforms like Shopify or even considering brick-and-mortar retail are potential avenues for growth.

Investor Sentiment

The initial euphoria among investors may have cooled, but the aggregator model still holds promise. However, investors are likely to become more discerning, focusing on companies with a proven track record and a clear path to profitability.

Regulatory Concerns: Navigating the Legal Labyrinth in Amazon Aggregators

The Amazon aggregator space is not just about smart acquisitions and scaling businesses; it’s also about navigating a complex web of legal and regulatory requirements. Failure to comply with these can result in hefty fines, legal battles, and even the unwinding of acquisitions. Here are some of the key regulatory concerns that Amazon aggregators need to be aware of:

Antitrust Laws

As aggregators grow and acquire more brands, they may come under the scrutiny of antitrust authorities. These laws are designed to prevent companies from gaining too much market power, which could lead to anti-competitive practices. They must be cautious not to violate these laws, both in the purchasing phase and in their post-acquisition business practices.

Amazon’s Evolving Policies

Amazon itself is a significant regulatory force in this space. The platform frequently updates its terms of service, and it is important to stay abreast of these changes to avoid penalties or even de-listing. For example, Amazon has specific requirements about product listings, customer reviews, and seller conduct that must be adhered to.

Data Protection and Privacy

With the acquisition of multiple brands comes the responsibility of managing vast amounts of customer data. Data protection laws such as GDPR in Europe and CCPA in California must be complied with. Failure to do so can result in severe fines and damage to reputation.

Intellectual Property Rights

When acquiring brands, aggregators must conduct thorough due diligence to ensure they are not infringing on any intellectual property rights. This includes patents, trademarks, and copyrights. Legal battles over IP can be costly and time-consuming, potentially derailing growth plans.

Cross-Border Regulations

For those operating internationally, understanding and complying with the laws and regulations of each country is crucial. This includes not just data protection laws but also import/export regulations, tax laws, and even employment laws.

Environmental Regulations

As eCommerce continues to grow, so does its environmental impact. Some jurisdictions are implementing regulations aimed at reducing this impact, such as requiring eco-friendly packaging. Aggregators must be aware of these regulations to avoid penalties and to enhance their brand image.

Diversification Strategies: Broadening Horizons Beyond Amazon

In the ever-changing landscape of eCommerce, putting all your eggs in one basket can be a risky move. Amazon aggregators are increasingly looking at diversification strategies to mitigate risks and tap into new growth avenues. Here’s how some are broadening their horizons beyond the Amazon ecosystem.

Expanding to Other eCommerce Platforms

One of the most straightforward diversification strategies is to expand to other eCommerce arenas like Shopify, eBay, or Walmart Marketplace. These platforms offer different customer demographics and shopping behaviours, providing an opportunity to reach a broader audience. For instance, Shopify’s more brand-centric approach can be an excellent fit for niche brands looking to build a dedicated customer base.

Multi-Channel Retailing

Some aggregators are adopting a multi-channel approach, selling not just through online marketplaces but also through their websites. This strategy allows for greater control over branding, customer experience, and, most importantly, profit margins.

Global Expansion

The eCommerce market is not limited to one country or region. Aggregators are increasingly looking at international markets to fuel their growth. However, global expansion comes with its challenges, including language barriers, cultural differences, and complex regulatory environments.

Brick-and-Mortar Ventures

While eCommerce is the core focus, there is potential to explore opportunities in brick-and-mortar retail. Physical stores offer a different set of advantages, including the ability to offer in-person customer experiences and to serve markets where online purchasing is less prevalent.

Product Line Extensions

Another diversification strategy involves extending the product lines of the acquired brands. For example, if an aggregator acquires a brand known for its kitchen gadgets, it might consider introducing related products like cookbooks or cooking classes, thereby increasing the brand’s revenue streams.

Partnerships and Collaborations

Forming strategic partnerships can also be a viable diversification strategy. Whether it’s a co-branding opportunity, a distribution agreement, or a technology partnership, collaborations can open doors to new markets and customer segments.

Investing in Technology

Investing in technology solutions that can be used across a portfolio of brands is another viable strategy. This includes customer relationship management (CRM) systems, inventory management software, and data analytics tools. These technologies not only improve operational efficiencies but also provide additional revenue streams by licensing them to other businesses.

Why Roll-Ups Can Go Wrong: Lessons from Other Industries

While the focus of this article is on Amazon aggregators, it’s worth noting that the challenges faced are not unique to this sector. Roll-ups in other industries have also experienced setbacks, and there are valuable lessons to be learned from their experiences.

The Liquidity Arbitrage Trap

Roll-ups often create initial value by providing liquidity for smaller companies, a phenomenon well-documented in the Extension Mergers: Why Roll-ups Succeed or Fail. However, this liquidity arbitrage eventually loses its potency, forcing the acquirer to find new sources of value.

- Velocity Express: This logistics company embarked on an aggressive roll-up strategy, acquiring numerous smaller players to provide liquidity and achieve rapid growth. However, as the benefits of liquidity arbitrage diminished, the company struggled to integrate its acquisitions effectively. This led to operational inefficiencies, poor financial performance, and ultimately, bankruptcy.

- Service Corporation International (SCI): Known for its roll-up strategy in the funeral home industry, SCI initially benefited from providing liquidity to smaller, family-owned businesses. However, as the company grew, it faced challenges in maintaining the quality and personalized service that smaller funeral homes were known for. The diminishing returns from liquidity arbitrage, coupled with failed integration efforts, led to a decline in SCI’s market value.

The Importance of Disciplined Strategy

Studies on roll up strategies emphasise the need for a disciplined approach. Due diligence should be a core part of the company’s operations, and there must be excellent planning to ensure cultural and operational fit. The risks of not integrating the businesses well can lead to a fragmented group of companies, each pulling in a different direction.

Restaurants: The Challenge of Brand Dilution and Operational Inefficiencies

In the restaurant industry, roll-ups have often been seen as a quick way to achieve scale and market penetration. However, this strategy comes with its own set of challenges:

- Brand Dilution: When a roll-up acquires multiple restaurant brands, there’s a risk of diluting the unique value proposition of each. For example, when Landry’s Inc. acquired a diverse range of restaurants, critics argued that the uniqueness of individual brands was compromised.

- Operational Inefficiencies: Managing diverse restaurant operations under one umbrella can lead to inefficiencies. For instance, the acquisition of multiple fast-food and fine-dining restaurants can result in a complex supply chain that’s hard to manage effectively.

- Case in Point: Dine Brands Global, the parent company of Applebee’s and IHOP, faced challenges in maintaining brand identity and operational efficiency post-acquisition, leading to declining sales and customer dissatisfaction.

Transportation: Regulatory Compliance and Fuel Cost Volatility

The logistics and transportation sector is another area where roll-ups have been prevalent but not always successful:

- Regulatory Compliance: The transportation industry is heavily regulated, and failure to comply with these regulations can result in hefty fines and legal issues. For example, the roll-up of several smaller logistics companies into a single entity can complicate compliance with diverse state and federal laws.

- Fuel Cost Volatility: The fluctuating cost of fuel can severely impact the profitability of transportation companies. Roll-ups in this sector often struggle to manage this volatility across different business units.

- Case in Point: XPO Logistics, a major player in the transportation industry, faced challenges in integrating its numerous acquisitions. The company had to deal with regulatory hurdles and was significantly affected by fluctuating fuel costs, leading to a re-evaluation of its roll-up strategy.

Final Thoughts

While the allure of rapid growth and scalability has drawn many players into the Amazon FBA aggregator space, the reality is far more nuanced. As this comprehensive analysis has shown, the journey is fraught with pitfalls, from operational inefficiencies to financial instability and even market volatility.

The recent turn of the tide against even the industry’s giants serves as a sobering reminder that no one is immune to these challenges. It underscores the need for a disciplined, well-thought-out strategy that goes beyond mere financial engineering. Due diligence, cultural fit, and operational excellence are not just buzzwords; they are critical components of any successful roll-up strategy.

Whether you’re an investor, an aggregator, or an industry observer, the need for a well-rounded understanding of this complex landscape has never been greater.